Page 95 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 95

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – BRI

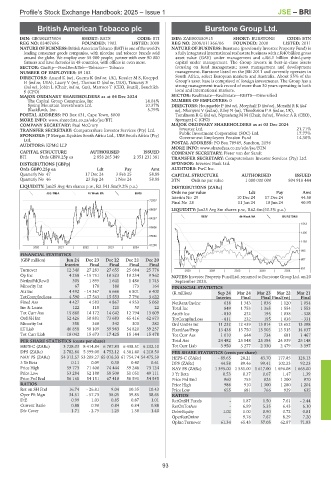

British American Tobacco plc Burstone Group Ltd.

BRI BUR

ISIN: GB0002875804 SHORT: BATS CODE: BTI ISIN: ZAE000180915 SHORT: BURSTONE CODE: BTN

REG NO: 03407696 FOUNDED: 1902 LISTED: 2008 REG NO: 2008/011366/06 FOUNDED: 2008 LISTED: 2011

NATUREOFBUSINESS: BritishAmericanTobacco(BAT)isoneoftheworld’s NATURE OF BUSINESS: Burstone (previously Investec Property Fund) is

leading consumer goods companies, with nicotine and tobacco brands sold a fully integrated internationalreal estate businesswith c.R40 billion gross

around the globe. We employ over 55 000 people, partner with over 90 000 asset value (GAV) under management and c.R6.1 billion third-party

farmers and have factories in 48 countries, with offices in even more. capital under management. The Group invests in best-in-class assets

SECTOR: CnsStp—FoodBev&Tob—Tobacco— Tobacco focusing on fund management; asset management and development

NUMBER OF EMPLOYEES: 89 182 management. Burstone listed on the JSE 2011 and currently operates in

DIRECTORS: Anand K (ne), Guerra K (ind ne, UK), Kessler M S, Koeppel South Africa, select European markets and Australia. About 55% of the

H(ind ne, USA), Laury V (ne), Thomas D (ind ne, USA), Timuray S Group’s asset base is comprised of foreign investments. The Group has a

(ind ne), Jobin L (Chair, ind ne, Can), Marroco T (CEO, Brazil), Benchikh strong management track record of more than 30 years operating in both

S (CFO) local and international markets.

MAJOR ORDINARY SHAREHOLDERS as at 04 Dec 2024 SECTOR: RealEstate—RealEstate—REITS—Diversified

The Capital Group Companies, Inc 14.04% NUMBER OF EMPLOYEES: 0

Spring Mountain Investments Ltd. 10.37% DIRECTORS: Hourquebie P (ind ne), Moephuli D (ind ne), Morathi R K (ind

BlackRock, Inc. 5.79% ne), NkonyeniV(ind ne), Riley N (ne), Theodosiou P A (ind ne, UK),

POSTAL ADDRESS: PO Box 631, Cape Town, 8000 Tomlinson R G (ind ne), Ngoasheng M M (Chair, ind ne), Wooler A R (CEO),

MORE INFO: www.sharedata.co.za/sdo/jse/BTI Sprenger J C (CFO)

COMPANY SECRETARY: Paul McCrory MAJOR ORDINARY SHAREHOLDERS as at 03 Dec 2024

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Investec Ltd. 21.71%

SPONSORS: JP Morgan Equities South Africa Ltd., UBS South Africa (Pty) Public Investment Corporation (SOC) Ltd. 17.77%

Ltd. Government Employees Pension Fund 14.30%

AUDITORS: KPMG LLP POSTAL ADDRESS: PO Box 78949, Sandton, 2196

MORE INFO: www.sharedata.co.za/sdo/jse/BTN

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Pieter van der Sandt

BTI Ords GBP0.25p ea 2 858 265 349 2 351 231 381 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [GBPp] SPONSOR: Investec Bank Ltd.

Ords GBP0.25p ea Ldt Pay Amt AUDITORS: PwC Inc.

Quarterly No 47 17 Dec 24 3 Feb 25 58.88 CAPITAL STRUCTURE AUTHORISED ISSUED

Quarterly No 46 23 Sep 24 1 Nov 24 58.88 BTN Ords no par value 1 000 000 000 804 918 444

LIQUIDITY: Jan25 Avg 4m shares p.w., R2 541.5m(9.2% p.a.) DISTRIBUTIONS [ZARc]

JSE-TABA 40 Week MA BATS Ords no par value Ldt Pay Amt

Interim No 29 10 Dec 24 17 Dec 24 44.58

72957

Final No 28 11 Jun 24 18 Jun 24 40.95

68607 LIQUIDITY: Jan25 Avg 8m shares p.w., R62.6m(50.3% p.a.)

REIV 40 Week MA BURSTONE

64257

1512

59906

1335

55556

1159

51206

2020 | 2021 | 2022 | 2023 | 2024 |

983

FINANCIAL STATISTICS

(GBP million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 807

Interim Final Final Final Final

Turnover 12 340 27 283 27 655 25 684 25 776 2020 | 2021 | 2022 | 2023 | 2024 | 631

Op Inc 4 258 - 15 751 10 523 10 234 9 962 NOTES: Investec Property Fund Ltd. renamed to Burstone Group Ltd. on 20

NetIntPd(Rcvd) 305 1 895 1 641 1 486 1 745 September 2023.

Minority Int 67 178 180 173 164 FINANCIAL STATISTICS

Att Inc 4 492 - 14 367 6 666 6 801 6 400 (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

TotCompIncLoss 4 590 - 17 563 15 553 7 796 3 622 Interim Final Final Final(rst) Final

Fixed Ass 4 427 4 583 4 867 4 953 5 060 NetRent/InvInc 618 1 343 1 036 1 120 1 054

Inv & Loans 122 118 121 50 22 Total Inc 849 1 753 1 365 1 554 1 553

Tot Curr Ass 15 860 14 172 14 642 12 794 13 609 Attrib Inc - 810 232 195 1 038 - 328

Ord SH Int 52 426 50 881 73 683 65 416 62 673 TotCompIncLoss - 811 232 195 1 038 - 331

Minority Int 358 368 342 300 282 Ord UntHs Int 11 232 12 439 13 014 13 652 13 398

LT Liab 46 858 50 109 59 983 54 820 59 257 FixedAss/Prop 13 438 13 750 13 503 13 515 14 637

Tot Curr Liab 18 042 15 673 17 425 15 144 15 478 Tot Curr Ass 1 010 644 734 681 1 467

PER SHARE STATISTICS (cents per share) Total Ass 24 482 25 848 25 384 24 039 25 148

HEPS-C (ZARc) 3 728.03 8 414.84 6 707.83 6 438.51 6 232.10 Tot Curr Liab 3 950 3 277 2 330 2 479 3 397

DPS (ZARc) 2 782.86 5 399.08 4 752.12 4 381.40 4 218.50 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 54 312.57 53 209.27 65 016.33 61 754.74 54 475.59 HEPS-C (ZARc) - 89.65 28.21 43.70 177.85 128.13

3 Yr Beta 0.11 0.09 0.30 0.40 0.61 DPS (ZARc) 44.58 89.46 99.41 102.23 92.23

Price High 59 773 71 400 74 444 59 248 73 124 NAV PS (ZARc) 1 395.00 1 551.00 1 617.00 1 696.08 1 665.00

Price Low 53 284 52 180 58 500 51 051 49 111 3 Yr Beta 0.53 0.37 0.67 1.47 1.39

Price Prd End 56 168 54 151 67 410 58 591 54 545 Price Prd End 960 753 825 1 200 970

RATIOS Price High 986 910 1 300 1 280 1 204

Ret on SH Fnd 16.74 - 26.81 9.04 10.35 10.43 Price Low 655 681 766 929 635

Oper Pft Mgn 34.51 - 57.73 38.05 39.85 38.65 RATIOS

D:E 0.99 1.03 0.85 0.87 1.01 RetOnSH Funds - 1.87 1.50 7.61 - 2.44

Current Ratio 0.88 0.90 0.84 0.84 0.88 RetOnTotAss - 6.99 5.35 6.43 6.10

Div Cover 1.71 - 2.75 1.25 1.38 1.40 Debt:Equity 1.02 1.00 0.90 0.72 0.81

OperRetOnInv - 9.76 7.67 8.29 7.20

OpInc:Turnover 61.34 65.43 57.05 62.87 71.83

93