Page 30 - shbh24_complete

P. 30

NSX – PDN Profile’s Stock Exchange Handbook: 2024 – Issue 3

DIRECTORS: Duvenhage G P J (alt), Gerdes H B (ind ne, Namb), Graig R

Paladin Energy Ltd. (ind ne), Harmse B R J (Exec Chair, Namb), Mendelsohn RPK(alt, Namb),

MostertMR(ne, Namb), Shikongo J N N (ind ne, Namb), HallA(MD,

PDN

ISIN: AU000000PDN8 SHORT: PALADIN CODE: PDN Namb), de Bruin S (CFO, Namb), Erasmus S L V (Group CEO, Namb)

REG NO: 47 061 681 098 FOUNDED: 1993 LISTED: 2008 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

NATURE OF BUSINESS: Paladin Energy Ltd. (ASX: PDN) is an Australian Paratus Group Holdings Ltd. 45.50%

listed uranium company focused on maximising the value of its 75% stake Government Institutions Pension Fund 17.70%

in the Langer Heinrich Uranium mine in Namibia. Langer Heinrich is a Erasmus, Schalk Leipoldt van Zyl 5.40%

globally significant, long-life operation, having already produced over POSTAL ADDRESS: PO Box 81588, Windhoek, Namibia

43Mlb U3O8 to date. Operations at Langer Heinrich were suspended in MORE INFO: www.sharedata.co.za/sdo/jse/PNH

2018 due to low uranium prices. Beyond Langer Heinrich, the Company COMPANY SECRETARY: Cronje Secretarial Services (Pty) Ltd.

also owns a large global portfolio of uranium exploration and development TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

assets. Nuclear power remains a cost-effective, low carbon option for

electricity generation. SPONSOR: Simonis Storm Securities (Pty) Ltd.

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining AUDITORS: PwC Inc.

NUMBER OF EMPLOYEES: 0 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Adams L (ind ne), Holzberger M (ind ne), Hronsky OAM Dr J PNH Ord shares NAD1c ea - 98 907 940

(ind ne), Main P (ne), Palmer J (ind ne), Watson P (ne), Lawrenson

C(Chair, ne), Purdy I (CEO), Sudlow A (CFO) DISTRIBUTIONS [NADc]

MAJOR ORDINARY SHAREHOLDERS as at 21 Aug 2023 Ord shares NAD1c ea Ldt Pay Amt

HSBC Custody Nominees (Australia) Ltd. 25.06% Interim No 9 19 Apr 24 17 May 24 10.00

Citicorp Nominees (Pty) Ltd. 19.10% Final No 8 20 Oct 23 10 Nov 23 10.00

JP Morgan Nominees Australia Ltd. 10.51% LIQUIDITY: Jul24 Avg 12 599 shares p.w., R152 798.0(0.7% p.a.)

POSTAL ADDRESS: PO Box 8062, Subiaco, Cloisters Square PO,

Western Australia, 6850 40 Week MA PARATUS NM

MORE INFO: www.sharedata.co.za/sdo/jse/PDN 1320

COMPANY SECRETARY: Jeremy Ryan

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 1256

SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

AUDITORS: PwC Inc. 1192

CAPITAL STRUCTURE AUTHORISED ISSUED 1128

PDN Ords no par - 298 979 523

1064

LIQUIDITY: Jul24 Avg 9 shares p.w., R2 021.4

1000

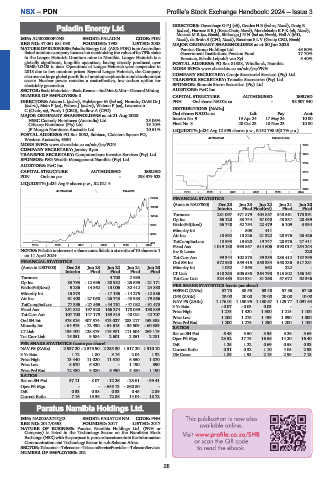

40 Week MA PALADIN 2019 | 2020 | 2021 | 2022 | 2023 | 2024

20185 FINANCIAL STATISTICS

(Amts in NAD’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

16230

Interim Final Final(rst) Final Final

Turnover 281 097 471 879 404 857 340 561 173 391

12275

Op Inc 66 120 83 744 67 040 48 357 28 439

8320 NetIntPd(Rcvd) 36 748 52 754 22 479 6 109 3 934

Minority Int - 803 411 - -

4365

Att Inc 18 592 18 826 21 322 28 976 25 426

TotCompIncLoss 18 593 19 628 19 747 28 976 27 411

410

Fixed Ass 1 019 180 993 867 614 606 390 017 254 244

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Paladin underwent a share consolidation at a ratio of 10 shares to 1 Inv & Loans - - - - 220

on 11 April 2024. Tot Curr Ass 99 344 102 873 89 355 233 412 182 395

FINANCIAL STATISTICS Ord SH Int 572 988 559 415 550 334 550 236 517 281

(Amts in USD’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Minority Int 1 032 1 365 562 222 -

Interim Final Final Final Final LT Liab 510 253 505 585 364 790 313 802 156 161

Turnover - - 4 700 2 985 - Tot Curr Liab 324 453 324 331 81 268 57 672 62 346

Op Inc 83 793 - 12 696 - 30 932 - 25 695 - 21 171 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 5 286 14 362 13 006 32 412 24 880 HEPS-C (ZARc) 37.73 38.55 53.48 57.86 67.26

Minority Int 15 373 - - 17 196 - 14 275 - 12 586 DPS (ZARc) 20.00 20.00 20.00 20.00 10.00

Att Inc 61 408 - 27 058 - 26 743 - 43 983 - 79 866 NAV PS (ZARc) 1 176.01 1 150.95 1 130.67 1 129.77 1 091.64

TotCompIncLoss 77 355 - 27 565 - 44 761 - 47 082 - 91 473 3 Yr Beta - 0.07 - 0.03 0.03 - -

Fixed Ass 251 832 197 928 166 274 178 089 190 889

Price High 1 275 1 320 1 300 1 215 1 100

Tot Curr Ass 107 700 147 179 189 513 40 021 42 707 Price Low 1 200 1 275 1 199 1 090 1 000

Ord SH Int 478 816 407 574 413 027 283 217 153 388 Price Prd End 1 200 1 275 1 290 1 200 1 100

Minority Int - 64 975 - 72 490 - 54 615 - 36 509 - 60 389 RATIOS

LT Liab 135 400 128 379 119 981 111 604 269 119 Ret on SH Fnd 6.48 3.50 3.95 5.26 3.69

Tot Curr Liab 15 051 9 584 2 601 2 851 2 281

Oper Pft Mgn 23.52 17.75 16.56 14.20 16.40

PER SHARE STATISTICS (cents per share) D:E 1.25 1.22 0.69 0.58 0.33

NAV PS (ZARc) 2 937.20 - 2 575.90 2 255.30 1 517.20 1 310.10 Current Ratio 0.31 0.32 1.10 4.05 2.93

3 Yr Beta 1.12 1.80 3.16 2.04 1.32 Div Cover 1.89 1.93 2.19 2.99 7.13

Price High 13 440 11 020 11 510 6 350 1 870

Price Low 8 670 6 320 - 1 190 390

Price Prd End 12 480 9 080 6 490 5 480 1 190

RATIOS

Ret on SH Fnd 37.11 - 8.07 - 12.26 - 23.61 - 99.41

Oper Pft Mgn - - - 658.13 - 860.80 -

D:E 0.33 0.38 0.33 0.45 2.89

Current Ratio 7.16 15.36 72.86 14.04 18.72

Paratus Namibia Holdings Ltd.

PNH

ISIN: NA000A2DTQ42 SHORT: PARATUS NM CODE: PNH

REG NO: 2017/0558 FOUNDED: 2017 LISTED: 2017

NATURE OF BUSINESS: Paratus Namibia Holdings Ltd. (PNH or

Company) is listed in the Technology Sector on the Namibian Stock

Exchange(NSX)withthepurposetopursueinvestmentsintheInformation

Communication and Technology Sector in sub-Saharan Africa.

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

NUMBER OF EMPLOYEES: 202

28