Page 147 - shbh24_complete

P. 147

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – MOT

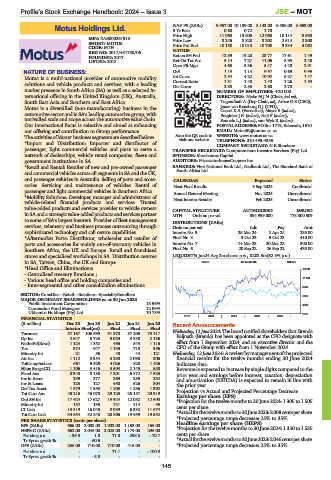

NAV PS (ZARc) 9 957.00 10 189.00 8 143.00 6 586.00 6 653.00

Motus Holdings Ltd. 3 Yr Beta 0.60 0.72 1.70 - -

MOT Price High 11 060 13 600 12 068 10 114 8 598

ISIN: ZAE000261913 Price Low 8 246 8 828 8 202 2 514 2 300

SHORT: MOTUS Price Prd End 10 150 10 018 10 700 9 334 3 062

CODE: MTH

REG NO: 2017/451730/06 RATIOS

FOUNDED: 2017 Ret on SH Fnd 12.89 19.20 23.77 17.61 1.49

LISTED: 2018 Ret On Tot Ass 5.14 7.27 11.06 8.93 2.48

Oper Pft Mgn 4.63 5.36 5.47 4.40 2.91

NATURE OF BUSINESS: D:E 1.13 1.14 0.67 0.69 0.96

Motus is a multi-national provider of automotive mobility Int Cover 2.34 4.22 10.02 6.27 1.47

1.40

1.53

1.40

Current Ratio

1.26

1.31

solutions and vehicle products and services, with a leading Div Cover 2.83 2.83 2.68 2.78 -

market presence in South Africa (SA) as well as a selected in- NUMBER OF EMPLOYEES: +20 000

ternational offering in the United Kingdom (UK), Australia, DIRECTORS: Njeke M J N (Chair, ind ne),

South East Asia and Southern and East Africa. Tugendhaft A (Dep Chair, ne), Arbee O S (CEO),

Motus is a diversified (non-manufacturing) business in the Janse van Rensburg O J (CFO),

Cassel K A (Executive), Mayet S (ind ne),

automotive sector and is SA’s leading automotive group, with Potgieter J N (ind ne), Roji F (ind ne),

unrivalled scale and scope across the automotive value chain. Sennelo L J (ind ne), van Wyk R (ind ne)

Our international focus is selective and aimed at enhancing POSTAL ADDRESS:POBox1719, Edenvale,1610

our offering and contribution to Group performance. EMAIL: MotusIR@motus.co.za

Scan the QR code to WEBSITE: www.motus.co.za

TheactivitiesofMotus’businesssegmentsaredescribedbelow: visit our website TELEPHONE: 010-493-4335

*Import and Distribution: Importer and distributor of COMPANY SECRETARY: N E Simelane

passenger, light commercial vehicles and parts to serve a TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

network of dealerships, vehicle rental companies, fleets and SPONSOR: Merchantec Capital

government institutions in SA. AUDITORS: PricewaterhouseCoopers Inc.

*Retail and Rental: Retailer of new and pre-owned passenger BANKERS: First National Bank Ltd., Nedbank Ltd., The Standard Bank of

and commercial vehicles across all segments in SA and the UK, South Africa Ltd.

and passenger vehicles in Australia. Selling of parts and acces- CALENDAR Expected Status

sories. Servicing and maintenance of vehicles. Rental of Next Final Results 3 Sep 2024 Confirmed

passenger and light commercial vehicles in Southern Africa.

Annual General Meeting Nov 2024 Unconfirmed

*Mobility Solutions: Developer, manager and administrator of Next Interim Results Feb 2025 Unconfirmed

vehicle-related financial products and services. Trusted

value-added products and services provider to vehicle owners CAPITAL STRUCTURE AUTHORISED ISSUED

in SA and a strategic value-added products and services partner MTH Ords no par val 394 999 000 178 300 509

to some of SA’s largest insurers. Provider of fleet management

DISTRIBUTIONS [ZARc]

services, telemetry and business process outsourcing through Ords no par val Ldt Pay Amt

sophisticated technology and call centre capabilities. Interim No 9 25 Mar 24 2 Apr 24 235.00

*Aftermarket Parts: Distributor, wholesaler and retailer of Final No 8 3 Oct 23 9 Oct 23 410.00

parts and accessories for mainly out-of-warranty vehicles in Interim No 7 14 Mar 23 20 Mar 23 300.00

Southern Africa, the UK and Europe. Retail and franchised Final No 6 20 Sep 22 26 Sep 22 435.00

stores and specialised workshops in SA. Distribution centres LIQUIDITY: Jun24 Avg 2m shares p.w., R202.5m(62.5% p.a.)

in SA, Taiwan, China, the UK and Europe. GERE 40 Week MA MOTUS

*Head Office and Eliminations: 13253

- Centralised treasury functions ;

- Various head office and holding companies and 11148

- Inter-segmental and other consolidation eliminations. 9043

SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

6937

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

Public Investment Corporation 13.96% 4832

Coronation Fund Managers 12.09%

Ukhamba Holdings (Pty) Ltd. 10.78% 2727

2019 | 2020 | 2021 | 2022 | 2023 |

FINANCIAL STATISTICS

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Recent Announcements

Interim Final(rst) Final Final Final

Turnover 57 167 106 699 91 978 87 205 73 417 Wednesday,12June2024:The board notified shareholders that Brenda

Op Inc 2 647 5 723 5 029 3 838 2 136 Baijnath (Brenda) has been appointed as the CFO designate with

NetIntPd(Rcvd) 1 124 1 352 496 543 1 116 effect from 1 September 2024, and an executive director and the

Tax 374 947 1 135 718 356 CFO of the Group with effect from 1 November 2024.

Minority Int 21 56 48 44 - 121 Wednesday,12June2024: Areview by managementofthe projected

Att Inc 1 112 3 354 3 290 2 098 306 financial results for the twelve months ending 30 June 2024

TotCompIncLoss 661 5 929 4 026 820 1 426 indicates that:

Hline Erngs-CO 1 106 3 416 3 504 2 145 550 Revenue is expected to increase by single digits compared to the

Fixed Ass 8 340 8 188 7 201 6 872 7 625 prior year and earnings before interest, taxation, depreciation

Inv in Assoc 299 277 269 289 232 and amortisation (EBITDA) is expected to remain in line with

Inv & Loans 123 127 450 526 504 the prior year.

Def Tax Asset 1 379 1 353 1 203 1 286 1 302 Projection vs Actual and Projected Percentage Decrease

Tot Curr Ass 45 216 46 070 29 125 25 157 29 919 Earnings per share (EPS)

Ord SH Int 17 424 17 627 13 924 12 052 12 508

Minority Int 152 135 121 114 - 56 *Projection for the twelve months to 30 June 2024: 1 305 to 1 505

LT Liab 13 819 16 045 8 089 6 332 11 674 cents per share

Tot Curr Liab 34 554 32 848 20 806 19 959 19 552 *Actualforthetwelvemonthsto30June2023:2008centspershare

*Projected percentage range decrease: 25% to 35%

PER SHARE STATISTICS (cents per share) Headline earnings per share (HEPS)

EPS (ZARc) 666.00 2 008.00 1 902.00 1 153.00 165.00

HEPS-C (ZARc) 662.00 2 046.00 2 025.00 1 179.00 296.00 *Projection for the twelve months to 30 June 2024: 1 330 to 1 535

Pct chng p.a. - 35.3 1.0 71.8 298.3 - 70.7 cents per share

Tr 5yr av grwth % - 60.6 - - - *Actualforthetwelvemonthsto30June2023:2046centspershare

DPS (ZARc) 235.00 710.00 710.00 415.00 - *Projected percentage range decrease: 25% to 35%

Pct chng p.a. - - 71.1 - - 100.0

Tr 5yr av grwth % - - 5.8 - - -

145