Page 82 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 82

JSE – ANG Profile’s Stock Exchange Handbook: 2025 – Issue 1

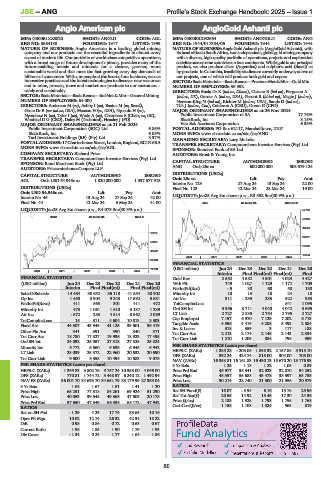

Anglo American plc AngloGold Ashanti plc

ANG ANG

ISIN: GB00B1XZS820 SHORT: ANGLO CODE: AGL ISIN: GB00BRXH2664 SHORT: ANGGOLD CODE: ANG

REG NO: 3564138 FOUNDED: 1917 LISTED: 1999 REG NO: 1944/017354/06 FOUNDED: 1944 LISTED: 1944

NATURE OF BUSINESS: Anglo American is a leading global mining NATURE OF BUSINESS: AngloGold Ashanti plc (AngloGold Ashanti), with

company and our products are the essential ingredients in almost every itsheadofficeinSouthAfrica,isanindependent,globalgoldminingcompany

aspect of modern life. Our portfolio of world-class competitive operations, with a diverse, high-quality portfolio of operations, projects and exploration

with a broad range of future development options, provides many of the activities across nine countries on four continents. While gold is our principal

future-enabling metals and minerals for a cleaner, greener, more product, we also produce silver (Argentina) and sulphuric acid (Brazil) as

sustainable world and that meet the fast growing every day demands of by-products. In Colombia, feasibility studies are currently underway at two of

billions of consumers. With our people at the heart of our business, we use our projects, one of which will produce both gold and copper.

innovative practices and the latest technologies to discover new resources SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

and to mine, process, move and market our products to our customers – NUMBER OF EMPLOYEES: 36 952

safely and sustainably. DIRECTORS: Busia Dr K (ind ne, Ghana), Cleaver B (ind ne), Ferguson A

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining (ind ne, UK), Garner A (ind ne, USA), Gasant R (ld ind ne), Magie J (ind ne),

NUMBER OF EMPLOYEES: 64 000 Newton-King N (ind ne), Richter M (ind ne, USA), Sands D (ind ne),

DIRECTORS: Anderson M (ne), Ashby I (ne), Bastos M (ne, Brazil), Tilk J (ind ne, Can), Calderon A (CEO), Doran G (CFO)

Grote Dr B (snr ind ne, USA), Maxson H (ne, USA), Nyasulu H (ne), MAJOR ORDINARY SHAREHOLDERS as at 26 Nov 2024

Nyembezi N (ne), Tyler I (ne), Wade A (ne), Chambers S (Chair, ne, UK), Public Investment Corporation of SA 17.76%

Wanblad D G (CEO), Daley M (Technical), Heasley J (FD) BlackRock, Inc. 8.15%

MAJOR ORDINARY SHAREHOLDERS as at 21 Feb 2024 Van Eck Assciates Corporation 6.35%

Public Investment Corporation (SOC) Ltd. 6.86% POSTAL ADDRESS: PO Box 62117, Marshalltown, 2107

BlackRock, Inc. 6.05% MORE INFO: www.sharedata.co.za/sdo/jse/ANG

Tarl Investment Holdings (RF) (Pty) Ltd. 3.37% MANAGING SECRETARY: Lucy Mokoka

POSTAL ADDRESS:17Charterhouse Street,London,England,EC1N6RA TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/AGL SPONSOR: Standard Bank of SA Ltd.

COMPANY SECRETARY: Richard Price AUDITORS: Ernst & Young Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PricewaterhouseCoopers LLP ANG Ords 25c ea 600 000 000 503 379 124

DISTRIBUTIONS [USDc]

CAPITAL STRUCTURE AUTHORISED ISSUED

AGL Ords USD 54.945c ea 1 820 000 000 1 337 577 913 Ords 25c ea Ldt Pay Amt

Interim No 129 27 Aug 24 13 Sep 24 22.00

DISTRIBUTIONS [USDc] Final No 128 12 Mar 24 28 Mar 24 19.00

Ords USD 54.945c ea Ldt Pay Amt

Interim No 45 13 Aug 24 27 Sep 24 42.00 LIQUIDITY: Jan25 Avg 8m shares p.w., R3 532.5m(80.9% p.a.)

Final No 44 12 Mar 24 3 May 24 41.00 MINI 40 Week MA ANGGOLD

LIQUIDITY: Jan25 Avg 8m shares p.w., R4 079.0m(30.3% p.a.) 57738

INDM 40 Week MA ANGLO

50129

42520

68281

34912

56901

27303

45522

19694

2020 | 2021 | 2022 | 2023 | 2024 |

34143

FINANCIAL STATISTICS

22763 (USD million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

2020 | 2021 | 2022 | 2023 | 2024 |

Interim Final Final(rst) Final(rst) Final

FINANCIAL STATISTICS Gold Rev 2 552 4 582 4 501 4 029 4 427

(USD million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 Wrk Pft 749 1 027 1 129 1 172 1 709

Interim Final Final(rst) Final Final(rst) NetIntPd(Rcd) - 5 30 68 58 150

SalesOfSubsids 14 464 30 652 35 118 41 554 30 902 Minority Int 10 13 18 24 18

Op Inc 1 450 3 904 9 243 17 592 5 631 Att Inc 311 - 235 233 622 953

NetIntPd(Rcvd) 411 563 301 411 472 TotCompIncLoss - - - 541 1 095

Minority Int 473 1 061 1 510 3 137 1 239 Ord SH Int 3 956 3 711 4 040 4 042 3 695

Att Inc - 672 283 4 514 8 562 2 089 LT Liab 2 727 2 835 2 754 2 795 2 727

TotCompIncLoss 15 311 4 604 10 813 3 303 Cap Employed 7 157 6 970 7 129 7 202 6 713

Fixed Ass 44 307 43 949 41 125 39 501 36 419 Tangible Assts 4 596 4 419 4 208 3 493 2 884

Other Fin Ass 341 391 390 340 371 Inv & Loans 318 359 3 117 188

Tot Curr Ass 18 780 17 327 19 936 18 923 17 495 Tot Curr Ass 2 213 2 174 2 145 2 143 2 334

Ord SH Int 24 092 25 057 27 318 27 825 25 824 Tot Curr Liab 1 210 1 205 884 798 959

Minority Int 6 772 6 560 6 635 6 945 6 942 PER SHARE STATISTICS (cents per share)

LT Liab 28 039 25 572 22 960 20 632 20 690 HEPS-C (ZARc) 1 385.28 - 203.06 1 898.92 2 157.88 3 915.10

Tot Curr Liab 9 500 9 355 10 494 10 583 9 078 DPS (ZARc) 392.24 424.74 815.00 304.00 705.00

NAV (ZARc) 16 358.81 16 161.83 16 430.13 15 670.20 13 176.93

PER SHARE STATISTICS (cents per share) 3 Yr Beta 1.25 1.18 1.22 1.05 0.89

HEPS-C (ZARc) 1 365.83 3 802.76 8 157.24 10 353.00 4 066.00 Price Prd End 45 977 35 341 32 923 32 870 34 252

DPS (ZARc) 770.81 1 744.72 3 448.57 6 240.12 1 492.94 Price High 48 357 55 688 43 478 38 597 63 735

NAV PS (ZARc) 36 004.70 34 693.70 34 651.79 33 179.99 27 353.04 Price Low 30 214 28 740 21 300 21 356 20 979

3 Yr Beta 1.68 1.67 1.51 1.41 1.20 RATIOS

Price High 65 251 77 318 84 261 69 924 51 290 Ret SH Fund($) 16.07 - 5.94 6.16 15.78 25.96

Price Low 40 053 39 548 49 368 47 505 20 178 Ret Tot Ass($) 20.55 14.92 15.45 17.30 24.36

Price Prd End 57 650 47 349 66 334 65 172 47 942 Price ($/oz) 2 183 1 928 1 793 1 796 1 768

RATIOS CashCost($/oz) 1 158 1 108 1 024 963 819

Ret on SH Fnd - 1.29 4.25 17.74 33.65 10.16

Oper Pft Mgn 10.02 12.74 26.32 42.34 18.22

D:E 0.98 0.86 0.72 0.63 0.67

Current Ratio 1.98 1.85 1.90 1.79 1.93

Div Cover - 1.34 0.24 1.77 1.64 1.86

80