Page 210 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 210

JSE – TSO Profile’s Stock Exchange Handbook: 2025 – Issue 2

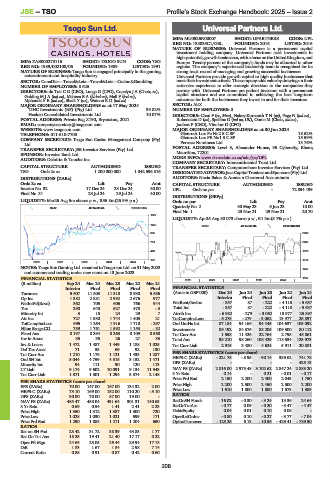

Tsogo Sun Ltd. Universal Partners Ltd.

TSO UNI

ISIN: MU0526N00007 SHORT: UPARTNERS CODE: UPL

REG NO: 138035C1/GBL FOUNDED: 2016 LISTED: 2016

NATURE OF BUSINESS: Universal Partners is a permanent capital

investment holding company. Universal Partners seek investments in

high-potential,growthbusinesses,withafocusontheUnitedKingdom,and

ISIN: ZAE000273116 SHORT: TSOGO SUN CODE: TSG Europe. Twenty percent of the company’s funds may be allocated to other

REG NO: 1989/002108/06 FOUNDED: 1989 LISTED: 1991 regions. The company’s experienced leadership team is recognised for its

NATURE OF BUSINESS: Tsogo Sun is engaged principally in the gaming, strong track record of managing and growing successful businesses.

entertainment and hospitality industry. Universal Partners provide growth capital to high quality businesses that

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling meet their investment criteria. The company adds value by drawing on their

NUMBER OF EMPLOYEES: 8 625 extensive experience to offer strategic direction to the companies they

DIRECTORS: du Toit C G (CEO), Lunga G (CFO), Copelyn J A (Chair, ne), partner with. Universal Partners are patient investors with a permanent

Golding M J A (ind ne), Mabuza B A (ld ind ne), Mall F (ind ne), capital structure and are committed to achieving the best long-term

Mphande V E (ind ne), Shaik Y (ne), Watson R D (ind ne) outcomes for both the businesses they invest in and for their investors.

MAJOR ORDINARY SHAREHOLDERS as at 17 May 2024 SECTOR: AltX

TIHC Investments (RF) (Pty) Ltd. 39.82% NUMBER OF EMPLOYEES: 0

Hosken Consolidated Investments Ltd. 10.07% DIRECTORS: Chan F (ne, Mau), Nakey-Kurnauth T N (ne), Page N (ind ne),

POSTAL ADDRESS: Private Bag X190, Bryanston, 2021 Rubenstein D (ne), Spellins G (ind ne, UK), Ooms M (Chair, ind ne),

EMAIL: companysecretary@tsogosun.com Joubert P (CEO), Vinokur D (CFO)

WEBSITE: www.tsogosun.com MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

TELEPHONE: 011-510-7700 Glenrock Lux Pe No2 S.C.SP. 18.52%

COMPANY SECRETARY: Tsogo Sun Casino Management Company (Pty) Glenrock Lux PE No1 S.C.SP. 15.59%

13.76%

Peresec Nominees Ltd.

Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebene,

Mauritius, 72201

SPONSOR: Investec Bank Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/UPL

AUDITORS: Deloitte & Touche Inc.

COMPANY SECRETARY: Intercontinental Trust Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TSG Ords 2c ea 1 200 000 000 1 042 596 816 DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: Nexia Baker & Arenson Chartered Accountants

Ords 2c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Interim No 32 17 Dec 24 23 Dec 24 30.00 UPL Ords no par - 72 894 199

Final No 31 23 Jul 24 29 Jul 24 40.00

DISTRIBUTIONS [GBPp]

LIQUIDITY: Mar25 Avg 5m shares p.w., R55.8m(25.9% p.a.) Ords no par Ldt Pay Amt

TRAV 40 Week MA TSOGO SUN Quarterly No 2 30 May 23 6 Jun 23 10.00

Final No 1 23 Nov 21 29 Nov 21 20.70

1527

LIQUIDITY: Apr25 Avg 80 073 shares p.w., R1.3m(5.7% p.a.)

1256

GENF 40 Week MA UPARTNERS

985 2500

714 2239

443 1979

172 1718

2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Tsogo Sun Gaming Ltd. renamed to Tsogo sun Ltd. on 31 May 2023 1457

and commenced trading under new name on 13 June 2023.

FINANCIAL STATISTICS 2020 | 2021 | 2022 | 2023 | 2024 | 1197

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Interim Final Final Final Final FINANCIAL STATISTICS

Turnover 5 607 11 503 11 318 8 938 5 686 (Amts in GBP’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Op Inc 1 382 2 881 2 992 2 676 977 Interim Final Final Final Final

NetIntPd(Rcvd) 362 705 606 766 944 NetRent/InvInc - 357 87 - 222 - 4 118 - 5 637

Tax 290 640 627 478 - 3 Total Inc - 357 87 - 222 - 4 118 - 5 637

Minority Int 3 15 24 29 7 Attrib Inc - 6 982 - 279 - 3 062 13 977 25 897

Att Inc 727 1 530 1 744 1 405 21 TotCompIncLoss - 6 275 - 279 - 3 062 13 977 25 897

TotCompIncLoss 695 1 264 1 916 1 710 - 297 Ord UntHs Int 87 184 94 166 94 445 104 637 105 092

Hline Erngs-CO 759 1 761 1 592 1 153 - 32 Investments 89 192 84 375 83 205 109 300 80 112

Fixed Ass 8 197 8 294 8 263 8 109 8 560 Tot Curr Ass 1 558 11 426 22 764 2 795 45 861

Inv in Assoc 35 35 26 27 33 Total Ass 93 210 98 260 108 429 118 534 125 973

Inv & Loans 1 472 1 487 1 449 1 188 1 025 Tot Curr Liab 2 915 3 480 4 624 5 911 20 881

Def Tax Asset 71 53 69 92 130

Tot Curr Ass 1 210 1 179 1 121 1 433 1 287 PER SHARE STATISTICS (cents per share)

Ord SH Int 5 044 4 759 4 515 3 152 1 471 HEPS-C (ZARc) - 221.78 - 8.95 - 90.14 389.62 741.78

Minority Int 94 111 90 120 113 DPS (ZARc) - - - - 425.13

LT Liab 9 174 9 602 10 091 9 134 11 943 NAV PS (ZARc) 2 816.00 2 975.48 3 102.62 2 847.24 2 883.20

Tot Curr Liab 1 371 1 301 1 294 3 374 2 148 3 Yr Beta 0.14 - 0.21 - 0.01 - 0.17

Price Prd End 2 150 2 200 2 400 2 043 1 750

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 70.00 147.00 167.00 134.32 2.00 Price High 2 200 2 500 2 450 2 500 2 200

HEPS-C (ZARc) 73.10 169.00 152.00 110.20 - 3.10 Price Low 1 610 1 800 1 800 1 573 1 389

DPS (ZARc) 30.00 70.00 87.00 19.00 - RATIOS

NAV PS (ZARc) 485.47 458.04 431.64 301.31 140.63 RetOnSH Funds - 16.02 - 0.30 - 3.24 13.36 24.64

3 Yr Beta 0.69 0.54 1.41 2.41 2.23 RetOnTotAss - 0.77 0.09 - 0.20 - 3.47 - 4.47

Price High 1 350 1 312 1 387 1 300 720 Debt:Equity 0.04 0.01 0.10 0.08 -

Price Low 1 028 1 030 1 021 599 171 OperRetOnInv - 0.80 0.10 - 0.27 - 3.77 - 7.04

Price Prd End 1 250 1 088 1 211 1 204 650 OpInc:Turnover - 125.26 6.13 - 10.56 - 429.41 - 789.50

RATIOS

Ret on SH Fnd 28.42 31.72 38.39 43.83 1.77

Ret On Tot Ass 18.25 19.41 21.40 17.17 0.22

Oper Pft Mgn 24.65 25.05 26.44 29.94 17.18

D:E 1.83 1.67 1.84 2.98 7.14

Current Ratio 0.88 0.91 0.87 0.42 0.60

208