Page 203 - shbh24_complete

P. 203

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – TEL

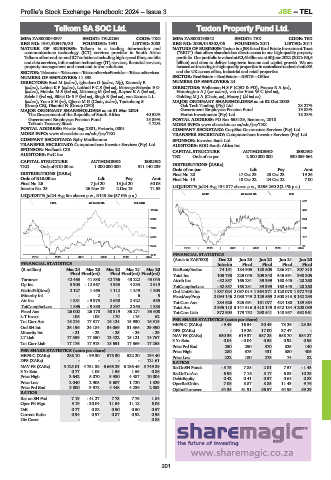

Telkom SA SOC Ltd. Texton Property Fund Ltd.

TEL TEX

ISIN: ZAE000044897 SHORT: TELKOM CODE: TKG ISIN: ZAE000190542 SHORT: TEX CODE: TEX

REG NO: 1991/005476/30 FOUNDED: 1991 LISTED: 2003 REG NO: 2005/019302/06 FOUNDED: 2011 LISTED: 2011

NATURE OF BUSINESS: Telkom is a leading information and NATURE OF BUSINESS: Texton is a JSE-listed Real Estate Investment Trust

communications technology (ICT) services provider in South Africa. (“REIT”) that offers shareholders direct access to our high-quality property

Telkom offers end-to-endICT solutionsincluding high-speed fibre, mobile portfolio.OurportfolioisvaluedatR2,6billionasat30June2022(2021:R3,6

and data services, information technology (IT) services, financial services, billion) and aims to deliver long-term income and capital growth. We are

property management and mast and tower solutions. focusedoninvestinginhigh-qualitypropertiesincentralisednodesinbothSA

SECTOR: Telecoms—Telecoms—TelecomServiceProvider—TelecomServices and the UK across office, industrial and retail properties.

NUMBER OF EMPLOYEES: 11 898 SECTOR: RealEstate—RealEstate—REITS—Office

DIRECTORS: Booi M (ind ne), Ighodaro O (ind ne, Nig), Kennedy B NUMBER OF EMPLOYEES: 24

(ind ne), Lebina K P (ind ne), LuthuliPCS(ind ne), Matenge-Sebesho E G DIRECTORS: WellemanHSP (CEO & FD), FrancoRA(ne),

(ind ne), Moloko M S (ind ne), Msimang M (ind ne), Rayner K A (ind ne), HanningtonAJ(snr ind ne), van der VentWC(ind ne),

Selele I (ind ne), Sibisi Dr S P (ind ne), Singh E (ind ne), von Zeuner L L GoldingMJA (Chair, ne), Macey J (ld ind ne)

(ind ne), Yoon S H (ne), Qhena M G (Chair, ind ne), Taukobong S MAJOR ORDINARY SHAREHOLDERS as at 02 Oct 2023

(Group CE), Dlamini N (Group CFO) Oak Tech Trading (Pty) Ltd. 23.27%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Government Employees Pension Fund 19.83%

The Government of the Republic of South Africa 40.52% Heriot Investments (Pty) Ltd. 18.23%

Government Employees Pension Fund 15.89% POSTAL ADDRESS: PO Box 653129, Benmore, 2010

Telkom Treasury Stock 4.72% MORE INFO: www.sharedata.co.za/sdo/jse/TEX

POSTAL ADDRESS: Private Bag X881, Pretoria, 0001 COMPANY SECRETARY: CorpStat Governance Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/TKG TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Ephy Motlhamme SPONSOR: Investec Bank Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: BDO South Africa Inc.

SPONSOR: Nedbank CIB CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc.

TEX Ords of no par 2 000 000 000 330 059 664

CAPITAL STRUCTURE AUTHORISED ISSUED

TKG Ords of R10.00 ea 1 000 000 000 511 140 239 DISTRIBUTIONS [ZARc]

Ords of no par Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 20 17 Oct 23 23 Oct 23 19.26

Ords of R10.00 ea Ldt Pay Amt Final No 19 18 Oct 22 24 Oct 22 7.00

Final No 26 7 Jul 20 13 Jul 20 50.08

Interim No 25 26 Nov 19 2 Dec 19 71.53 LIQUIDITY: Jul24 Avg 134 877 shares p.w., R355 260.2(2.1% p.a.)

REIV 40 Week MA TEX

LIQUIDITY: Jul24 Avg 6m shares p.w., R143.8m(57.0% p.a.)

537

FTEL 40 Week MA TELKOM

11925 446

9882 354

7839 263

5796 171

3754 80

2019 | 2020 | 2021 | 2022 | 2023 | 2024

1711 FINANCIAL STATISTICS

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(Amts in ZAR’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

FINANCIAL STATISTICS Interim Final Final Final Final

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 NetRent/InvInc 74 151 184 905 188 505 286 871 307 810

Final Final(rst) Final Final(rst) Final(rst) Total Inc 103 798 225 045 209 340 346 591 398 305

Turnover 42 463 41 838 42 756 43 222 43 043 Attrib Inc - 52 857 165 231 39 399 160 445 - 28 260

Op Inc 3 903 - 12 567 4 933 4 833 2 619 TotCompIncLoss - 52 857 165 231 39 399 160 445 - 28 260

NetIntPd(Rcvd) 2 127 1 465 1 112 1 249 1 803 Ord UntHs Int 1 837 024 2 097 014 1 964 371 2 120 078 1 972 740

Minority Int - 2 1 6 5 FixedAss/Prop 2 094 146 2 083 749 2 129 569 2 508 813 3 152 293

Att Inc 1 881 - 9 973 2 630 2 422 535 Tot Curr Ass 284 626 325 691 161 077 424 180 189 864

TotCompIncLoss 1 895 - 9 883 2 897 2 353 1 383 Total Ass 2 995 110 3 141 916 3 410 149 3 642 134 4 208 089

Fixed Ass 26 002 26 178 38 319 36 271 33 608 Tot Curr Liab 372 904 179 752 298 541 148 957 592 961

L-T Invest 106 108 170 115 62 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 16 216 17 317 16 124 15 930 16 315 HEPS-C (ZARc) - 9.49 16.54 30.49 73.26 - 23.35

Ord SH Int 26 196 24 184 34 069 31 366 29 390

37.47

19.26

17.00

Minority Int - 21 - 23 - 25 - 25 - 29 DPS (ZARc) 630.36 - 619.37 587.28 588.70 584.27 -

NAV PS (ZARc)

LT Liab 17 359 17 550 13 422 15 121 14 767

Tot Curr Liab 17 176 17 913 18 551 17 369 17 258 3 Yr Beta 0.04 - 0.04 0.58 0.92 0.95

Price Prd End 250 250 370 325 140

PER SHARE STATISTICS (cents per share) Price High 280 375 431 380 405

HEPS-C (ZARc) 288.10 - 99.30 575.30 522.20 194.40 Price Low 222 180 275 74 82

DPS (ZARc) - - - - 121.61 RATIOS

NAV PS (ZARc) 5 125.01 4 731.38 6 665.29 6 136.48 5 749.89 RetOnSH Funds - 5.75 7.88 2.01 7.57 - 1.43

3 Yr Beta 0.77 1.05 1.56 1.55 0.86 RetOnTotAss 6.93 7.16 5.17 6.83 10.29

Price High 3 642 5 070 5 980 4 487 10 004 Debt:Equity 0.42 0.41 0.57 0.64 0.83

Price Low 2 040 2 908 3 607 1 720 1 329 OperRetOnInv 7.08 8.87 8.85 11.43 9.76

Price Prd End 3 000 3 572 4 448 4 236 2 053 OpInc:Turnover 54.35 61.91 56.57 64.95 59.29

RATIOS

Ret on SH Fnd 7.19 - 41.27 7.73 7.75 1.84

Oper Pft Mgn 9.19 - 30.04 11.54 11.18 6.08

D:E 0.77 0.82 0.50 0.50 0.57

Current Ratio 0.94 0.97 0.87 0.92 0.95

Div Cover - - - - 0.88

201