Page 26 - shbh24_complete

P. 26

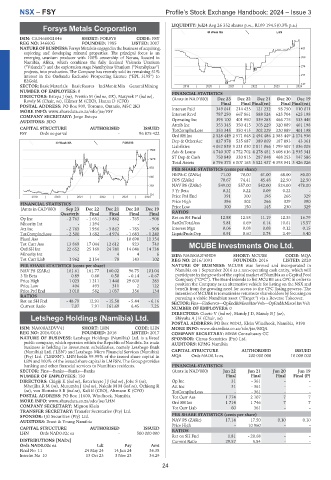

NSX – FSY Profile’s Stock Exchange Handbook: 2024 – Issue 3

LIQUIDITY: Jul24 Avg 26 352 shares p.w., R109 194.5(0.3% p.a.)

Forsys Metals Corporation

40 Week MA LHN

FSY

ISIN: CA34660G1046 SHORT: FORSYS CODE: FSY

REG NO: 34660G FOUNDED: 1985 LISTED: 2007

NATURE OF BUSINESS: ForsysMetalsisengagedinthe businessof acquiring, 401

exploring and developing mineral properties. The principal focus is an

emerging uranium producer with 100% ownership of Norasa, located in 338

Namibia, Africa, which combines the fully licensed Valencia Uranium

(“Valencia”) and the exploration stage Namibplaas Uranium (“Namibplaas”) 274

projects, into production. The Company has recently sold its remaining 51%

interest in the Ondundu Exclusive Prospecting Licence (“EPL 3195”) to 211

B2Gold.

147

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining 2019 | 2020 | 2021 | 2022 | 2023 | 2024

NUMBER OF EMPLOYEES: 0 FINANCIAL STATISTICS

DIRECTORS: Estepa J (ne), Frewin M (ind ne, UK), Matysek P (ind ne),

Rowly M (Chair, ne), Hilmer M (CEO), Hanna D (CFO) (Amts in NAD’000) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

Final

Final Final(rst)

Final Final(rst)

POSTAL ADDRESS: PO Box 909, Toronto, Ontario, M5C 2K3

98 750

MORE INFO: www.sharedata.co.za/sdo/jse/FSY Interest Paid 349 041 214 435 121 232 625 704 110 011

Interest Rcvd

787 250

667 861

588 524

625 198

COMPANY SECRETARY: Jorge Estepa

AUDITORS: BDO Operating Inc 395 100 401 950 339 283 466 775 533 445

Attrib Inc 353 345 350 415 303 229 320 889 401 198

CAPITAL STRUCTURE AUTHORISED ISSUED TotCompIncLoss 353 345 350 415 302 229 320 889 401 198

FSY Ords no par val - 96 875 422

Ord SH Int 2 528 449 2 571 048 2 494 486 2 383 449 2 174 936

Dep & OtherAcc 827 978 535 687 389 069 187 893 43 361

40 Week MA FORSYS

Liabilities 4 052 839 3 221 030 2 811 866 1 799 507 1 036 005

1562

Adv & Loans 4 740 307 4 752 702 4 278 481 3 608 616 2 935 341

ST Dep & Cash 750 849 320 815 287 048 468 253 147 586

1270

Total Assets 6 796 373 6 007 163 5 521 437 4 398 041 3 426 026

978

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 71.00 70.00 61.00 68.00 80.00

685

DPS (ZARc) 70.67 74.41 45.48 22.50 22.50

NAV PS (ZARc) 549.00 557.00 542.00 524.00 478.00

393

3 Yr Beta 0.21 0.22 0.09 0.22 -

101 Price Prd End 391 300 196 266 329

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Price High 396 302 266 329 390

FINANCIAL STATISTICS

(Amts in CAD’000) Sep 23 Dec 22 Dec 21 Dec 20 Dec 19 Price Low 300 150 145 230 329

Quarterly Final Final Final Final RATIOS

Op Inc - 2 763 - 1 631 - 3 862 - 765 - 908 Ret on SH Fund 12.88 12.58 11.19 12.35 16.79

Minority Int - 1 294 - - - RetOnTotalAss 5.81 6.69 6.14 10.61 15.57

Att Inc - 2 763 1 956 - 3 862 - 765 - 908 Interest Mgn 0.06 0.08 0.08 0.12 0.15

TotCompIncLoss - 2 500 1 682 - 4 974 - 1 683 - 1 240 LiquidFnds:Dep 0.91 0.60 0.74 2.49 3.40

Fixed Ass - - - 10 698 11 354

Tot Curr Ass 13 869 17 044 12 612 923 740 MCUBE Investments One Ltd.

Ord SH Int 22 652 25 169 24 781 14 048 14 738

MQA

Minority Int - - 4 4 6 ISIN: NA000A2P8HD9 SHORT: MCUBE CODE: MQA

Tot Curr Liab 1 962 2 154 78 143 102 REG NO: 2016/1091 FOUNDED: 2016 LISTED: 2020

PER SHARE STATISTICS (cents per share) NATURE OF BUSINESS: MCUBE was formed and incorporated in

NAV PS (ZARc) 161.61 161.77 160.02 96.75 101.04 Namibia on 1 September 2016 as a non-operating cash entity, which will

3 Yr Beta 0.89 0.60 0.50 - 0.14 - 0.67 participate in the growth of the capital market of Namibia as a Capital Pool

Price High 1 023 1 211 1 440 29 600 283 Company (“CPC”). The Board intends to list MCUBE as a CPC in order to

Price Low 404 493 311 2 122 position the Company as an alternative vehicle for listing on the NSX and

Price Prd End 1 010 582 1 037 356 134 benefit from the growing need for access to the CPC listing process. The

intention of MCUBE is to maximise returns to shareholders by focusing on

RATIOS pursuing a viable Namibian asset (“Target”) via a Reverse Takeover.

Ret on SH Fnd - 48.79 12.91 - 15.58 - 5.44 - 6.16 SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

Current Ratio 7.07 7.91 161.69 6.45 7.25

NUMBER OF EMPLOYEES: 0

DIRECTORS: Cloete V (ind ne), Mandy J D, MandyBJ(ne),

Letshego Holdings (Namibia) Ltd. ShiyukaAJH (Chair, ne)

POSTAL ADDRESS: PO Box 90242, Klein Windhoek, Namibia, 9190

LHN

ISIN: NA000A2DVV41 SHORT: LHN CODE: LHN MORE INFO: www.sharedata.co.za/sdo/jse/MQA

REG NO: 2016/0145 FOUNDED: 2016 LISTED: 2017 COMPANY SECRETARY: MMM Consultancy CC

NATURE OF BUSINESS: Letshego Holdings (Namibia) Ltd. is a listed SPONSOR: Cirrus Securities (Pty) Ltd.

public company, which operates within the Republic of Namibia. Its main AUDITORS: KPMG Namibia

business is holding its investment subsidiaries, namely Letshego Bank

(Namibia) Ltd. (‘LBN’) and Letshego Micro Financial Services (Namibia) CAPITAL STRUCTURE AUTHORISED ISSUED

(Pty) Ltd. (‘LMFSN’). LHN holds 99.99% of the issued share capital in MQA Ords NAD0.1c ea 200 000 000 10 000 000

LBN and 100% of the issued share capital in LMFSN. The Group provides

banking and other financial services to Namibian residents. FINANCIAL STATISTICS

SECTOR: Fins—Banks—Banks—Banks (Amts in NAD’000) Jun 22 Jun 21 Jun 20 Jun 19

NUMBER OF EMPLOYEES: 150 Final Final Final Final (P)

DIRECTORS: Chigiji K (ind ne), EsterhuyseJJ(ind ne), Jobe S (ne), Op Inc 31 - 361 - -

MbetjihaRM(ne), Mutumba J (ind ne), NakaleMM(ind ne), Ochieng R Att Inc 31 - 361 - -

(ne), von BlottnitzSB(ind ne), Kali E (CEO), Altmann K (CFO) TotCompIncLoss - - 361 - -

POSTAL ADDRESS: PO Box 11600, Windhoek, Namibia Tot Curr Ass 1 774 2 107 7 7

MORE INFO: www.sharedata.co.za/sdo/jse/LHN Ord SH Int 1 714 1 746 7 7

COMPANY SECRETARY: Mignon Klein Tot Curr Liab 60 361 - -

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

SPONSOR: IJG Securities (Pty) Ltd. PER SHARE STATISTICS (cents per share)

AUDITORS: Ernst & Young Namibia NAV PS (ZARc) 17.14 17.50 0.10 0.10

Price High - 10 960 - -

CAPITAL STRUCTURE AUTHORISED ISSUED

LHN Ords NAD0.02c ea - 500 000 000 RATIOS

Ret on SH Fnd 1.81 - 20.68 - -

DISTRIBUTIONS [NADc] Current Ratio 29.57 5.84 - -

Ords NAD0.02c ea Ldt Pay Amt

Final No 11 24 May 24 14 Jun 24 36.38

Interim No 10 13 Oct 23 3 Nov 23 34.29

24