Page 86 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 86

JSE – AST Profile’s Stock Exchange Handbook: 2025 – Issue 1

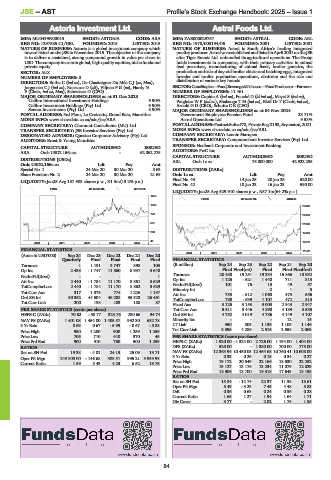

Astoria Investment Ltd. Astral Foods Ltd.

AST AST

ISIN: MU0499N00015 SHORT: ASTORIA CODE: ARA ISIN: ZAE000029757 SHORT: ASTRAL CODE: ARL

REG NO: 1297585 C1/GBL FOUNDED: 2015 LISTED: 2015 REG NO: 1978/003194/06 FOUNDED: 2001 LISTED: 2001

NATURE OF BUSINESS: Astoria is a global investment company which NATURE OF BUSINESS: Astral is South Africa’s leading integrated

inward listed on the JSE in November 2015. The objective of the company poultryproducer. Astralwasestablished andlistedinApril2001 onthe JSE

is to deliver a sustained, strong compound growth in value per share in after Tiger Brands Ltd. unbundled its agricultural operations. The Group

USD. The company investsin global, high quality equities, niche fundsand holds investments in companies, with their primary activities in animal

private equity. feed pre-mixes, manufacturing of animal feeds, broiler genetics, the

SECTOR: AltX production and sale of day-old broiler chicks and hatching eggs, integrated

NUMBER OF EMPLOYEES: 0 breeder and broiler production operations, abattoirs and the sale and

DIRECTORS: Botha C (ind ne), De Chasteigner Du MéeCJ(ne, Mau), distribution of various key brands.

JorgensenCJ(ind ne), Rosevear D (alt), ViljoenPG(ne), Hardy N SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

F (Chair, ind ne, Mau), Schweizer D (CFO) NUMBER OF EMPLOYEES: 11 461

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 DIRECTORS: Cupido A (ind ne), Fouché D (ld ind ne), Mayet S (ind ne),

Calibre International Investment Holdings 9.90% Potgieter W F (ind ne), Shabangu T M (ind ne), Eloff Dr T (Chair, ind ne),

Calibre Investment Holdings (Pty) Ltd. 9.90% Arnold G D (CEO), Schutte C E (CEO)

Seneca Investments (Pty) Ltd. 8.90% MAJOR ORDINARY SHAREHOLDERS as at 04 Nov 2024

POSTAL ADDRESS: 3rd Floor, La Croisette, Grand Baie, Mauritius Government Employees Pension Fund 23.71%

MORE INFO: www.sharedata.co.za/sdo/jse/ARA Astral Operations Ltd. 9.53%

COMPANY SECRETARY: Clermont Consultants (MU) Ltd. POSTAL ADDRESS:PostnetSuite#78, PrivateBagX153, Bryanston,2021

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/ARL

DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd. COMPANY SECRETARY: Leonie Marupen

AUDITORS: Ernst & Young Mauritius TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking

CAPITAL STRUCTURE AUTHORISED ISSUED

ARA Ords USD2.166c ea - 62 062 275 AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [USDc] ARL Ords 1c ea 75 000 000 42 922 235

Ords USD2.166c ea Ldt Pay Amt

Special No 1 24 Mar 20 30 Mar 20 8.63 DISTRIBUTIONS [ZARc]

Share Premium No 2 24 Mar 20 30 Mar 20 21.69 Ords 1c ea Ldt Pay Amt

Final No 43 14 Jan 25 20 Jan 25 520.00

LIQUIDITY: Jan25 Avg 157 908 shares p.w., R1.3m(13.2% p.a.)

Final No 42 10 Jan 23 16 Jan 23 590.00

FINA 40 Week MA ASTORIA

LIQUIDITY: Jan25 Avg 529 910 shares p.w., R87.1m(64.2% p.a.)

1259

FOOD 40 Week MA ASTRAL

1016 27320

773 24160

531 21000

288

17840

45 14680

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 11520

2020 | 2021 | 2022 | 2023 | 2024 |

(Amts in USD’000) Sep 24 Dec 23 Dec 22 Dec 21 Dec 20

Quarterly Final Final Final Final FINANCIAL STATISTICS

Turnover 1 1 191 3 747 898 103 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Op Inc 2 438 - 1 747 11 560 8 937 3 640 Final Final(rst) Final Final Final(rst)

NetIntPd(Rcvd) - - - - 1 Turnover 20 480 19 251 19 334 15 866 13 932

Att Inc 2 440 - 1 784 11 170 8 861 3 629 Op Inc 1 125 - 621 1 440 711 813

101

NetIntPd(Rcvd)

49

57

15

76

TotCompIncLoss 2 440 - 1 784 11 170 8 862 3 629

Tot Curr Ass 317 1 075 774 1 226 1 197 Minority Int 753 - - 512 - 1 068 2 473 1 556 5

Att Inc

Ord SH Int 50 352 44 504 46 288 35 323 26 461 TotCompIncLoss 738 - 539 1 107 472 513

Tot Curr Liab 200 198 183 188 87

Fixed Ass 3 125 3 153 3 003 2 943 2 947

PER SHARE STATISTICS (cents per share) Tot Curr Ass 5 611 5 446 4 890 4 189 3 535

HEPS-C (ZARc) 70.62 - 58.77 323.76 230.66 94.74 Ord SH Int 4 752 4 019 4 786 4 149 4 107

NAV PS (ZARc) 1 401.08 1 454.00 1 405.57 992.30 682.78 Minority Int - - - 12 15

3 Yr Beta 0.69 0.67 - 5.99 - 8.67 - 5.88 LT Liab 950 805 1 136 1 105 1 146

Price High 950 1 200 900 1 259 1 259 Tot Curr Liab 3 395 4 286 2 516 2 558 2 063

Price Low 706 710 440 370 45 PER SHARE STATISTICS (cents per share)

Price Prd End 900 910 760 500 1 259 HEPS-C (ZARc) 1 920.00 - 1 324.00 2 726.00 1 194.00 1 404.00

RATIOS DPS (ZARc) 520.00 - 1 380.00 700.00 775.00

Ret on SH Fnd 19.38 - 4.01 24.13 25.09 13.71 NAV PS (ZARc) 12 363.94 10 450.05 12 464.68 10 760.41 10 608.00

Oper Pft Mgn 243 800.00 - 146.68 308.51 995.21 3 533.98 3 Yr Beta 0.33 0.26 0.15 0.34 0.27

Current Ratio 1.59 5.43 4.23 6.52 13.76 Price High 19 172 20 549 22 166 18 530 22 252

Price Low 13 127 13 176 13 234 11 079 12 029

Price Prd End 18 906 13 700 19 318 17 643 13 153

RATIOS

Ret on SH Fnd 15.84 - 12.74 22.37 11.38 13.61

Oper Pft Mgn 5.49 - 3.23 7.45 4.48 5.83

D:E 0.36 0.63 0.24 0.36 0.28

Current Ratio 1.65 1.27 1.94 1.64 1.71

Div Cover 3.77 - 2.02 1.75 1.85

84