Page 207 - shbh24_complete

P. 207

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – TRE

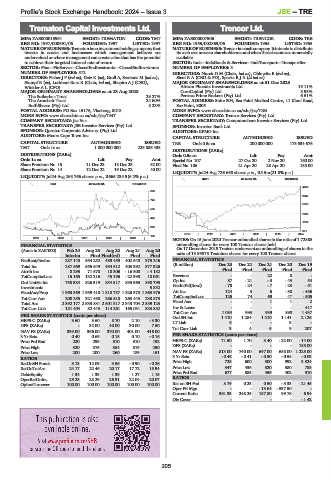

Trematon Capital Investments Ltd. Trencor Ltd.

TRE TRE

ISIN: ZAE000013991 SHORT: TREMATON CODE: TMT ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE

REG NO: 1997/008691/06 FOUNDED: 1997 LISTED: 1997 REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955

NATURE OF BUSINESS:Trematonis aninvestmentholding company that NATUREOF BUSINESS:Trencorisacashcompany.Itintendstodistribute

invests in assets and businesses which management believes are its cash resources to shareholders as andwhen these become commercially

undervalued or where management can create value that has the potential available.

to achieve their targeted internal rate of return. SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts NUMBER OF EMPLOYEES: 3

NUMBER OF EMPLOYEES: 512 DIRECTORS: Nurek D M (Chair, ind ne), Oblowitz E (ind ne),

DIRECTORS: Fisher J P (ind ne), Getz K (ne), Groll A, Sessions M (ind ne), Sieni R A (CEO & FD), SparksRJA(ld ind ne)

Stumpf R (ne), Lockhart-Ross R (Chair, ind ne), Shapiro A J (CEO), MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

Winkler A L (CFO) African Phoenix Investments Ltd. 19.11%

MAJOR ORDINARY SHAREHOLDERS as at 23 Aug 2023 CoroCapital (Pty) Ltd. 8.93%

The Suikerbos Trust 29.27% Peresec Prime Brokers (Pty) Ltd. 6.51%

The Armchair Trust 24.60% POSTAL ADDRESS: Suite 304, Sea Point Medical Centre, 11 Kloof Road,

Buff-Shares (Pty) Ltd. 8.23% Sea Point, 8005

POSTAL ADDRESS: PO Box 15176, Vlaeberg, 8018 MORE INFO: www.sharedata.co.za/sdo/jse/TRE

MORE INFO: www.sharedata.co.za/sdo/jse/TMT COMPANY SECRETARY: Trencor Services (Pty) Ltd.

COMPANY SECRETARY: Jac Vos TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Investec Bank Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd. AUDITORS: KPMG Inc.

AUDITORS: Moore Cape Town Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED TRE Ords 0.5c ea 200 000 000 173 534 676

TMT Ords 1c ea 1 000 000 000 223 886 435

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 0.5c ea Ldt Pay Amt

Ords 1c ea Ldt Pay Amt Special No 107 27 Oct 20 2 Nov 20 160.00

Share Premium No 15 11 Dec 23 18 Dec 23 32.00 Final No 106 21 Apr 20 28 Apr 20 185.00

Share Premium No 14 12 Dec 22 19 Dec 22 40.00

LIQUIDITY: Jul24 Avg 726 668 shares p.w., R5.5m(21.8% p.a.)

LIQUIDITY: Jul24 Avg 265 766 shares p.w., R665 235.9(6.2% p.a.)

INDT 40 Week MA TRENCOR

EQII 40 Week MA TREMATON

4466

865

3647

725

2828

585

2009

445

1190

305

371

2019 | 2020 | 2021 | 2022 | 2023 | 2024

165

2019 | 2020 | 2021 | 2022 | 2023 | NOTES: On 15 June 2020 Trencor unbundled shares in the ratio of 1.72885

FINANCIAL STATISTICS unbundling shares for every 100 Trencor shares held.

(Amts in ZAR’000) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20 On 17 December 2019 Trencor underwent an unbundling of shares in the

Interim Final Final(rst) Final Final ratio of 13.99075 Textainer shares for every 100 Trencor shares.

NetRent/InvInc 287 148 554 252 489 459 402 540 375 246 FINANCIAL STATISTICS

Total Inc 287 669 555 649 494 512 403 392 377 326 (R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

Attrib Inc 8 295 71 578 18 306 - 16 500 - 4 182 Final Final Final Final Final

TotCompIncLoss 15 165 132 216 45 196 - 22 998 18 061 Revenue - - 22 8 -

Ord UntHs Int 758 384 826 319 834 517 835 965 898 795 Op Inc 87 - 21 -3 -43 54

Investments - - - - 5 832 NetIntPd(Rcvd) - 78 - 24 - 7 - 23 - 51

FixedAss/Prop 1 963 369 1 959 410 1 818 757 1 826 373 1 863 976 Att Inc 124 3 6 - 38 - 456

Tot Curr Ass 208 255 321 488 266 518 263 443 230 573 TotCompIncLoss 125 74 69 47 - 505

Total Ass 2 392 177 2 533 831 2 501 317 2 343 704 2 389 123 Fixed Ass - - 1 1 2

Tot Curr Liab 181 404 82 443 114 261 165 031 333 882 Inv & Loans - - - - 417

Tot Curr Ass 1 084 993 939 898 1 437

PER SHARE STATISTICS (cents per share) Ord SH Int 1 410 1 284 1 210 1 141 2 126

HEPS-C (ZARc) 3.60 3.60 8.70 2.10 - 3.30 LT Liab 6 - - 3 -

DPS (ZARc) - 32.00 40.00 30.00 7.50 Tot Curr Liab 3 4 5 9 207

NAV PS (ZARc) 339.00 366.00 370.00 401.00 416.00

3 Yr Beta 0.40 0.69 0.15 0.10 - 0.16 PER SHARE STATISTICS (cents per share)

Price Prd End 220 299 310 310 192 HEPS-C (ZARc) 71.50 1.70 3.40 - 22.00 - 14.00

Price High 320 375 384 319 290 DPS (ZARc) - - - - 185.00

Price Low 200 200 260 189 151 NAV PS (ZARc) 813.00 740.00 697.00 658.00 1 225.00

RATIOS 3 Yr Beta - 0.46 - 0.41 - 0.50 - 0.58 - 0.03

RetOnSH Funds 3.13 12.09 3.56 - 0.90 - 0.26 Price High 725 600 500 992 3 324

RetOnTotAss 24.17 22.46 20.17 17.72 15.94 Price Low 547 436 320 380 785

Debt:Equity 1.34 1.33 1.39 1.27 1.15 Price Prd End 677 585 459 402 910

OperRetOnInv 29.25 28.29 26.91 22.04 20.07 RATIOS

Ret on SH Fnd 8.79 0.23 0.50 - 3.33 - 21.45

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

Oper Pft Mgn - - - 13.64 - 537.50 -

Current Ratio 361.33 248.25 187.80 99.78 6.94

Div Cover - - - - - 1.42

205