Page 202 - shbh24_complete

P. 202

JSE – SYG Profile’s Stock Exchange Handbook: 2024 – Issue 3

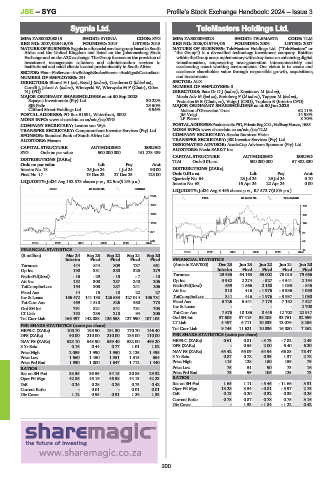

Sygnia Ltd. TeleMasters Holdings Ltd.

SYG TEL

ISIN: ZAE000208815 SHORT: SYGNIA CODE: SYG ISIN: ZAE000093324 SHORT: TELEMASTR CODE: TLM

REG NO: 2007/025416/06 FOUNDED: 2015 LISTED: 2015 REG NO: 2006/015734/06 FOUNDED: 2006 LISTED: 2007

NATURE OF BUSINESS: Sygnia is a financial services group based in South NATURE OF BUSINESS: TeleMasters Holdings Ltd. (“TeleMasters” or

Africa and the United Kingdom and listed on the Johannesburg Stock “the Group”) is a diversified technology investment company. Entities

Exchange and on the A2X exchange. The Group focuses on the provision of within the Group are complementary with a key focus on enhancing digital

investment management solutions and administration services to transformation, empowering next-generation interconnectivity and

institutional and retail clients located predominantly in South Africa. accelerating smart working environments. Our vision is to create and

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians accelerate shareholder value through responsible growth, acquisitions,

NUMBER OF EMPLOYEES: 291 and investments.

DIRECTORS: BhoratHI(ne), Boyd J (ind ne), Cavaleros G (ld ind ne), SECTOR: AltX

Corelli J, Jakoet A (ind ne), Wierzycki W, Wierzycka M F (Chair), Giles NUMBER OF EMPLOYEES: 0

N J (FD) DIRECTORS: Bate DrDJ(ind ne), Krastanov M (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023 Moela Adv M (ind ne), Steinberg F (ld ind ne), Tappan M (ind ne),

Sapayoa Investments (Pty) Ltd. 30.22% Pretorius M B (Chair, ne), Voigt J (CEO), Topham B (Interim CFO)

SJB Peile 29.50% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

Clifford Street Holdings Ltd. 6.96% Maison d’Obsession Trust 62.11%

POSTAL ADDRESS: PO Box 51591, Waterfront, 8002 JM Voigt 14.98%

MORE INFO: www.sharedata.co.za/sdo/jse/SYG LP Pieton 8.70%

COMPANY SECRETARY: Leanne van Wyk POSTALADDRESS:Postnetsuite#51,PrivateBagX81,HalfwayHouse,1685

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/TLM

SPONSOR: Standard Bank of South Africa Ltd. COMPANY SECRETARY: Sascha Ramirez-Victor

AUDITORS: Mazars TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

SYG Ords no par value 500 000 000 151 278 489 AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] TLM Ords 0.01c ea 500 000 000 57 482 830

Ords no par value Ldt Pay Amt

Interim No 18 25 Jun 24 1 Jul 24 90.00 DISTRIBUTIONS [ZARc]

Final No 17 19 Dec 23 27 Dec 23 123.00 Ords 0.01c ea Ldt Pay Amt

Quarterly No 64 23 Jul 24 29 Jul 24 0.10

LIQUIDITY: Jul24 Avg 152 573 shares p.w., R2.9m(5.2% p.a.)

Interim No 63 16 Apr 24 22 Apr 24 0.00

GENF 40 Week MA SYGNIA

LIQUIDITY: Jul24 Avg 8 455 shares p.w., R7 572.7(0.8% p.a.)

2145

FTEL 40 Week MA TELEMASTR

1827 198

1508 162

1190 125

871 89

553 52

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 16

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

Interim Final Final Final Final FINANCIAL STATISTICS

Turnover 444 844 809 737 661 (Amts in ZAR’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Op Inc 190 381 380 325 279 Interim Final Final Final Final

NetIntPd(Rcvd) - 16 -29 - 15 -7 -10 Turnover 29 986 64 163 65 002 76 013 79 666

Att Inc 152 300 287 240 206 Op Inc 3 982 2 274 - 527 - 4 541 2 194

TotCompIncLoss 154 303 287 241 206 NetIntPd(Rcvd) 659 1 566 2 168 1 085 - 846

Fixed Ass 14 15 18 22 27 Att Inc 310 416 - 1 976 - 3 936 1 090

Inv & Loans 166 472 141 133 126 633 127 014 106 731 TotCompIncLoss 311 416 - 1 976 - 3 937 1 090

Tot Curr Ass 469 1 510 526 980 773 Fixed Ass 6 726 6 441 7 173 7 192 7 527

Ord SH Int 791 821 841 781 703 Inv & Loans - - - - 2 700

LT Liab 192 233 218 94 206 Tot Curr Ass 7 576 10 136 8 445 12 702 22 917

Tot Curr Liab 166 497 142 088 126 558 127 590 107 105 Ord SH Int 37 606 37 415 36 208 33 751 32 959

LT Liab 4 457 6 711 10 839 13 076 8 256

PER SHARE STATISTICS (cents per share) Tot Curr Liab 9 745 11 621 10 836 16 880 7 262

HEPS-C (ZARc) 100.70 198.90 191.30 170.70 146.40

DPS (ZARc) 90.00 210.00 210.00 135.00 110.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 523.10 543.90 559.40 522.00 499.20 HEPS-C (ZARc) 0.61 0.81 - 3.73 - 7.82 2.49

3 Yr Beta 0.16 0.44 0.77 1.01 1.02 DPS (ZARc) - 0.55 2.00 6.40 6.20

Price High 2 059 1 990 1 950 2 125 1 495 NAV PS (ZARc) 65.42 65.09 64.94 66.83 78.47

Price Low 1 660 1 450 1 351 1 315 654 3 Yr Beta 0.87 0.72 0.39 1.37 2.78

Price Prd End 1 930 1 800 1 647 1 712 1 440 Price High 115 128 150 159 79

RATIOS Price Low 75 51 90 73 16

Ret on SH Fnd 38.55 36.59 34.15 30.85 29.32 Price Prd End 75 99 106 125 73

Oper Pft Mgn 42.86 45.16 46.98 44.13 42.23 RATIOS

D:E 0.24 0.28 0.26 0.73 0.42 Ret on SH Fnd 1.65 1.11 - 5.46 - 11.66 3.31

Current Ratio - 0.01 - 0.01 0.01 Oper Pft Mgn 13.28 3.54 - 0.81 - 5.97 2.75

Div Cover 1.12 0.95 0.91 1.26 1.33 D:E 0.13 0.20 0.32 0.39 0.25

Current Ratio 0.78 0.87 0.78 0.75 3.16

Div Cover - 1.33 - 1.84 - 1.22 0.42

200