Page 215 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 215

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – WOO

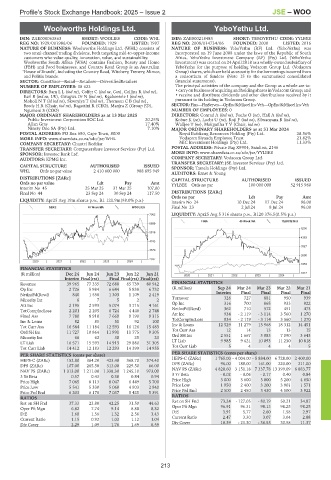

Woolworths Holdings Ltd. YeboYethu Ltd.

WOO YEB

ISIN: ZAE000063863 SHORT: WOOLIES CODE: WHL ISIN: ZAE000218483 SHORT: YEBOYETHU CODE: YYLBEE

REG NO: 1929/001986/06 FOUNDED: 1929 LISTED: 1997 REG NO: 2008/014734/06 FOUNDED: 2008 LISTED: 2016

NATURE OF BUSINESS: Woolworths Holdings Ltd. (WHL) consists of NATURE OF BUSINESS: YeboYethu (RF) Ltd. (YeboYethu) was

two omni-channel trading divisions, both targeting mid-to-upper-income incorporated on 19 June 2008 under the laws of the Republic of South

customers who value quality, innovation, value, and sustainability. Africa. YeboYethu Investment Company (RF) (Pty) Ltd. (YeboYethu

Woolworths South Africa (WSA) contains Fashion, Beauty and Home Investment) was created on 24 April 2018 as a wholly-owned subsidiary of

(FBH) and Food businesses, and Country Road Group is an Australian YeboYethu for the purpose of holding Vodacom Group Ltd. (Vodacom

‘House of Brands’, including the Country Road, Witchery, Trenery, Mimco, Group) shares, which are held as security for the borrowings incurred from

and Politix brands. a consortium of funders (Note 15 to the summarised consolidated

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers financial statements).

NUMBER OF EMPLOYEES: 38 623 The principal activities of the company and the Group as a whole are to:

DIRECTORS: BamLL(ind ne), Colfer C (ind ne, Can), Collins R (ind ne), •carryonbusinessofacquiring andholdingsharesinVodacomGroup;and

Earl B (ind ne, UK), Gwagwa Dr N (ind ne), Kgaboesele I (ind ne), • receive and distribute dividends and other distributions received by it

MoholiNT(ld ind ne), Skweyiya T (ind ne), ThomsonCB(ind ne), pursuant to its holding in Vodacom Group.

Brody H R (Chair, ind ne), Bagattini R (CEO), Manjra Z (Group FD), SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

Ngumeni S (COO) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 13 Mar 2025 DIRECTORS: Conrad A (ind ne), Fuchs O (ne), Hall A (ind ne),

Public Investment Corporation SOC Ltd. 20.25% Kobue K (ne), Lucht U (ne), Roji F (ind ne), Silwanyana B (ind ne),

Allan Gray 17.40% Walljee T (ne), Mokgatlha T V (Chair, ind ne)

Ninety One SA (Pty) Ltd. 7.10% MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

POSTAL ADDRESS: PO Box 680, Cape Town, 8000 Royal Bafokeng Resources Holding (Pty) Ltd. 28.56%

MORE INFO: www.sharedata.co.za/sdo/jse/WHL Vodacom Siyanda Employee Trust 21.82%

COMPANY SECRETARY: Chantel Reddiar MIC Investment Holdings (Pty) Ltd. 11.33%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: Private Bag X9904, Sandton, 2146

SPONSOR: Investec Bank Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/YYLBEE

AUDITORS: KPMG Inc. COMPANY SECRETARY: Vodacom Group Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Tamela Holdings (Pty) Ltd.

WHL Ords no par value 2 410 600 000 988 695 949

AUDITORS: Ernst & Young

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords no par value Ldt Pay Amt YYLBEE Ords no par 100 000 000 52 915 960

Interim No 45 25 Mar 25 31 Mar 25 107.00

Final No 44 23 Sep 24 30 Sep 24 117.50 DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

LIQUIDITY: Apr25 Avg 19m shares p.w., R1 121.9m(98.0% p.a.) Interim No 24 10 Dec 24 17 Dec 24 96.00

GERE 40 Week MA WOOLIES FinalNo 23 2 Jul24 8 Jul24 96.00

7962 LIQUIDITY: Apr25 Avg 5 316 shares p.w., R120 376.5(0.5% p.a.)

FINA 40 Week MA YEBOYETHU

6889

5200

5816

4363

4743

3527

3670

2690

2597

2020 | 2021 | 2022 | 2023 | 2024 |

1853

FINANCIAL STATISTICS

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 2020 | 2021 | 2022 | 2023 | 2024 | 1017

Interim Final(rst) Final Final(rst) Final(rst)

Revenue 39 965 77 335 72 688 65 739 80 942 FINANCIAL STATISTICS

Op Inc 2 726 5 984 6 644 5 838 6 732 (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

NetIntPd(Rcvd) 840 1 558 1 303 1 109 2 419 Interim Final Final Final Final

Minority Int 6 7 5 2 2 Turnover 326 727 881 950 939

Att Inc 2 195 2 593 5 074 3 715 4 161 Op Inc 316 700 865 933 922

TotCompIncLoss 2 201 2 205 6 724 4 448 2 748 NetIntPd(Rcvd) 362 710 572 451 473

Fixed Ass 7 780 8 910 7 669 9 190 9 315 Att Inc 934 - 2 119 - 3 114 3 560 1 270

Inv & Loans 82 85 51 92 100 TotCompIncLoss 934 - 2 119 - 3 114 3 560 1 270

Tot Curr Ass 16 584 11 184 12 593 16 126 15 483 Inv & Loans 12 529 11 279 13 968 18 312 14 451

Ord SH Int 11 727 10 864 11 991 11 775 9 305 Tot Curr Ass 12 14 13 13 15

Minority Int 66 62 30 25 23 Ord SH Int 2 551 1 667 3 883 7 090 3 643

LT Liab 16 571 15 593 14 913 29 880 31 305 LT Liab 9 985 9 621 10 093 11 230 10 818

Tot Curr Liab 14 412 12 183 12 293 14 399 14 955 Tot Curr Liab 5 4 4 4 5

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 152.80 364.20 423.40 368.70 374.40 HEPS-C (ZARc) 1 765.00 - 4 004.00 - 5 884.00 6 728.00 2 400.00

DPS (ZARc) 107.00 265.50 313.00 229.50 66.00 DPS (ZARc) 96.00 188.00 161.00 220.00 211.00

NAV PS (ZARc) 1 313.00 1 211.00 1 338.30 1 245.10 973.00 NAV PS (ZARc) 4 820.60 3 151.18 7 337.78 13 399.09 6 883.77

3 Yr Beta 0.57 0.43 0.38 0.84 0.94 3 Yr Beta - 0.02 - 0.06 - 0.17 0.40 0.84

Price High 7 065 8 113 8 047 6 449 5 700 Price High 3 000 3 600 5 000 5 200 4 650

Price Low 5 541 5 330 5 060 4 903 2 940 Price Low 1 950 2 400 3 200 3 901 1 571

Price Prd End 6 203 6 178 7 037 5 425 5 391 Price Prd End 2 500 2 450 3 430 4 500 3 922

RATIOS RATIOS

Ret on SH Fnd 37.33 23.80 42.25 31.50 44.63 Ret on SH Fnd 73.24 - 127.05 - 80.19 50.21 34.87

Oper Pft Mgn 96.91 96.31 98.13 98.25 98.25

Oper Pft Mgn 6.82 7.74 9.14 8.88 8.32

D:E 1.60 1.56 1.32 2.56 3.43 D:E 3.91 5.77 2.60 1.58 2.97

Current Ratio 1.15 0.92 1.02 1.12 1.04 Current Ratio 2.47 3.30 3.07 3.04 2.88

Div Cover 2.29 1.09 1.76 1.69 6.59 Div Cover 18.39 - 21.30 - 36.55 30.58 11.37

213