Page 27 - shbh24_complete

P. 27

Profile’s Stock Exchange Handbook: 2024 – Issue 3 NSX – MOC

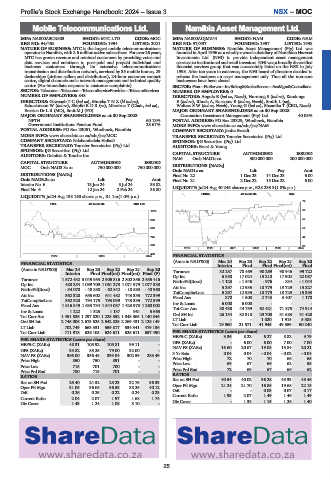

Mobile Telecommunications Ltd. Namibia Asset Management Ltd.

MOC NAM

ISIN: NA000A3CR803 SHORT: MTC LTD CODE: MOC ISIN: NA000AOJMZ44 SHORT: NAM CODE: NAM

REG NO: 94/458 FOUNDED: 1994 LISTED: 2021 REG NO: 97/397 FOUNDED: 1997 LISTED: 1998

NATURE OF BUSINESS: MTC is the largest mobile telecommunications NATURE OF BUSINESS: Namibia Asset Management (Pty) Ltd. was

operator in Namibia, with 2.6 million active subscribers. For over 26 years, founded in April 1996 as a wholly-owned subsidiary of Namibian Harvest

MTC has grown revenue and retained customers by providing voice and Investments Ltd. (NHI) to provide independent asset management

data services and solutions to post-paid and prepaid individual and services to institutional and retail investors. NHI was a broadly diversified

business customers through its extensive telecommunications financial services group that was successfully listed on the NSX in July

transmission and distribution network, serviced by 35 mobile homes, 29 1998. After ten years in existence, the NHI board of directors decided to

dealerships (airtime sellers and distributors), 24-hour customer contact refocus the business on asset management only. Thus all the non-core

centre, digital channels and a network management and technical quality businesses have been closed.

centre (For immediate response to customer complaints). SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

SECTOR: Telecoms—Telecoms—TelecomServiceProvider—TelecomServices NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 848 DIRECTORS: Angula E (ind ne, Namb), Hornung S (ind ne), Kandongo

DIRECTORS: GawaxabTC(ind ne), MutekaTNZ(ld ind ne), E(ind ne), Rhoda A, Rossouw B (ind ne, Namb), Smith L (ne),

Schuckmann W (ind ne), ShipikiRDR(ne), Mberirua T (Chair, ind ne), WaltersSW(ind ne, Namb), Young G (ind ne), Shaanika T (CEO, Namb)

Erastus Dr L R (MD), Smit M J (FD) MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023 Coronation Investment Management (Pty) Ltd. 40.05%

NPTH 60.13% POSTAL ADDRESS: PO Box 23329, Windhoek, Namibia

Government Institutions Pension Fund 28.67% MORE INFO: www.sharedata.co.za/sdo/jse/NAM

POSTAL ADDRESS: PO Box 23051, Windhoek, Namibia COMPANY SECRETARY: Janita Breedt

MORE INFO: www.sharedata.co.za/sdo/jse/MOC TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

COMPANY SECRETARY: Ndahambelela Haikali SPONSOR: IJG Securities (Pty) Ltd.

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. AUDITORS: Ernst & Young

SPONSOR: IJG Securities (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

NAM Ords NAD1c ea 300 000 000 200 000 000

CAPITAL STRUCTURE AUTHORISED ISSUED

MOC Ords NAD3.3c ea 750 000 000 750 000 000 DISTRIBUTIONS [NADc]

Ords NAD1c ea Ldt Pay Amt

DISTRIBUTIONS [NADc] Final No 22 1 Dec 23 14 Dec 23 6.00

Ords NAD3.3c ea Ldt Pay Amt Final No 21 2 Dec 22 15 Dec 22 6.00

Interim No 6 13 Jun 24 5 Jul 24 33.82

Final No 5 12 Jan 24 2 Feb 24 38.80 LIQUIDITY: Jul24 Avg 40 245 shares p.w., R28 233.3(1.0% p.a.)

FINSA 40 Week MA NAM

LIQUIDITY: Jul24 Avg 138 160 shares p.w., R1.1m(1.0% p.a.)

72

FTEL 40 Week MA MTC LTD

1078 65

960 57

843 50

725 42

608 35

2019 | 2020 | 2021 | 2022 | 2023 | 2024

490

2022 | 2023 | 2024 FINANCIAL STATISTICS

(Amts in NAD’000) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

FINANCIAL STATISTICS Interim Final Final Final(rst) Final

(Amts in NAD’000) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20 Turnover 32 257 78 469 90 269 90 946 99 722

Interim Final Final(rst) Final(rst) Final (P)

6 850

22 087

17 024

Turnover 1 572 432 3 049 953 2 905 316 2 802 356 2 685 416 Op Inc - 1 123 - 1 546 15 210 17 902 - 1 044

- 976

NetIntPd(Rcvd)

- 834

Op Inc 488 254 1 099 709 1 061 273 1 071 979 1 077 338

NetIntPd(Rcvd) - 34 078 - 48 888 - 62 842 - 18 583 - 40 968 Att Inc 5 297 12 935 10 779 13 729 15 227

10 779

15 393

TotCompIncLoss

5 297

13 729

12 935

Att Inc 362 320 655 602 641 482 743 335 772 399

870

TotCompIncLoss 362 320 794 175 793 039 743 335 772 399 Fixed Ass 6 000 1 508 2 743 - 3 407 - 1 170 -

6 000

Inv & Loans

Fixed Ass 1 616 849 1 633 734 1 544 037 1 423 973 1 260 002 Tot Curr Ass 38 438 44 759 62 421 71 875 74 914

Inv & Loans 1 222 1 525 1 137 961 5 665

Tot Curr Ass 1 451 526 1 297 820 1 228 352 1 048 365 1 140 846 Ord SH Int 26 134 - 32 318 - 29 708 31 683 31 420

1 915

5 388

LT Liab

1 020

Ord SH Int 2 745 006 2 673 625 2 542 825 2 269 431 2 126 149

LT Liab 702 749 663 331 559 817 534 341 479 136 Tot Curr Liab 19 960 21 571 41 945 49 359 50 240

Tot Curr Liab 711 918 626 105 624 611 625 611 657 490 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 3.36 8.22 6.27 8.82 9.79

PER SHARE STATISTICS (cents per share) DPS (ZARc) - 6.00 6.00 7.00 7.00

HEPS-C (ZARc) 48.31 105.92 105.81 99.11 - NAV PS (ZARc) 16.60 20.67 19.08 15.84 20.21

DPS (ZARc) 33.82 85.25 79.00 32.00 -

NAV PS (ZARc) 366.00 356.48 339.04 302.59 283.49 3 Yr Beta 0.04 0.04 - 0.04 - 0.02 - 0.04

66

70

70

65

Price High

72

Price High 850 750 891 - -

Price Low 715 701 700 - - Price Low 69 67 66 62 55

62

67

72

Price Prd End

66

69

Price Prd End 780 715 701 - - RATIOS

RATIOS

Ret on SH Fnd 26.40 24.52 25.23 32.75 36.33 Ret on SH Fnd 40.54 40.02 36.28 43.33 48.46

19.68

21.24

Oper Pft Mgn

21.70

22.15

16.85

Oper Pft Mgn 31.05 36.06 36.53 38.25 40.12

D:E 0.26 0.25 0.22 0.24 0.23 D:E 1.93 - 2.07 - 0.03 0.07 0.17

1.49

Current Ratio

1.49

1.46

Current Ratio 2.04 2.07 1.97 1.68 1.74 Div Cover - 1.38 1.15 1.26 1.40

Div Cover 1.43 1.24 1.08 3.10 -

25