Page 29 - shbh24_complete

P. 29

Profile’s Stock Exchange Handbook: 2024 – Issue 3 NSX – OMJ

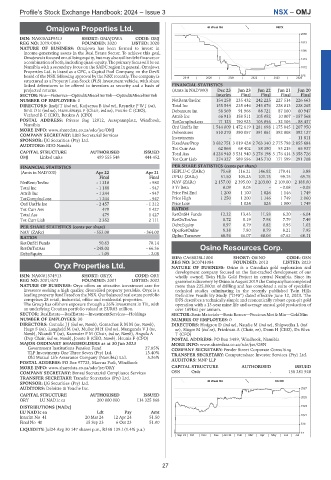

Omajowa Properties Ltd. 40 Week MA ORYX

2060

OMJ

ISIN: NA000A2P9513 SHORT: OMAJOWA CODE: OMJ

REG NO: 2019/0840 FOUNDED: 2020 LISTED: 2020 1813

NATURE OF BUSINESS: Omajowa has been formed to invest in

income-generating assets in the Real Estate Sector. To achieve this goal, 1566

Omajowaisfocusedonutilisingequity,butmayalsoutilisedebtfinance;or 1319

acombinationofboth, includingquasi-equity.Theprimaryfocuswillbe on

Namibia with a secondary focus on the SADC region in general. Omajowa 1072

Properties Ltd. is listed as a CPC, a Capital Pool Company, on the DevX

board of the NSX following approval by the NSX recently. The company is 2019 | 2020 | 2021 | 2022 | 2023 | 2024 825

structured as a Property Loan Stock (PLS) investment vehicle, with share

linked debentures to be offered to investors as security and a basis of FINANCIAL STATISTICS

projected returns. (Amts in NAD’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh Interim Final Final Final Final

NUMBER OF EMPLOYEES: 0 NetRent/InvInc 154 258 235 432 242 225 227 514 226 663

DIRECTORS: Iindji T (ind ne), Katjaerua B (ind ne), ReynekePWJ(ne), Total Inc 155 544 235 646 243 076 228 013 228 265

SmitDE(ind ne), Hamukwaya F (Chair, ind ne), Fourie C (CEO), Debenture Int 58 569 91 966 88 721 87 160 60 947

Verhoef B C (CIO), Beukes A (CFO) Attrib Inc 66 913 158 511 105 052 10 007 - 157 568

POSTAL ADDRESS: Private Bag 12012, Ausspannplatz, Windhoek, TotCompIncLoss 71 123 190 923 105 856 - 32 105 - 88 437

Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/OMJ Ord UntHs Int 1 544 009 1 472 619 1 281 698 1 175 845 1 207 950

Debentures

391 061

390 057

392 127

392 008

510 270

COMPANY SECRETARY: L&B Secretarial Services

11 811

-

-

-

-

SPONSOR: IJG Securities (Pty) Ltd. Investments 3 682 751 3 019 424 2 763 340 2 775 798 2 855 684

FixedAss/Prop

AUDITORS: BDO Nambia

Tot Curr Ass 62 864 68 402 58 390 53 215 65 937

CAPITAL STRUCTURE AUTHORISED ISSUED Total Ass 4 226 940 3 531 940 3 276 198 3 176 414 3 358 726

OMJ Linked units 499 555 548 444 452

Tot Curr Liab 274 327 589 596 345 710 171 599 291 708

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in NAD’000) Apr 22 Apr 21 HEPLU-C (ZARc) 75.68 116.21 146.82 179.41 3.88

Final Final DPLU (ZARc) 51.50 105.25 101.75 99.75 69.75

NetRent/InvInc - 1 210 - 980 NAV (ZARc) 2 157.00 2 395.00 2 203.00 2 109.00 2 188.00

Total Inc - 1 188 - 947 3 Yr Beta 0.09 0.05 - - 0.08 - 0.05

Attrib Inc - 1 244 - 947 Price Prd End 1 200 1 100 1 026 1 146 1 749

TotCompIncLoss - 1 244 - 947 Price High 1 250 1 200 1 146 1 749 2 060

Ord UntHs Int - 2 457 - 1 212 Price Low - 1 024 825 1 000 1 749

Tot Curr Ass 479 1 427 RATIOS

Total Ass 479 1 427 RetOnSH Funds 12.22 13.45 11.58 6.20 - 6.04

Tot Curr Liab 2 352 2 111 RetOnTotAss 8.72 8.19 7.98 7.79 7.49

Debt:Equity 0.97 0.79 0.82 0.95 1.02

PER SHARE STATISTICS (cents per share)

NAV (ZARc) - 553.00 - 364.00 OperRetOnInv 8.38 7.80 8.79 8.21 7.95

RATIOS OpInc:Turnover 68.56 66.07 68.06 67.62 68.11

RetOnSH Funds 50.63 78.14

RetOnTotAss - 248.02 - 66.36 Osino Resources Corp.

Debt:Equity - 1.05 - 2.08 OSN

ISIN: CA68828L1004 SHORT: OSINO CODE: OSN

REG NO: BC0741084 FOUNDED: 2012 LISTED: 2023

Oryx Properties Ltd. NATURE OF BUSINESS: Osino is a Canadian gold exploration and

ORY development company focused on the fast-tracked development of our

ISIN: NA0001574913 SHORT: ORYX CODE: ORY wholly owned, Twin Hills Gold Project in central Namibia. Since its

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002 grassrootsdiscovery by Osinoin August 2019 the Company has completed

NATURE OF BUSINESS: Oryx offers an attractive investment case for more than 225,000m of drilling and has completed a suite of specialist

investors seeking a high quality, diversified property portfolio. Oryx is a technical studies culminating in the recently published Twin Hills

leading property fund listed on the NSX. Our balanced real estate portfolio Definitive Feasibility Study (“DFS”) dated effective June 12, 2023. The

comprises 28 retail, industrial, office and residential properties. DFS describes a technically simple and economically robust open-pit gold

The Group has offshore exposure through a 26% investment in TIL, with operation with a 13-year mine life and average annual gold production of

an underlying Croatian portfolio valued at EUR83 million. over 169koz per annum.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

NUMBER OF EMPLOYEES: 30 NUMBER OF EMPLOYEES: 0

DIRECTORS: ComalieJJ(ind ne, Namb), GomachasRMM(ne, Namb), DIRECTORS: Hodgson D (ind ne), Naudie M (ind ne), Shigwedha L (ind

Hugo S (ne), Langheld M (ne), MullerMH(ind ne), MungundaVJ(ne, ne), Singer M (ind ne), Friedman A (Chair, ne), Daun H (CEO), Da Silva

Namb), Nkandi T (ne), Kazmaier P M (Chair, ind ne, Namb), Angula A T (CFO)

(Dep Chair, ind ne, Namb), Jooste B (CEO, Namb), Heunis F (CFO) POSTAL ADDRESS: PO Box 3489, Windhoek, Namibia

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 MORE INFO: www.sharedata.co.za/sdo/jse/OSN

Government Institutions Pension Fund 27.85% COMPANY SECRETARY: Pender Street Corporate Consulting

TLP Investments One Three Seven (Pty) Ltd. 15.40% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Old Mutual Life Assurance Company (Namibia) Ltd. 5.36%

POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek AUDITORS: MNP LLP

MORE INFO: www.sharedata.co.za/sdo/jse/ORY CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Bonsai Secretarial Compliance Services OSN Ords - 158 281 928

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

40 Week MA OSINO

SPONSOR: IJG Securities (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc. 2527

CAPITAL STRUCTURE AUTHORISED ISSUED

ORY LU NAD1c ea 200 000 000 114 325 868 2025

DISTRIBUTIONS [NADc] 1523

LU NAD1c ea Ldt Pay Amt

1021

Interim No 41 20 Mar 24 12 Apr 24 51.50

Final No 40 15 Sep 23 6 Oct 23 51.00

519

LIQUIDITY: Jul24 Avg 30 147 shares p.w., R358 129.1(1.4% p.a.)

17

| Sep 23 | Oct | Nov | Dec | Jan 24 | Feb | Mar | Apr | May | Jun | Jul

27