Page 91 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 91

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – BID

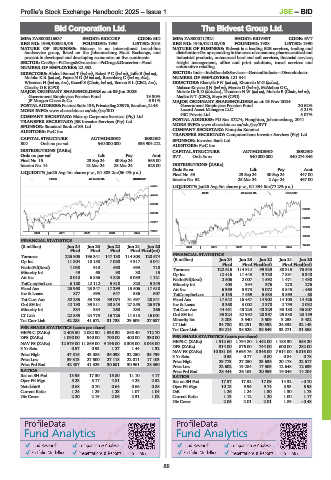

Bid Corporation Ltd. The Bidvest Group Ltd.

BID BID

ISIN: ZAE000216537 SHORT: BIDCORP CODE: BID ISIN: ZAE000117321 SHORT: BIDVEST CODE: BVT

REG NO: 1995/008615/06 FOUNDED: 1995 LISTED: 2016 REG NO: 1946/021180/06 FOUNDED: 1988 LISTED: 1990

NATURE OF BUSINESS: Bidcorp is an international broad-line NATURE OF BUSINESS: Bidvest is a leading B2B services, trading and

foodservice group, listed on the Johannesburg Stock Exchange, and distribution Groupoperating inthe areasofconsumer, pharmaceutical and

present in developed and developing economies on five continents. industrial products, outsourced hard and soft services, financial services,

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food freight management, office and print solutions, travel services and

NUMBER OF EMPLOYEES: 22 552 automotive retailing.

DIRECTORS: Abdool-Samad T (ind ne), Baloyi P C (ind ne), Joffe B (ind ne), SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

Moloko KR(ind ne), Payne N G (ld ind ne), Rosenberg C (ind ne, Aus), NUMBER OF EMPLOYEES: 121 344

Wiseman H (ind ne, Aus), Koseff S (Chair, ind ne), Berson B L (CEO, Aus), DIRECTORS: Khanyile F N (ind ne), Khumalo M G (ind ne),

Cleasby D E (CFO) Mabaso-Koyana S N (ind ne), Masata D (ind ne), McMahon G C,

MAJOR ORDINARY SHAREHOLDERS as at 09 Jan 2025 Mokate Dr R D (ld ind ne), Thomson N W (ind ne), Mohale B (Chair, ind ne),

Government Employees Pension Fund 19.30% Madisa N T (CEO), Steyn M (CFO)

JP Morgan Chase & Co. 6.91% MAJOR ORDINARY SHAREHOLDERS as at 19 Nov 2024

POSTAL ADDRESS:PostnetSuite136, PrivateBagX9976, Sandton,2146 Government Employees Pension Fund 20.62%

MORE INFO: www.sharedata.co.za/sdo/jse/BID Lazard Asset Managers LLC 5.21%

COMPANY SECRETARY: Bidcorp Corporate Services (Pty) Ltd. GIC Private Ltd. 5.07%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 87274, Houghton, Johannesburg, 2041

SPONSOR: Standard Bank of SA Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/BVT

AUDITORS: PwC Inc. COMPANY SECRETARY: Nonqaba Katamzi

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Investec Bank Ltd.

BID Ords no par val 540 000 000 336 904 212

AUDITORS: PwC Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords no par val Ldt Pay Amt BVT Ords 5c ea 540 000 000 340 274 346

Final No 15 23 Sep 24 30 Sep 24 565.00

Interim No 14 18 Mar 24 25 Mar 24 525.00 DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt

LIQUIDITY: Jan25 Avg 4m shares p.w., R1 883.2m(66.4% p.a.) Final No 53 23 Sep 24 30 Sep 24 447.00

FOOR 40 Week MA BIDCORP Interim No 52 25 Mar 24 2 Apr 24 467.00

50461 LIQUIDITY: Jan25 Avg 5m shares p.w., R1 334.8m(77.2% p.a.)

GENI 40 Week MA BIDVEST

44375

38289

25800

32203

22480

26117

19160

20031

2020 | 2021 | 2022 | 2023 | 2024 |

15840

FINANCIAL STATISTICS

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 2020 | 2021 | 2022 | 2023 | 2024 | 12520

Final Final Final Final Final(rst)

Turnover 225 905 196 341 147 138 114 803 120 574 FINANCIAL STATISTICS

Op Inc 11 804 10 158 7 080 4 917 3 041 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final

Final Final(rst)

Final Final(rst)

NetIntPd(Rcvd) 1 038 910 690 693 710

Turnover 122 616 114 912 99 929 88 315 76 543

Minority Int 49 65 90 30 15 Op Inc 12 416 11 443 9 730 7 891 5 340

Att Inc 8 010 6 886 4 825 3 089 1 121 NetIntPd(Rcvd) 2 506 2 007 1 592 1 471 1 430

TotCompIncLoss 6 180 12 112 5 818 820 5 345 Minority Int 403 394 376 278 276

Fixed Ass 25 968 23 347 17 299 15 506 17 618 Att Inc 6 369 5 973 5 072 3 845 - 463

Inv & Loans 877 693 647 586 607 TotCompIncLoss 6 133 7 669 5 533 3 569 - 68

Tot Curr Ass 52 255 53 783 39 074 31 697 28 841 Fixed Ass 17 642 16 457 14 902 14 108 14 426

Ord SH Int 42 190 39 811 30 843 27 855 26 976 Inv & Loans 3 368 3 002 2 378 2 759 2 032

Minority Int 334 384 260 233 266 Tot Curr Ass 44 451 43 223 40 329 33 188 36 807

LT Liab 22 855 24 773 16 726 11 513 16 001 Ord SH Int 35 324 32 992 28 367 25 538 23 159

Tot Curr Liab 42 288 41 672 31 738 29 609 27 687 Minority Int 3 208 3 340 3 509 3 253 3 482

LT Liab 34 780 32 291 30 592 24 338 32 143

PER SHARE STATISTICS (cents per share) Tot Curr Liab 39 214 38 528 33 549 33 271 31 558

HEPS-C (ZARc) 2 405.50 2 082.90 1 538.30 868.40 712.70

DPS (ZARc) 1 090.00 940.00 700.00 400.00 330.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 12 579.00 11 869.00 9 196.00 8 305.00 8 043.00 HEPS-C (ZARc) 1 912.60 1 794.80 1 442.00 1 183.30 553.20

3 Yr Beta 0.57 0.93 1.27 1.44 1.32 DPS (ZARc) 914.00 876.00 744.00 600.00 282.00

Price High 47 816 43 386 36 098 32 250 35 799 NAV PS (ZARc) 10 381.06 9 695.76 8 346.00 7 514.00 6 816.00

0.53

0.77

0.80

0.84

0.78

3 Yr Beta

Price Low 39 313 27 500 27 118 22 011 17 103 Price High 29 773 27 250 23 636 20 178 22 617

Price Prd End 42 487 41 329 30 681 30 961 28 350 Price Low 22 602 19 284 17 509 12 648 12 639

RATIOS Price Prd End 28 444 26 163 20 959 19 046 14 204

Ret on SH Fnd 18.95 17.30 15.80 11.10 4.17 RATIOS

Oper Pft Mgn 5.23 5.17 4.81 4.28 2.52 Ret on SH Fnd 17.57 17.52 17.09 14.32 - 0.70

Net debt:E 0.68 0.70 0.64 0.66 0.88 Oper Pft Mgn 10.13 9.96 9.74 8.93 6.98

Current Ratio 1.24 1.29 1.23 1.07 1.04 D:E 1.26 1.24 1.30 1.30 1.73

Div Cover 2.20 2.19 2.06 2.31 1.02 Current Ratio 1.13 1.12 1.20 1.00 1.17

Div Cover 2.05 2.01 2.01 1.89 - 0.48

89