Page 216 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 216

JSE – YOR Profile’s Stock Exchange Handbook: 2025 – Issue 2

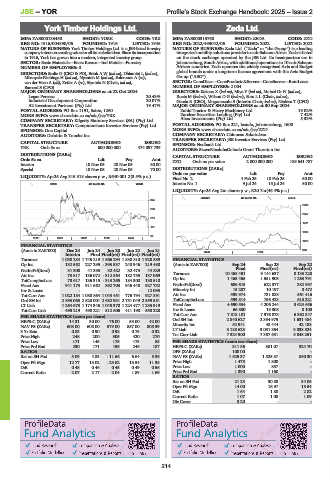

York Timber Holdings Ltd. Zeda Ltd.

YOR ZED

ISIN: ZAE000133450 SHORT: YORK CODE: YRK ISIN: ZAE000315768 SHORT: ZEDA CODE: ZZD

REG NO: 1916/004890/06 FOUNDED: 1916 LISTED: 1946 REG NO: 2022/493042/06 FOUNDED: 2022 LISTED: 2022

NATURE OF BUSINESS: York Timber Holdings Ltd. is a JSE-listed forestry NATURE OF BUSINESS: Zeda Ltd. (“Zeda” or “the Group”) is a leading

companyintentoncreatingvalueforallitsstakeholders.Sinceitsincorporation integrated mobility solutionsprovider insub-SaharanAfrica. Zeda is listed

in 1916, York has grown into a modern, integrated forestry group. on the stock exchange operated by the JSE Ltd. Its headquarters are in

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Forestry Johannesburg, South Africa, with additional operations in 10 sub-Saharan

NUMBER OF EMPLOYEES: 0 African countries. Zeda operates the widely recognised Avis and Budget

DIRECTORS: StoltzG(CEO&FD), Brink A W(ind ne), Dhlamini L (ind ne), global brands under a long-term licence agreement with the Avis Budget

Mbanyele-Ntshinga H (ind ne), Nyanteh M (ind ne), Solomons A (ne), Group (“ABG”).

van der Veen A (alt), Zetler A (ne), Siyotula N (Chair, ind ne), SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—RentLease

Barnard S (CFO) NUMBER OF EMPLOYEES: 2 004

MAJOR ORDINARY SHAREHOLDERS as at 22 Oct 2024 DIRECTORS: Kakana X (ind ne), Miya Y (ind ne), Motsei Dr N (ind ne),

Legae Peresec 20.43% Roets M (ind ne), Wilson D G (ind ne), BamLL(Chair, ind ne),

Industrial Development Corporation 20.07% Ganda R (CEO), Mngomezulu S (Interim Chair, ind ne), Ntshiza T (CFO)

A2 Investment Partners (Pty) Ltd. 19.47% MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024

POSTAL ADDRESS: PO Box 1191, Sabie, 1260 Zahid Tractor & Heavy Machinery Ltd. 19.02%

MORE INFO: www.sharedata.co.za/sdo/jse/YRK Zarclear Securities Lending (Pty) Ltd. 7.42%

COMPANY SECRETARY: Kilgetty Statutory Services (SA) (Pty) Ltd. Abax Investments (Pty) Ltd. 5.33%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 221, Isando, Johannesburg, 1600

SPONSOR: One Capital MORE INFO: www.sharedata.co.za/sdo/jse/ZZD

AUDITORS: Deloitte & Touche Inc. COMPANY SECRETARY: Chioneso Sakutukwa

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Nedbank Ltd.

YRK Ords 5c ea 600 000 000 474 097 739

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords 5c ea Ldt Pay Amt ZZD Ords no par value 2 000 000 000 189 641 787

Interim 18 Nov 05 28 Nov 05 30.00

Special 18 Nov 05 28 Nov 05 70.00 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

LIQUIDITY: Apr25 Avg 315 318 shares p.w., R640 001.2(3.5% p.a.) Final No 2 4 Feb 25 10 Feb 25 50.00

IDMS 40 Week MA YORK Interim No 1 9 Jul 24 15 Jul 24 50.00

LIQUIDITY: Apr25 Avg 2m shares p.w., R20.7m(46.4% p.a.)

JS4021 40 Week MA ZEDA

345

2333

280

2057

216

1781

151

1505

86

2020 | 2021 | 2022 | 2023 | 2024 |

1229

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 2023 | 2024 | 953

Interim Final Final(rst) Final(rst) Final(rst)

Turnover 1 038 284 1 745 219 1 666 294 1 838 810 1 928 589 FINANCIAL STATISTICS

Op Inc 132 562 227 295 - 393 537 248 946 219 480 (Amts in ZAR’000) Sep 24 Sep 23 Sep 22

NetIntPd(Rcvd) 31 308 41 385 32 422 32 473 44 829 Final Final(rst) Final(rst)

Att Inc 73 617 136 072 - 312 864 182 755 137 069 Turnover 10 468 451 9 144 637 8 133 228

TotCompIncLoss 73 617 136 315 - 313 265 184 300 138 510 Op Inc 1 465 465 1 551 903 1 263 791

Fixed Ass 941 173 911 662 892 703 946 448 927 732 NetIntPd(Rcvd) 686 615 622 377 382 997

Inv & Loans - - - - 12 093 Minority Int 15 287 10 197 8 472

Tot Curr Ass 1 022 184 1 080 864 1 043 451 776 794 927 891 Att Inc 598 974 731 883 561 416

Ord SH Int 2 893 063 2 820 001 2 682 931 2 751 049 2 559 581 TotCompIncLoss 599 814 756 423 613 221

LT Liab 1 264 673 1 174 346 1 045 370 1 224 477 1 235 919 Fixed Ass 4 690 534 4 206 244 3 624 656

Tot Curr Liab 493 219 498 221 512 506 411 198 550 228 Inv & Loans 66 830 18 308 8 100

Tot Curr Ass 7 818 101 7 976 873 6 362 847

PER SHARE STATISTICS (cents per share) Ord SH Int 2 840 627 2 354 975 1 631 484

HEPS-C (ZARc) 14.31 30.00 - 76.00 53.00 42.00 Minority Int 52 941 48 444 42 188

NAV PS (ZARc) 608.00 608.00 579.00 857.00 805.39 LT Liab 3 188 623 3 051 864 3 038 824

3 Yr Beta 0.83 0.90 0.98 0.73 0.32

Price High 248 200 305 420 270 Tot Curr Liab 7 324 900 7 357 651 5 848 251

Price Low 171 145 175 173 85 PER SHARE STATISTICS (cents per share)

Price Prd End 230 171 196 246 187 HEPS-C (ZARc) 311.86 381.07 324.70

RATIOS DPS (ZARc) 100.00 - -

Ret on SH Fnd 5.09 4.83 - 11.66 6.64 5.36 NAV PS (ZARc) 1 525.37 1 525.37 860.30

Oper Pft Mgn 12.77 13.02 - 23.62 13.54 11.38 Price High 1 475 1 800 -

D:E 0.48 0.46 0.45 0.49 0.56 Price Low 1 000 857 -

Current Ratio 2.07 2.17 2.04 1.89 1.69 Price Prd End 1 390 1 160 -

RATIOS

Ret on SH Fnd 21.23 30.88 34.05

Oper Pft Mgn 14.00 16.97 15.54

D:E 1.64 1.88 2.82

Current Ratio 1.07 1.08 1.09

Div Cover 3.20 - -

214