Page 87 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 87

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – ATT

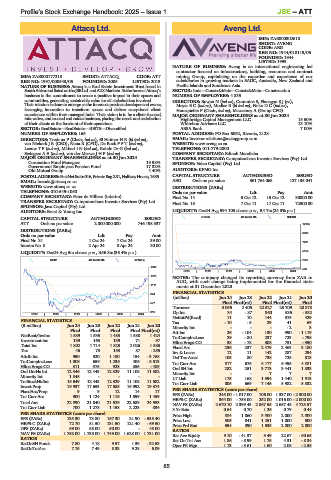

Attacq Ltd. Aveng Ltd.

ATT AVE

ISIN: ZAE000302618

SHORT: AVENG

CODE: AEG

REG NO: 1944/018119/06

FOUNDED: 1944

LISTED: 1999

NATURE OF BUSINESS: Aveng is an international engineering led

contractor focused on infrastructure, building, resources and contract

ISIN: ZAE000177218 SHORT: ATTACQ CODE: ATT mining Group, capitalising on the expertise and experience of our

REG NO: 1997/000543/06 FOUNDED: 2005 LISTED: 2013 subsidiaries in growing markets in SADC, Australia, New Zealand and

NATURE OF BUSINESS: Attacq is a Real Estate Investment Trust based in Pacific Islands and Southeast Asia.

SouthAfricaandlistedontheJSELtd.andA2XMarkets.AttheheartofAttacq’s SECTOR: Inds—Constr&Mats—Constr&Mats—Construction

business is the commitment to create a positive impact in their spaces and NUMBER OF EMPLOYEES: 4 835

communities, generating sustainable value for all stakeholders involved. DIRECTORS: Bowen N (ind ne), Cummins S, FlanaganSJ(ne),

Their mission is clear: to emerge as the foremost precinct developer and owner, MeyerBC(ind ne), Modise B (ld ind ne), NokoDC(ind ne),

leveraging innovation to transform spaces and deliver exceptional client Hourquebie P (Chair, ind ne), Macartney A (Group CFO)

experiences within their managed hubs. Their vision is to be a client-focused, MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

innovative, and trusted real estate business, placing the needs and satisfaction Highbridge Capital Management LLC 15.50%

of their clients at the forefront of their operations. Whitebox Advisors LLC 13.10%

SECTOR: RealEstate—RealEstate—REITS—Diversified ABSA Bank 7.00%

NUMBER OF EMPLOYEES: 166 POSTAL ADDRESS: PO Box 6062, Rivonia, 2128

DIRECTORS: Tredoux P (Chair, ind ne), El HaimerHR(ld ind ne), EMAIL: Investor.relations@avenggroup.com

van Niekerk J R (CEO), Nana R (CFO), De BuckFFT(ind ne), WEBSITE: www.aveng.co.za

LeeuwTP(ind ne), MkhariIN(ind ne), Rohde Dr G (ind ne), TELEPHONE: 011-779-2800

SwiegersAE(ind ne), van der MerweJHP(ind ne) COMPANY SECRETARY: Edinah Mandizha

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Coronation Fund Managers 19.98% SPONSOR: Valeo Capital (Pty) Ltd.

Government Employees Pension Fund 17.32% AUDITORS: KPMG Inc.

Old Mutual Group 4.40%

POSTALADDRESS:PostNetSuite016,PrivateBagX81,HalfwayHouse,1685 CAPITAL STRUCTURE AUTHORISED ISSUED

EMAIL: brenda@attacq.co.za AEG Ords no par value 361 764 068 127 135 041

WEBSITE: www.attacq.co.za DISTRIBUTIONS [ZARc]

TELEPHONE: 010-549-1050 Ords no par value Ldt Pay Amt

COMPANY SECRETARY: Peter de Villiers (interim) Final No 14 5 Oct 12 15 Oct 12 30000.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 13 7 Oct 11 17 Oct 11 72500.00

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: Ernst & Young Inc. LIQUIDITY: Dec24 Avg 594 103 shares p.w., R4.7m(24.3% p.a.)

CONM 40 Week MA AVENG

CAPITAL STRUCTURE AUTHORISED ISSUED

ATT Ords no par value 2 000 000 000 746 198 337 12135

DISTRIBUTIONS [ZARc]

9808

Ords no par value Ldt Pay Amt

Final No 31 1 Oct 24 7 Oct 24 39.00 7481

Interim No 8 2 Apr 24 8 Apr 24 30.00

5154

LIQUIDITY: Dec24 Avg 5m shares p.w., R56.8m(36.4% p.a.)

REIV 40 Week MA ATTACQ 2827

1646

500

2019 | 2020 | 2021 | 2022 | 2023 | 2024

1378 NOTES: The company changed its reporting currency from ZAR to

AUD, with such change being implemented for the financial state-

1111 ments at 31 December 2023.

FINANCIAL STATISTICS

844

(million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

577 Final Final(rst) Final Final(rst) Final

Turnover 3 055 2 405 22 527 25 709 20 878

310 Op Inc 34 - 87 360 536 - 532

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NetIntPd(Rcvd) 11 10 144 375 429

FINANCIAL STATISTICS Tax - 10 - 5 29 41 69

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Minority Int - - - - 2 3

Final Final Final Final Final(rst) Att Inc 26 - 104 130 990 - 1 119

NetRent/InvInc 1 589 1 535 1 483 1 588 1 424 TotCompIncLoss 29 - 80 237 723 - 798

Investment inc 139 163 139 71 97 Hline Erngs-CO 38 - 78 308 751 - 950

Total Inc 1 802 1 714 1 825 2 026 1 586 Fixed Ass 236 237 2 479 2 463 3 180

Tax 46 73 153 87 - 255 Inv & Loans 12 11 142 287 294

Attrib Inc 950 520 1 180 154 - 3 768 Def Tax Asset 105 80 738 725 813

TotCompIncLoss 1 008 659 1 236 406 - 3 513 Tot Curr Ass 817 676 8 177 6 495 4 881

Hline Erngs-CO 511 575 928 855 - 489 Ord SH Int 282 251 3 713 3 441 1 833

Ord UntHs Int 12 546 12 443 12 329 11 108 11 582 Minority Int - - 7 7 7

Minority Int 1 848 - - - - LT Liab 175 168 1 594 1 440 1 913

TotStockHldInt 15 649 12 443 12 329 11 108 11 582 Tot Curr Liab 805 669 7 145 5 982 5 832

Invest Prop 19 937 17 653 17 585 16 992 19 374

FixedAss/Prop 9 9 12 14 17 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 900 1 124 1 116 1 599 1 459 EPS (ZARc) 245.00 - 1 017.00 106.00 1 337.00 - 2 300.00

Total Ass 22 890 21 840 21 626 22 589 24 553 HEPS-C (ZARc) 364.00 - 753.00 252.00 1 016.00 - 2 000.00

Tot Curr Liab 700 1 278 1 158 2 223 834 NAV PS (ZARc) 2 670.10 2 399.43 2 867.55 2 657.48 4 725.57

3 Yr Beta 0.64 0.70 1.26 0.79 0.44

PER SHARE STATISTICS (cents per share) Price High 884 1 860 3 500 2 000 2 000

EPS (ZARc) 135.30 73.80 167.30 21.90 - 535.40 Price Low 505 841 1 251 1 000 500

HEPS-C (ZARc) 72.70 81.50 131.50 121.40 - 69.50 Price Prd End 694 890 1 535 2 000 2 000

DPS (ZARc) 69.00 58.00 50.00 - 45.00 RATIOS

NAV PS (ZARc) 1 758.00 1 735.00 1 749.00 1 628.00 1 731.00 Ret Ave Equity 9.10 - 41.37 3.49 22.67 - 60.65

RATIOS Ret On Tot Ass 1.86 - 8.99 1.75 4.31 - 8.34

RetOnSH Funds 7.80 4.18 9.57 1.39 - 32.53 Oper Pft Mgn 1.13 - 3.61 1.60 2.08 - 2.55

RetOnTotAss 7.75 7.49 8.33 9.28 6.09

85