Page 89 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 89

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – BAL

Balwin Properties Ltd. Barloworld Ltd.

BAL BAR

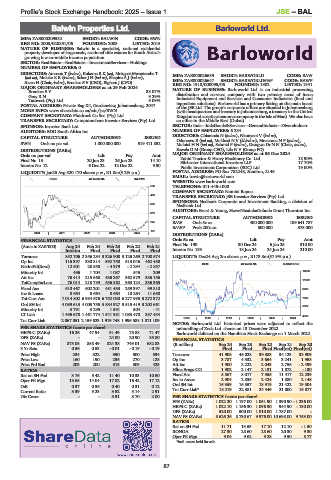

ISIN: ZAE000209532 SHORT: BALWIN CODE: BWN

REG NO: 2003/028851/06 FOUNDED: 2003 LISTED: 2015

NATURE OF BUSINESS: Balwin is a specialist, national residential

property developer of large-scale, sectional title estates for South Africa’s

growing low-to-middle income population.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NUMBER OF EMPLOYEES: 0

DIRECTORS: Amosun T (ind ne), Kukama RK(ne), Mokgosi-Mwantembe T

CODE: BAW

(ind ne), Moloko KR(ind ne), Scher J H (ind ne), Shapiro A J (ind ne), ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAWP

SHORT: BARWORLD6%P

ISIN: ZAE000026647

Saven H (Chair, ind ne), Brookes S V (CEO), Bigham J (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941

Brookes S V 33.07% NATURE OF BUSINESS: Barloworld Ltd. is an industrial processing,

Gray R N 9.29% distribution and services company with two primary areas of focus:

Tatovect (Pty) Ltd. 9.09% Industrial Equipment and Services and Consumer Industries (food and

POSTAL ADDRESS: Private Bag X4, Gardenview, Johannesburg, 2047 ingredient solutions). Barloworld has a primary listing on the main board

of the JSE Ltd. The group’s corporate offices are situated in Johannesburg

MORE INFO: www.sharedata.co.za/sdo/jse/BWN (with headquarters and treasury in Johannesburg, a treasury in the United

COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd. KingdomandacaptiveinsurancecompanyintheIsleofMan).Wealsohave

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. an office in the Middle East (Dubai).

SPONSOR: Investec Bank Ltd. SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

AUDITORS: BDO South Africa Inc. NUMBER OF EMPLOYEES: 6 234

DIRECTORS: Chiaranda N (ind ne), NkonyeniV(ind ne),

CAPITAL STRUCTURE AUTHORISED ISSUED

BWN Ords no par val 1 000 000 000 519 411 852 Odunewu B (ind ne), Mokhesi N V (ld ind ne), Mnxasana N P (ind ne),

Molotsi H N (ind ne), Schmid P (ind ne), Gwagwa Dr N N (Chair, ind ne),

DISTRIBUTIONS [ZARc] Sewela D M (Group CEO), Lila N V (Group FD)

Ords no par val Ldt Pay Amt MAJOR ORDINARY SHAREHOLDERS as at 06 Dec 2024

Final No 13 20 Jun 23 26 Jun 23 14.10 Zahid Tractor & Heavy Machinery Co. Ltd. 18.90%

Silchester International Investors LLP

17.70%

Interim No 12 6 Dec 22 12 Dec 22 9.90

Public Investment Corporation (SOC) Ltd. 19.00%

LIQUIDITY: Jan25 Avg 520 170 shares p.w., R1.0m(5.2% p.a.) POSTAL ADDRESS: PO Box 782248, Sandton, 2146

EMAIL: bawir@barloworld.com

REDS 40 Week MA BALWIN

WEBSITE: www.barloworld.com

539 TELEPHONE: 011-445-1000

COMPANY SECRETARY: Nomini Rapoo

466 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSORS: Nedbank Corporate and Investment Banking, a division of

392

Nedbank Ltd.

AUDITORS: Ernst & Young, SizweNtsalubaGobodo Grant Thornton Inc.

319

CAPITAL STRUCTURE AUTHORISED ISSUED

245 BAW Ords 5c ea 400 000 000 189 641 787

BAWP Prefs 200c ea 500 000 375 000

172

2020 | 2021 | 2022 | 2023 | 2024 |

DISTRIBUTIONS [ZARc]

FINANCIAL STATISTICS Ords 5c ea Ldt Pay Amt

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 Final No 190 30 Dec 24 6 Jan 25 310.00

Interim Final Final Final Final Interim No 189 18 Jun 24 24 Jun 24 210.00

Turnover 852 706 2 356 284 3 326 908 3 125 269 2 700 574 LIQUIDITY: Dec24 Avg 2m shares p.w., R173.8m(57.9% p.a.)

Op Inc 116 397 330 814 592 750 513 046 462 450

GENI 40 Week MA BARWORLD

NetIntPd(Rcvd) 12 601 20 558 - 4 379 - 2 294 - 2 857

Minority Int 496 1 704 1 087 545 209 12668

Att Inc 76 414 215 668 436 267 362 579 336 156

11082

TotCompIncLoss 76 014 218 789 436 862 363 124 336 365

Fixed Ass 610 467 602 201 481 433 259 397 99 810 9495

Inv & Loans 8 664 8 664 8 664 10 264 11 658

Tot Curr Ass 7 014 802 6 984 676 6 752 030 6 277 985 5 272 372 7909

Ord SH Int 4 089 613 4 005 755 3 834 927 3 515 419 3 202 661

6322

Minority Int 3 791 3 295 1 591 504 - 41

LT Liab 1 496 678 1 461 774 1 541 981 1 083 470 387 434 4736

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Tot Curr Liab 2 067 051 2 159 523 1 919 748 1 996 588 1 811 109

NOTES: Barloworld Ltd. historical prices were adjusted to reflect the

PER SHARE STATISTICS (cents per share) unbundling of Zeda Ltd. shares on 13 December 2022.

HEPS-C (ZARc) 16.26 47.94 91.49 75.88 71.47 Barloworld delisted on the Namibian Stock Exchange on 1 March 2022.

DPS (ZARc) - - 24.00 20.90 35.80 FINANCIAL STATISTICS

NAV PS (ZARc) 875.05 858.49 824.38 749.01 682.83 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

3 Yr Beta 0.56 0.53 - 0.01 - 0.19 - 0.19 Final Final Final Final(rst) Final(rst)

Price High 234 322 350 500 534 Turnover 41 908 45 028 39 383 34 123 33 909

Price Low 160 190 236 270 128 Op Inc 3 787 4 332 3 654 3 241 1 958

Price Prd End 203 200 315 309 425 Att Inc 1 900 2 222 2 043 2 756 - 2 499

RATIOS Hline Erngs-CO 1 902 2 147 2 131 1 872 - 130

Ret on SH Fnd 3.76 5.42 11.40 10.33 10.50 Fixed Ass 8 567 8 017 7 555 11 417 12 239

Oper Pft Mgn 13.65 14.04 17.82 16.42 17.12 Inv in Assoc 2 904 2 835 2 424 1 880 2 148

Ord SH Int 16 359 16 557 18 919 21 422 19 504

D:E 0.37 0.36 0.40 0.31 0.12

Current Ratio 3.39 3.23 3.52 3.14 2.91 Tot Curr Liab* 18 219 22 381 24 449 21 000 16 877

Div Cover - - 3.91 3.70 2.00 PER SHARE STATISTICS (cents per share)

EPS (ZARc) 1 022.20 1 197.00 1 051.90 1 390.90 - 1 236.00

HEPS-C (ZARc) 1 022.10 1 156.30 1 096.30 944.90 - 130.00

DPS (ZARc) 520.00 500.00 1 010.00 1 787.00 -

NAV PS (ZARc) 8 626.26 8 730.67 9 976.00 10 698.00 9 753.00

RATIOS

Ret on SH Fnd 11.71 13.53 17.10 12.10 - 1.50

RONOA 27.30 28.60 28.60 20.30 9.30

Oper Pft Mgn 9.04 9.62 9.28 9.50 5.77

*incl. assets held for sale

87