Page 142 - shbh24_complete

P. 142

JSE – MAR Profile’s Stock Exchange Handbook: 2024 – Issue 3

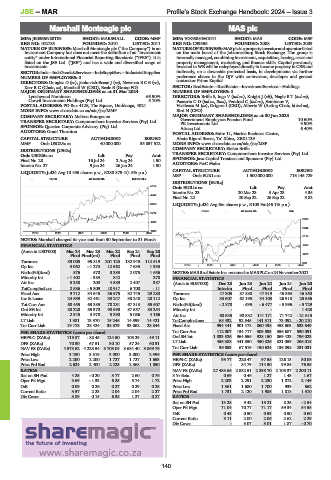

Marshall Monteagle plc MAS plc

MAR MAS

ISIN: JE00B5N88T08 SHORT: MARSHALL CODE: MMP ISIN: VGG5884M1041 SHORT: MAS CODE: MSP

REG NO: 102785 FOUNDED: 2010 LISTED: 2011 REG NO: C99355 FOUNDED: 2008 LISTED: 2009

NATURE OF BUSINESS: Marshall Monteagle plc (“the Company”) is an NATUREOF BUSINESS:MASplcisaproperty investorandoperatorlisted

Investment Company but does not meet the definition of an “investment on the main board of the Johannesburg Stock Exchange. The group is

entity” under International Financial Reporting Standards (“IFRS”). It is internally managed, combining investment, acquisition, leasing, asset and

listed on the JSE Ltd. (“JSE”) and has a wide and diversified range of property management, marketing, and finance skills. Capital previously

investments. invested in WE will be redeployed directly in income property in CEE and

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies indirectly, on a downside protected basis, in developments via further

NUMBER OF EMPLOYEES: 0 preference shares in the DJV with co-investor, developer and general

DIRECTORS: Douglas D (ne), Jankovich-Besan J (ne), Newman B C B (ne), contractor Prime Kapital.

Kerr R C (Chair, ne), Marshall W (CEO), Beale E (Group FD) SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 NUMBER OF EMPLOYEES: 0

Lynchwood Nominees 66.90% DIRECTORS: Briffa S, Iuga V (ind ne), Knight J (alt), NagleBT(ind ne),

Corwil Investments Holdings (Pty) Ltd. 5.70% PascariuCD(ind ne, Rom), Pendred C (ind ne), Semionov V,

POSTAL ADDRESS: PO Box 4126, The Square, Umhlanga, 4021 Vasilescu M (ne), Grigore I (CEO), Alberts W (Acting Chair, ld ind ne),

MORE INFO: www.sharedata.co.za/sdo/jse/MMP Bird N (CFO)

COMPANY SECRETARY: Melissa Bourgeous MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Government Employees Pension Fund 10.60%

PK Investments Ltd.

9.90%

SPONSOR: Questco Corporate Advisory (Pty) Ltd. Attacq Ltd. 6.40%

AUDITORS: Grant Thornton POSTAL ADDRESS: Suite 11, Marina Business Centre,

CAPITAL STRUCTURE AUTHORISED ISSUED Abate Rigord Street, Ta’ Xbiex, XBX1129

MMP Ords USD25c ea 40 000 000 35 857 512 MORE INFO: www.sharedata.co.za/sdo/jse/MSP

COMPANY SECRETARY: Stefan Briffa

DISTRIBUTIONS [USDc]

Ords USD25c ea Ldt Pay Amt TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Final No 28 16 Jul 24 2 Aug 24 1.90 SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Interim No 27 9 Jan 24 26 Jan 24 1.90 AUDITORS: PwC Malta

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Jul24 Avg 10 455 shares p.w., R288 879.4(1.5% p.a.)

MSP Ords EUR1c ea 1 500 000 000 716 145 729

SUPS 40 Week MA MARSHALL

DISTRIBUTIONS [EURc]

5124 Ords EUR1c ea Ldt Pay Amt

Interim No 23 20 Mar 23 3 Apr 23 4.36

4340

Final No 22 20 Sep 22 26 Sep 22 3.82

3556 LIQUIDITY: Jul24 Avg 6m shares p.w., R108.9m(46.1% p.a.)

REDS 40 Week MA MAS

2772

2965

1989

2542

1205

2019 | 2020 | 2021 | 2022 | 2023 | 2024

2119

NOTES: Marshall changed its year end from 30 September to 31 March.

FINANCIAL STATISTICS 1696

(Amts in USD’000) Mar 24 Mar 23 Mar 22 Sep 21 Sep 20

Final Final(rst) Final Final Final 1273

Turnover 83 005 95 819 201 123 132 945 112 519

850

Op Inc 3 062 - 1 273 12 562 7 635 1 935 2019 | 2020 | 2021 | 2022 | 2023 | 2024

NetIntPd(Rcvd) 576 570 3 383 2 075 1 656 NOTES:MASRealEstateInc.renamedtoMASPLCon24November2021.

Minority Int - 1 402 - 383 842 - 278 FINANCIAL STATISTICS

Att Inc 5 250 200 4 589 2 407 387 (Amts in EUR’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

TotCompIncLoss 2 586 - 5 309 10 917 6 708 - 11 Interim Final Final Final Final

Fixed Ass 9 712 34 645 36 675 32 745 29 280 Turnover 47 305 87 888 47 919 45 363 46 850

Inv & Loans 24 689 32 461 33 247 38 248 28 112 Op Inc 33 607 62 195 34 103 26 918 25 556

Tot Curr Ass 68 455 63 385 78 231 67 313 65 507 NetIntPd(Rcvd) - 2 878 - 635 - 6 477 - 5 996 - 5 729

Ord SH Int 88 220 85 370 90 698 87 557 83 254 Minority Int - - - - 1 428

Minority Int 2 345 3 978 5 390 5 086 4 166 Att Inc 68 635 90 832 141 171 71 742 - 21 615

LT Liab 1 381 13 370 15 246 14 599 14 421 TotCompIncLoss 68 432 92 545 141 311 73 092 - 20 210

Tot Curr Liab 19 178 28 424 38 379 33 062 28 844 Fixed Ass 994 441 901 472 860 498 458 603 533 649

PER SHARE STATISTICS (cents per share) Tot Curr Ass 112 007 134 717 309 893 356 687 530 091

HEPS-C (ZARc) 119.87 - 88.45 124.50 105.29 - 49.11 Ord SH Int 1 033 526 964 656 928 150 869 423 796 023

DPS (ZARc) 70.30 67.51 30.10 57.24 60.31 LT Liab 456 388 441 850 450 826 321 059 266 015

NAV PS (ZARc) 4 578.62 4 223.54 3 703.04 3 684.40 3 869.76 Tot Curr Liab 36 053 67 519 150 624 136 098 231 031

Price High 3 250 3 519 3 000 3 000 2 396 PER SHARE STATISTICS (cents per share)

Price Low 2 200 2 200 1 727 1 727 1 653 HEPS-C (ZARc) 93.77 220.47 97.58 126.13 30.08

Price Prd End 2 624 2 400 2 225 2 368 1 850 DPS (ZARc) - 84.79 114.50 99.85 76.55

RATIOS NAV PS (ZARc) 27 488.66 2 882.51 2 298.70 2 105.37 2 200.11

Ret on SH Fnd 4.25 - 0.20 3.77 2.60 0.76 3 Yr Beta 0.69 0.46 1.27 1.43 1.67

Oper Pft Mgn 3.69 - 1.33 6.25 5.74 1.72 Price High 2 203 2 291 2 230 1 872 2 149

D:E 0.09 0.26 0.27 0.29 0.25 Price Low 1 361 1 680 1 700 939 562

Current Ratio 3.57 2.23 2.04 2.04 2.27 Price Prd End 1 731 2 120 1 985 1 818 1 310

Div Cover 3.89 0.15 6.38 1.27 0.27 RATIOS

Ret on SH Fnd 13.28 9.42 15.21 8.25 - 2.54

Oper Pft Mgn 71.04 70.77 71.17 59.34 54.55

D:E 0.45 0.50 0.53 0.50 0.60

Current Ratio 3.11 2.00 2.06 2.62 2.29

Div Cover - 3.07 3.01 1.87 - 0.70

140