Page 141 - shbh24_complete

P. 141

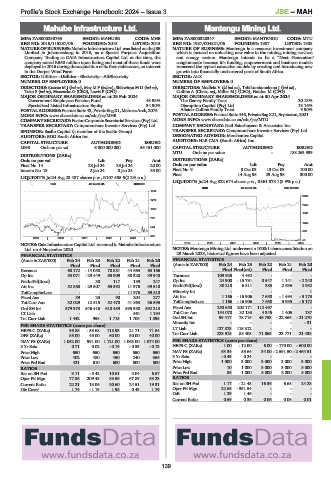

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – MAH

Mahube Infrastructure Ltd. Mantengu Mining Ltd.

MAH MAN

ISIN: ZAE000290763 SHORT: MAHUBE CODE: MHB ISIN: ZAE000320347 SHORT: MANTENGU CODE: MTU

REG NO: 2015/115237/06 FOUNDED: 2015 LISTED: 2015 REG NO: 1987/004821/06 FOUNDED: 1987 LISTED: 1988

NATURE OF BUSINESS: Mahube Infrastructure Ltd. was listed on the JSE NATURE OF BUSINESS: Mantengu is a resource investment company

Limited in Johannesburg in 2015, as a Special Purpose Acquisition which is focused on unlocking new value in the mining, mining services

Company. Trading as GAIA Infrastructure Capital Ltd. at the time, the and energy sectors. Mantengu intends to be a “Next Generation”

company raised R550 million upon listing and most of these funds were conglomerate because it’s funding, empowerment and business models

deployed in 2016 during the acquisition of its first viable asset, an interest transcend the typical extractive models by creating and introducing new

in the Dorper Wind Farm. growth into financially unchartered parts of South Africa.

SECTOR: Utilities—Utilities—Electricity—AltElectricity SECTOR: AltX

NUMBER OF EMPLOYEES: 0 NUMBER OF EMPLOYEES: 0

DIRECTORS: Kuscus M J (ind ne), May M F (ind ne), ShikwinyaMD(ind ne), DIRECTORS: Madlela V (ld ind ne), Tshikundamalema J (ind ne),

Tuku S (ind ne), Moseneke G (CEO), Lewis P (CFO) Collins A (Chair, ne), Miller M J (CEO), Naidoo M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2024

Government Employees Pension Fund 43.93% The Gamsy Family Trust 20.13%

Specialised Listed Infrastructure Equity 34.90% Disruption Capital (Pty) Ltd. 13.16%

POSTAL ADDRESS:PostnetSuite43, PrivateBagX1,MelroseArch,2076 Alistair Collins Family Trust 9.90%

MORE INFO: www.sharedata.co.za/sdo/jse/MHB POSTAL ADDRESS:PostnetSuite446, PrivateBagX21,Bryanston,2021

COMPANY SECRETARY: FusionCorporateSecretarialServices(Pty)Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/MTU

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Neil Esterhuysen & Associates Inc.

SPONSOR: Sasfin Capital (a member of the Sasfin Group) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: BDO South Africa Inc. DESIGNATED ADVISOR: Merchantec Capital

AUDITORS: HLB CMA (South Africa) Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

MHB Ords no par val 6 000 000 000 55 151 000 CAPITAL STRUCTURE AUTHORISED ISSUED

MTU Ords no par value - 188 263 939

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 14 23 Jul 24 29 Jul 24 20.00 Ords no par value Ldt Pay Amt

Interim No 13 2 Jan 24 8 Jan 24 35.00 Final No 9 3 Oct 03 13 Oct 03 100.00

Final 14 Aug 98 29 Aug 98 300.00

LIQUIDITY: Jul24 Avg 23 487 shares p.w., R107 585.6(2.2% p.a.)

LIQUIDITY: Jul24 Avg 322 674 shares p.w., R361 873.1(8.9% p.a.)

EQII 40 Week MA MAHUBE

IIND 40 Week MA MANTENGU

1514

3032

1272

2437

1029

1841

787

1246

544

650

302

2019 | 2020 | 2021 | 2022 | 2023 |

55

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Gaia Infrastructure Capital Ltd. renamed to Mahube Infrastructure

Ltd. on 4 November 2020. NOTES: Mantengu Mining Ltd. underwent a 1000:1 share consolidation on

FINANCIAL STATISTICS 29 March 2023, historical figures have been adjusted.

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 FINANCIAL STATISTICS

Final Final Final Final Final (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Revenue 68 172 - 14 058 78 881 44 663 63 166 Final Final(rst) Final Final Final

Op Inc 53 071 - 29 449 65 909 30 320 39 940 Turnover 109 925 4 492 - - -

NetIntPd(Rcvd) - 30 117 189 247 Op Inc 24 900 - 15 791 8 547 1 141 - 2 240

Att Inc 52 860 - 29 607 65 592 11 976 39 510 NetIntPd(Rcvd) 30 218 6 311 383 2 635 2 932

TotCompIncLoss - - - 11 976 39 510 Minority Int - - - - 1

Fixed Ass 39 23 90 204 277 Att Inc 1 166 - 16 906 7 650 - 1 494 - 5 173

Tot Curr Ass 32 029 12 515 52 478 41 863 36 595 TotCompIncLoss 1 166 - 16 906 7 650 3 935 - 5 172

Ord SH Int 579 973 546 416 618 489 585 988 592 213 Fixed Ass 250 650 202 171 112 497 - -

LT Liab - - - 561 1 194 Tot Curr Ass 154 070 32 133 4 345 1 405 137

Tot Curr Liab 1 442 958 1 715 1 708 1 895 Ord SH Int 99 417 78 716 46 753 - 22 366 - 21 270

Minority Int - - - - - 31

PER SHARE STATISTICS (cents per share) LT Liab 127 873 115 312 - - -

HEPS-C (ZARc) 95.85 - 53.68 118.93 21.71 71.64

DPS (ZARc) 55.00 45.00 60.00 50.00 40.00 Tot Curr Liab 223 915 88 408 71 065 23 771 21 438

NAV PS (ZARc) 1 052.00 991.00 1 121.00 1 063.00 1 074.00 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.71 0.02 - 0.19 - 0.33 - 0.13 HEPS-C (ZARc) 1.00 - 12.00 6.00 - 170.00 - 600.00

Price High 650 650 650 550 650 NAV PS (ZARc) 63.34 55.64 34.00 - 2 591.50 - 2 464.51

Price Low 402 480 450 240 365 3 Yr Beta - 0.49 0.24 - - -

Price Prd End 421 610 600 500 500 Price High 1 000 3 000 3 000 3 000 3 000

RATIOS Price Low 10 1 000 3 000 3 000 3 000

Ret on SH Fnd 9.11 - 5.42 10.61 2.04 6.67 Price Prd End 85 1 000 3 000 3 000 3 000

Oper Pft Mgn 77.85 209.48 83.55 67.89 63.23 RATIOS

Current Ratio 22.21 13.06 30.60 24.51 19.31 Ret on SH Fnd 1.17 - 21.48 16.36 6.68 24.28

Div Cover 1.74 - 1.19 1.98 0.43 1.79 Oper Pft Mgn 22.65 - 351.54 - - -

D:E 1.29 1.46 - - -

Current Ratio 0.69 0.36 0.06 0.06 0.01

139