Page 80 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 80

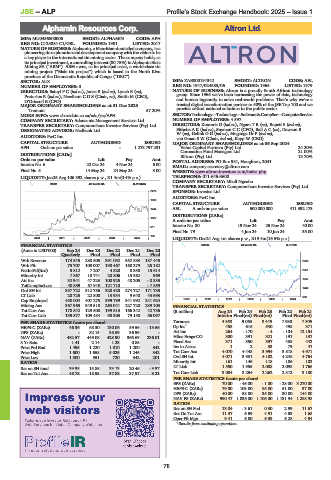

JSE – ALP Profile’s Stock Exchange Handbook: 2025 – Issue 1

Alphamin Resources Corp. Altron Ltd.

ALP ALT

ISIN: MU0456S00006 SHORT: ALPHAMIN CODE: APH

REG NO: C125884 C1/GBL FOUNDED: 1981 LISTED: 2017

NATURE OF BUSINESS: Alphamin, a Mauritian-domiciled company, is a

pioneering tin exploration and development company with the vision to be

a key player in the international tin mining sector. The company holds, as

its principal investment, a controlling interest (80.75%) in Alphamin Bisie

Mining SA (“ABM”). ABM owns, as its principal asset, a world-class tin

mining project (“Bisie tin project”) which is based in the North Kivu

province of the Democratic Republic of Congo (“DRC”).

SECTOR: AltX ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL

NUMBER OF EMPLOYEES: 0 REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979

DIRECTORS: BaloyiPC(ind ne), Jones B (ind ne), Lynch B (ne), NATURE OF BUSINESS: Altron is a proudly South African technology

Pretorius R (ind ne), NeedhamCDS (Chair, ne), Smith M (CEO), group. Since 1965 we’ve been harnessing the power of data, technology

O’Driscoll E (CFO) and human ingenuity to solve real-world problems. That’s why we’re a

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 trusted digital transformation partner to 50% of the JSE Top 100 and we

Tremont 57.20% provide critical national solutions to the public sector.

MORE INFO: www.sharedata.co.za/sdo/jse/APH SECTOR:Technology—Technology—Software&CompSer—ComputerService

COMPANY SECRETARY: Adansonia Management Services Ltd. NUMBER OF EMPLOYEES: 4 597

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DIRECTORS: Kouteris G (ind ne), NgaraTR(ne), Rapeti S (ind ne),

DESIGNATED ADVISOR: Nedbank Ltd. SithebeAK(ind ne), Snyman C C (CFO), BallAC(ne), Dawson B

AUDITORS: PwC Inc. W(ne), GelinkGG(ind ne), Mnganga Dr P (ind ne),

van Graan S W (Chair, ind ne), Kapp W (CEO)

CAPITAL STRUCTURE AUTHORISED ISSUED MAJOR ORDINARY SHAREHOLDERS as at 06 Sep 2024

APH Ords no par value - 1 273 797 231 Value Capital Partners (Pty) Ltd. 24.20%

Coronation Fund Managers Ltd. 21.00%

DISTRIBUTIONS [CADc] Biltron (Pty) Ltd. 13.70%

Ords no par value Ldt Pay Amt POSTAL ADDRESS: PO Box 981, Houghton, 2041

Interim No 6 22 Oct 24 4 Nov 24 6.00 EMAIL: company.secretary@altron.com

Final No 5 14 May 24 24 May 24 3.00 WEBSITE: www.altron-investors.com/index.php

LIQUIDITY: Jan25 Avg 106 392 shares p.w., R1.4m(0.4% p.a.) TELEPHONE: 011-645-3600

COMPANY SECRETARY: Mbali Ngcobo

INDM 40 Week MA ALPHAMIN

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

2276 SPONSOR: Investec Ltd.

AUDITORS: PwC Inc.

1860

CAPITAL STRUCTURE AUTHORISED ISSUED

1444 AEL A ords no par value 500 000 000 411 392 173

DISTRIBUTIONS [ZARc]

1027

A ords no par value Ldt Pay Amt

611 Interim No 80 19 Nov 24 25 Nov 24 40.00

Final No 79 4 Jun 24 10 Jun 24 33.00

195

2020 | 2021 | 2022 | 2023 | 2024 | LIQUIDITY: Dec24 Avg 1m shares p.w., R19.4m(16.5% p.a.)

FINANCIAL STATISTICS SCOM 40 Week MA ALTRON

(Amts in USD’000) Sep 24 Dec 23 Dec 22 Dec 21 Dec 20

Quarterly Final Final Final Final

Wrk Revenue 174 545 288 505 391 052 352 883 187 445 2906

Wrk Pft 75 707 105 007 190 467 168 279 25 182

NetIntPd(Rcd) 3 812 7 207 4 820 8 358 15 614 2351

Minority Int 7 867 10 741 20 806 15 362 969

Att Inc 32 941 47 223 100 925 48 205 - 8 835 1797

TotCompIncLoss 40 839 57 940 121 710 - - 7 859

1242

Ord SH Int 357 722 312 786 320 425 274 727 171 735

LT Liab 20 725 22 800 13 934 9 640 43 693 688

Cap Employed 450 004 407 275 399 799 341 992 241 624 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Mining Ass 367 965 349 518 263 041 227 720 239 103 FINANCIAL STATISTICS

Tot Curr Ass 178 842 129 508 199 513 166 342 42 736 (R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Tot Curr Liab 139 577 109 484 90 303 79 158 56 097 Interim Final(rst) Final(rst) Final Final(rst)

PER SHARE STATISTICS (cents per share) Turnover 4 868 9 063 8 445 7 930 7 505

HEPS-C (ZARc) 46.36 68.30 130.06 59.56 - 13.66 Op Inc 1 458 616 540 498 371

DPS (ZARc) - 82.15 38.69 36.99 - Att Inc 264 - 170 - 4 - 104 12 154

NAV (ZARc) 482.57 449.08 428.90 366.69 236.01 Hline Erngs-CO 300 391 321 191 137

3 Yr Beta 1.41 2.14 1.23 0.85 - Fixed Ass 371 350 397 438 442

Price Prd End 1 495 1 220 1 010 1 200 342 Inv in Assoc 1 2 33 79 47

Price High 1 600 1 658 5 025 1 246 342 Tot Curr Ass 4 070 4 448 3 994 3 818 4 971

Price Low 1 300 951 720 342 201 Ord SH Int 4 071 3 931 4 182 4 248 4 764

RATIOS Minority Int 161 146 118 106 102

Ret on SH fund 39.98 15.86 33.13 20.46 - 3.97 LT Liab 1 550 1 955 2 088 2 098 1 766

Ret on Tot Ass 48.78 18.93 37.88 37.97 3.21 Tot Curr Liab 3 084 3 254 2 262 2 312 3 180

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 70.00 - 45.00 - 1.00 - 28.00 3 270.00

HEPS-C (ZARc) 79.00 103.00 85.00 51.00 37.00

DPS (ZARc) 40.00 58.00 35.00 30.00 144.00

NAV PS (ZARc) 990.47 1 036.00 1 105.00 1 131.94 1 288.98

RATIOS

Ret on SH Fnd 13.04 - 3.61 0.30 2.99 11.67

Ret On Tot Ass 11.37 6.59 4.91 4.53 1.68

Oper Pft Mgn 9.41 6.80 6.39 6.28 4.94

1 Results from continuing operations

78