Page 210 - shbh24_complete

P. 210

JSE – VIS Profile’s Stock Exchange Handbook: 2024 – Issue 3

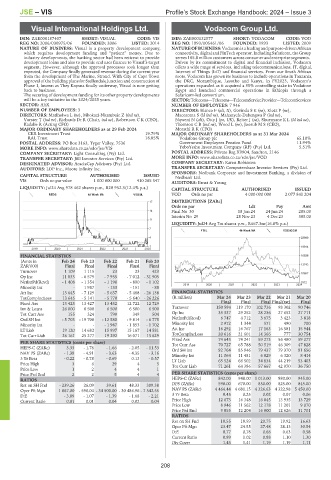

Visual International Holdings Ltd. Vodacom Group Ltd.

VIS VOD

ISIN: ZAE000187407 SHORT: VISUAL CODE: VIS ISIN: ZAE000132577 SHORT: VODACOM CODE: VOD

REG NO: 2006/030975/06 FOUNDED: 2006 LISTED: 2014 REG NO: 1993/005461/06 FOUNDED: 1993 LISTED: 2009

NATURE OF BUSINESS: Visual is a property development company, NATUREOF BUSINESS:Vodacomisaleadingandpurpose-drivenAfrican

which requires development funding and “patient” money. Due to connectivity, digital andFinTech operator.IncludingSafaricom, the Group

industry developments, the banking sector had been reticent to provide serves185.8 millioncustomersacrossconsumerandenterprisesegments.

development loans and also to provide end user finance to Visual’s target Driven by its commitment to digital and financial inclusion, Vodacom

segment. However, although the approval processes took longer than offers a wide range of services, including telecommunications, IT, digital,

expected, the Company finally generated revenue during the current year Internet of Things (IoT) and financial services. From our South African

from the development of The Marine, Strand. With City of Cape Town roots, Vodacom has grown its business to include operations in Tanzania,

approval of the building plans for Stellendale Junction and construction of the DRC, Mozambique, Lesotho and Kenya. In FY2023, Vodacom’s

Phase 1, known as They Knysna finally underway, Visual is now getting operations expanded as it acquired a 55% controlling stake in Vodafone

back to business. Egypt and launched commercial operations in Ethiopia through a

The securing of development funding for its other property developments Safaricom-led consortium.

will be a key initiative in the 2024/2025 years. SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

SECTOR: AltX NUMBER OF EMPLOYEES: 7 946

NUMBER OF EMPLOYEES: 3 DIRECTORS: Bianco F (alt, It), GovindaSK(ne), Klotz P (ne),

DIRECTORS: Matlholwa L (ne), Mbokazi-Nkambule Z (ind ne), Macozoma S (ld ind ne), Mahanyele-Dabengwa P (ind ne),

Vorster T (ind ne), Richards Dr R (Chair, ind ne), Robertson C K (CEO), Nqweni N (alt), Otty J (ne, UK), Reiter J (ne), ShuenyaneKL(ld ind ne),

Kadalie R (Acting CFO) ThomsonCB(ind ne), Wood L (ne), Joosub M S (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 Morathi R K (CFO)

CKR Investment Trust 19.79% MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

RAL Trust 18.85% Vodafone Group plc 65.10%

POSTAL ADDRESS: PO Box 3163, Tyger Valley, 7536 Government Employees Pension Fund 11.94%

MORE INFO: www.sharedata.co.za/sdo/jse/VIS YeboYethu Investment Company (RF) (Pty) Ltd. 5.51%

COMPANY SECRETARY: Light Consulting (Pty) Ltd. POSTAL ADDRESS: Private Bag X9904, Sandton, 2146

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/VOD

DESIGNATED ADVISOR: AcaciaCap Advisors (Pty) Ltd. COMPANY SECRETARY: Karen Robinson

AUDITORS: LDP Inc., Moore Infinity Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: Nedbank Corporate and Investment Banking, a division of

CAPITAL STRUCTURE AUTHORISED ISSUED Nedbank Ltd.

VIS Ords no par value 1 000 000 000 410 265 547

AUDITORS: Ernst & Young

LIQUIDITY: Jul24 Avg 978 462 shares p.w., R20 952.3(12.4% p.a.) CAPITAL STRUCTURE AUTHORISED ISSUED

REDS 40 Week MA VISUAL VOD Ords no par 4 000 000 000 2 077 841 204

17 DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

14 Final No 30 18 Jun 24 24 Jun 24 285.00

Interim No 29 28 Nov 23 4 Dec 23 305.00

11

LIQUIDITY: Jul24 Avg 7m shares p.w., R667.3m(16.8% p.a.)

7

FTEL 40 Week MA VODACOM

4 22999

1 19914

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 16828

(Amts in Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

ZAR’000) Final Final Final Final Final 13743

Turnover 1 109 1 115 23 23 423

10657

Op Inc 11 833 - 6 579 - 7 935 - 7 012 - 31 905

NetIntPd(Rcvd) - 1 408 - 1 354 - 1 190 - 890 - 1 102 7572

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Minority Int - 1 987 - 133 - 151 - 88

Att Inc 13 645 - 7 129 - 5 637 - 5 488 - 26 138 FINANCIAL STATISTICS

TotCompIncLoss 13 645 - 5 141 - 5 770 - 5 640 - 26 226 (R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Fixed Ass 13 423 13 427 13 432 12 722 12 729 Final Final Final Final(rst) Final

Inv & Loans 26 000 6 500 6 500 6 500 6 500 Turnover 150 594 119 170 102 736 98 302 90 746

Tot Curr Ass 155 324 790 349 504 Op Inc 35 337 29 252 28 236 27 652 27 711

Ord SH Int - 5 703 - 19 708 - 12 580 - 9 814 - 6 775 NetIntPd(Rcvd) 6 747 4 712 3 675 3 423 3 818

Minority Int - - - 1 987 - 1 853 - 1 702 Minority Int 2 972 1 344 571 490 700

LT Liab 19 120 14 682 15 997 15 167 14 581 Att Inc 16 292 16 767 17 163 16 581 15 944

Tot Curr Liab 26 161 25 277 19 292 16 071 13 629 TotCompIncLoss 20 616 21 601 14 366 777 30 754

Fixed Ass 74 643 74 241 59 273 56 480 59 277

PER SHARE STATISTICS (cents per share) Tot Curr Ass 70 727 65 788 50 519 46 309 47 828

HEPS-C (ZARc) 3.33 - 1.78 - 1.66 - 2.05 - 11.53 Ord SH Int 92 764 85 946 79 437 79 370 91 656

NAV PS (ZARc) - 1.39 - 4.91 - 3.63 - 4.35 - 3.16

Minority Int 11 064 11 481 6 029 6 320 8 414

3 Yr Beta - 0.22 - 0.78 - 0.69 0.13 - 0.57 LT Liab 65 524 66 502 34 834 44 219 53 403

Price High 3 6 29 4 5 Tot Curr Liab 71 261 64 386 57 667 42 070 36 750

Price Low 1 2 4 4 1

Price Prd End 2 2 5 4 4 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 842.00 948.00 1 013.00 980.00 945.00

Ret on SH Fnd - 239.26 26.09 39.61 48.33 309.38 DPS (ZARc) 590.00 670.00 850.00 825.00 845.00

Oper Pft Mgn 1 067.00 - 590.04 - 34 500.00 - 30 486.96 - 7 542.55 NAV PS (ZARc) 4 464.44 4 681.15 4 326.63 4 322.98 5 450.00

D:E - 3.89 - 1.07 - 1.39 - 1.68 - 2.21 3 Yr Beta 0.45 0.25 0.02 0.07 0.06

Current Ratio 0.01 0.01 0.04 0.02 0.04 Price High 12 673 16 348 16 045 13 935 13 729

Price Low 8 946 11 562 12 178 11 201 9 070

Price Prd End 9 855 12 204 16 000 12 626 11 701

RATIOS

Ret on SH Fnd 18.55 18.59 20.75 19.92 16.63

Oper Pft Mgn 23.47 24.55 27.48 28.13 30.54

D:E 0.77 0.78 0.68 0.63 0.58

Current Ratio 0.99 1.02 0.88 1.10 1.30

Div Cover 1.43 1.41 1.19 1.19 1.11

208