Page 208 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 208

JSE – TRE Profile’s Stock Exchange Handbook: 2025 – Issue 2

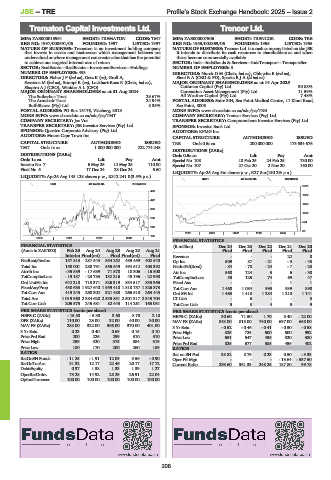

Trematon Capital Investments Ltd. Trencor Ltd.

TRE TRE

ISIN: ZAE000013991 SHORT: TREMATON CODE: TMT ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE

REG NO: 1997/008691/06 FOUNDED: 1997 LISTED: 1997 REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955

NATURE OF BUSINESS: Trematon is an investment holding company NATURE OF BUSINESS: Trencor Ltd. is a cash company listed on the JSE.

that invests in assets and businesses which management believes are It intends to distribute its cash resources to shareholders as and when

undervalued or where management can create value that has the potential these become commercially available.

to achieve our targeted internal rate of return. SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings NUMBER OF EMPLOYEES: 3

NUMBER OF EMPLOYEES: 493 DIRECTORS: Nurek D M (Chair, ind ne), Oblowitz E (ind ne),

DIRECTORS: FisherJP(ind ne), Getz K (ne), Groll A, Sieni R A (CEO & FD), SparksRJA(ld ind ne)

Sessions M (ind ne), Stumpf R (ne), Lockhart-Ross R (Chair, ind ne), MAJOR ORDINARY SHAREHOLDERS as at 14 Apr 2025

Shapiro A J (CEO), Winkler A L (CFO) Cuthman Capital (Pty) Ltd. 30.88%

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024 Coronation Asset Management (Pty) Ltd. 11.59%

The Suikerbos Trust 29.67% All Weather Capital (Pty) Ltd. 7.48%

The Armchair Trust 24.94% POSTAL ADDRESS: Suite 304, Sea Point Medical Centre, 11 Kloof Road,

Buff-Shares (Pty) Ltd. 8.35% Sea Point, 8005

POSTAL ADDRESS: PO Box 15176, Vlaeberg, 8018 MORE INFO: www.sharedata.co.za/sdo/jse/TRE

MORE INFO: www.sharedata.co.za/sdo/jse/TMT COMPANY SECRETARY: Trencor Services (Pty) Ltd.

COMPANY SECRETARY: Jac Vos TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Investec Bank Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. AUDITORS: KPMG Inc.

AUDITORS: Moore Cape Town Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED TRE Ords 0.5c ea 200 000 000 173 534 676

TMT Ords 1c ea 1 000 000 000 222 774 248

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 0.5c ea Ldt Pay Amt

Ords 1c ea Ldt Pay Amt Special No 108 18 Feb 25 24 Feb 25 730.00

Interim No 7 6 May 25 12 May 25 110.00 Special No 107 27 Oct 20 2 Nov 20 160.00

Final No 6 17 Dec 24 23 Dec 24 6.60

LIQUIDITY: Apr25 Avg 5m shares p.w., R27.8m(150.2% p.a.)

LIQUIDITY: Apr25 Avg 148 128 shares p.w., R312 241.0(3.5% p.a.)

INDT 40 Week MA TRENCOR

EQII 40 Week MA TREMATON

2378

486

1922

422

1466

358

1010

293

554

229

98

2020 | 2021 | 2022 | 2023 | 2024 |

165

2020 | 2021 | 2022 | 2023 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

(Amts in ZAR’000) Feb 25 Aug 24 Aug 23 Aug 22 Aug 21 Final Final Final Final Final

Interim Final(rst) Final Final(rst) Final Revenue - - - 22 8

NetRent/InvInc 157 813 287 543 554 252 489 459 402 540 Op Inc 509 87 - 21 - 3 - 43

Total Inc 158 001 288 791 555 649 494 512 403 392 NetIntPd(Rcvd) - 84 -78 - 24 -7 -23

Attrib Inc - 35 589 - 17 689 71 578 18 306 - 16 500 Att Inc 568 124 3 6 - 38

TotCompIncLoss - 19 187 - 23 783 132 216 45 196 - 22 998 TotCompIncLoss 53 125 74 69 47

Ord UntHs Int 642 218 718 371 826 319 834 517 835 965 Fixed Ass - - - 1 1

FixedAss/Prop 430 683 1 927 640 1 959 410 1 818 757 1 826 373 Tot Curr Ass 1 468 1 084 993 939 898

Tot Curr Ass 419 245 268 302 321 488 266 518 263 443 Ord SH Int 1 463 1 410 1 284 1 210 1 141

Total Ass 1 019 960 2 384 620 2 533 831 2 501 317 2 343 704 LT Liab - 6 - - 3

Tot Curr Liab 205 575 245 681 82 443 114 261 165 031 Tot Curr Liab 5 3 4 5 9

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 15.50 - 5.30 3.60 8.70 2.10 HEPS-C (ZARc) 30.60 71.50 1.70 3.40 - 22.00

DPS (ZARc) 110.00 23.00 32.00 40.00 30.00 NAV PS (ZARc) 843.00 813.00 740.00 697.00 658.00

NAV PS (ZARc) 288.00 322.00 366.00 370.00 401.00 3 Yr Beta - 0.52 - 0.46 - 0.41 - 0.50 - 0.58

3 Yr Beta 0.23 0.40 0.69 0.15 0.10 Price High 825 725 600 500 992

Price Prd End 200 226 299 310 310 Price Low 651 547 436 320 380

Price High 299 320 375 384 319 Price Prd End 825 677 585 459 402

Price Low 180 170 200 260 189 RATIOS

RATIOS Ret on SH Fnd 38.82 8.79 0.23 0.50 - 3.33

RetOnSH Funds - 11.25 - 1.91 12.09 3.56 - 0.90 Oper Pft Mgn - - - - 13.64 - 537.50

RetOnTotAss 31.32 12.17 22.46 20.17 17.72 Current Ratio 293.60 361.33 248.25 187.80 99.78

Debt:Equity 0.37 1.38 1.33 1.39 1.27

OperRetOnInv 73.28 14.92 28.29 26.91 22.04

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

206