Page 83 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 83

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – ANH

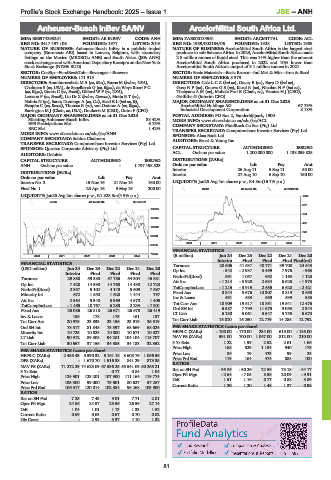

Anheuser-Busch InBev SA/NV ArcelorMittal South Africa Ltd.

ANH ARC

ISIN: BE0974293251 SHORT: AB INBEV CODE: ANH ISIN: ZAE000134961 SHORT: ARCMITTAL CODE: ACL

REG NO: 0417.497.106. FOUNDED: 1977 LISTED: 2016 REG NO: 1989/002164/06 FOUNDED: 1928 LISTED: 1989

NATURE OF BUSINESS: Anheuser-Busch InBev is a publicly traded NATURE OF BUSINESS: ArcelorMittal South Africa is the largest steel

company (Euronext: ABI) based in Leuven, Belgium, with secondary producer in sub-Saharan Africa. In 2023, ArcelorMittal South Africa made

listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH) 2.8 million tonnes of liquid steel. This was 14% higher than the amount

stock exchanges and with American Depositary Receipts on the New York ArcelorMittal South Africa produced in 2022 and 10% lower than

Stock Exchange (NYSE: BUD). Arcelormittal South Africa’s output of 3.1 million tonnes in 2021.

SECTOR: CnsStp—FoodBev&Tob—Beverages—Brewers SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Iron & Steel

NUMBER OF EMPLOYEES: 171 915 NUMBER OF EMPLOYEES: 8 379

DIRECTORS: Aramburuzabala M A (ne, Mex), Burns M (ind ne, USA), DIRECTORS: CeleLCZ(ind ne), Davey B (ne), Earp D (ind ne),

Chalmers S (ne, USA), de Spoelberch G (ne, Blgm), de Ways Ruart P C GosaNP(ne), GouwsGS(ne), Karol R (ne), NicolauNF(ind ne),

(ne, Blgm), Garcia C (ne, Brazil), Gifford W F (ne, USA), ThebyaneAM(ne), Mohale Prof B (Chair, ne), Verster H J (CEO),

Lemann P (ne, Brazil), Liu Dr X (ind ne, German), Motta R T (ne), Griffiths G (Interim CFO)

Nohria N (ne), Santo Domingo A (ne, Col), Sceti E L (ind ne, It), MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

Sicupira C (ne, Brazil), Thomas R (ne), van Damme A (ne, Blgm), ArcelorMittal Holdings AG 67.79%

Barrington M J (Chair, ne, USA), Doukeris M (CEO), Dutra F (CFO) Industrial Development Corporation 8.18%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 POSTAL ADDRESS: PO Box 2, Vanderbijlpark, 1900

Stichting Anheuser-Busch InBev 33.42% MORE INFO: www.sharedata.co.za/sdo/jse/ACL

EPS Participations Sàrl 6.75% COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

BRC Sàrl 1.42%

MORE INFO: www.sharedata.co.za/sdo/jse/ANH TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Absa Bank Ltd.

COMPANY SECRETARY: Sabine Chalmers AUDITORS: Ernst & Young Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Deloitte ACL Ords no par value 1 200 000 000 1 138 059 825

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

ANH Ords no par value - 1 797 198 523 Ords no par value Ldt Pay Amt

Interim 26 Aug 11 5 Sep 11 55.00

DISTRIBUTIONS [EURc] Interim 27 Aug 10 6 Sep 10 150.00

Ords no par value Ldt Pay Amt

Interim No 2 15 Nov 16 21 Nov 16 160.00 LIQUIDITY: Jan25 Avg 4m shares p.w., R4.8m(16.7% p.a.)

Final No 1 28 Apr 16 9 May 16 200.00 INDM 40 Week MA ARCMITTAL

LIQUIDITY: Jan25 Avg 2m shares p.w., R1 828.3m(4.9% p.a.) 1040

BEVR 40 Week MA AB INBEV

837

133922

634

121263

432

108603

229

95943

26

2020 | 2021 | 2022 | 2023 | 2024 |

83284

FINANCIAL STATISTICS

70624

2020 | 2021 | 2022 | 2023 | 2024 | (R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final(rst)

FINANCIAL STATISTICS Turnover 20 506 41 637 40 771 39 708 24 643

(USD million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final Op Inc - 542 - 2 937 3 499 7 976 - 963

Turnover 29 880 59 380 57 786 54 304 46 881 NetIntPd(Rcvd) 591 1 057 952 1 163 1 123

Op Inc 7 428 14 590 14 768 14 438 12 723 Att Inc - 1 214 - 3 920 2 634 6 625 - 1 973

2 655

6 620

- 2 421

TotCompIncLoss

- 1 215

- 3 915

NetIntPd(Rcvd) 2 357 5 102 4 148 5 609 7 697

Minority Int 672 1 550 1 628 1 444 797 Fixed Ass 8 844 8 676 10 307 8 819 8 658

683

659

639

583

Inv & Loans

691

Att Inc 2 564 5 340 5 969 4 670 1 405 Tot Curr Ass 18 909 19 517 18 851 19 541 12 476

TotCompIncLoss - 1 485 10 767 6 283 2 233 - 7 901

Fixed Ass 25 086 26 818 26 671 26 678 26 419 Ord SH Int 6 587 7 799 11 675 9 053 2 344

5 061

6 130

5 547

6 673

5 755

LT Liab

Inv & Loans 185 178 175 161 137

Tot Curr Ass 20 975 23 333 23 156 23 919 26 519 Tot Curr Liab 15 810 16 250 12 779 14 285 12 792

Ord SH Int 78 517 81 848 73 397 68 669 68 024 PER SHARE STATISTICS (cents per share)

Minority Int 10 725 10 828 10 880 10 671 10 327 HEPS-C (ZARc) - 100.00 - 170.00 234.00 615.00 - 185.00

LT Liab 90 912 89 508 94 281 104 104 115 707 NAV PS (ZARc) 591.00 700.00 1 047.00 812.00 210.00

Tot Curr Liab 30 567 37 156 34 385 34 183 32 352 3 Yr Beta 1.22 1.99 2.52 2.61 1.66

Price High 168 529 1 134 940 175

PER SHARE STATISTICS (cents per share) Price Low 86 79 423 99 25

HEPS-C (ZARc) 2 488.43 5 390.32 6 161.18 3 608.76 1 086.36

DPS (ZARc) - 1 670.70 1 516.38 841.29 873.35 Price Prd End 119 164 474 888 100

NAV PS (ZARc) 71 272.29 74 623.09 67 536.25 55 541.09 50 265.21 RATIOS - 36.86 - 50.26 22.56 73.18 - 84.17

Ret on SH Fnd

3 Yr Beta - - 0.77 0.84 1.04

Price High 124 901 123 201 107 900 111 164 119 774 Oper Pft Mgn - 2.64 - 7.05 8.58 20.09 - 3.91

0.88

3.89

1.16

D:E

0.77

1.51

Price Low 105 300 99 000 79 601 80 627 57 267

Price Prd End 106 317 120 014 102 384 96 268 103 900 Current Ratio 1.20 1.20 1.48 1.37 0.98

RATIOS

Ret on SH Fnd 7.25 7.43 9.01 7.71 2.81

Oper Pft Mgn 24.86 24.57 25.56 26.59 27.14

D:E 1.04 1.01 1.13 1.33 1.52

Current Ratio 0.69 0.63 0.67 0.70 0.82

Div Cover - 2.93 3.37 4.10 1.32

81