Page 79 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 79

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – AHV

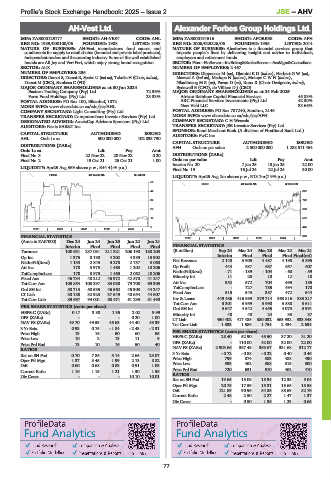

AH-Vest Ltd. Alexander Forbes Group Holdings Ltd.

AHV ALE

ISIN: ZAE000129177 SHORT: AH-VEST CODE: AHL ISIN: ZAE000191516 SHORT: AFORBES CODE: AFH

REG NO: 1989/000100/06 FOUNDED: 1988 LISTED: 1998 REG NO: 2006/025226/06 FOUNDED: 1935 LISTED: 2014

NATURE OF BUSINESS: AH-Vest manufactures food sauces and NATURE OF BUSINESS: Alexforbes is a financial services group that

condiments for supply to retail chains (branded and private label products), impacts people’s lives by delivering insight and advice to individuals,

independent traders and the catering industry. Some of the well established employers and retirement funds.

brands are All Joy and Veri Peri, which enjoy strong brand recognition. SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

SECTOR: AltX NUMBER OF EMPLOYEES: 2 467

NUMBER OF EMPLOYEES: 296 DIRECTORS: Dippenaar M (ne), Dlamini K D (ind ne), Herbert G W (ne),

DIRECTORS: Darsot S, Darsot R, Speirs U (ind ne), Takolia H (Chair, ind ne), Mazwai A (ind ne), MedupeN(ind ne), Molope CWN(ind ne),

Darsot M (CEO), Sambaza C (FD) Nkadimeng M R (ne), Pavan D (ne), Roux R (Chair Designate, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 Bydawell B (CFO), de Villiers D J (CEO)

Eastern Trading Company (Pty) Ltd. 72.36% MAJOR ORDINARY SHAREHOLDERS as at 24 Feb 2025

Farm Food Holdings (Pty) Ltd. 23.33% African Rainbow Capital Financial Services 45.83%

POSTAL ADDRESS: PO Box 100, Eikenhof, 1872 ARC Financial Services Investments (Pty) Ltd. 42.30%

MORE INFO: www.sharedata.co.za/sdo/jse/AHL New Veld LLC 33.66%

COMPANY SECRETARY: Light Consulting (Pty) Ltd. POSTAL ADDRESS: PO Box 787240, Sandton, 2146

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/AFH

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. COMPANY SECRETARY: C H Wessels

AUDITORS: Nexia SAB&T Inc. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: PwC Inc.

AHL Ords 1c ea 500 000 000 102 035 730

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] AFH Ords no par value 2 500 000 000 1 288 511 454

Ords 1c ea Ldt Pay Amt

Final No 3 22 Nov 22 28 Nov 22 0.20 DISTRIBUTIONS [ZARc]

Final No 2 19 Oct 21 25 Oct 21 1.00 Ords no par value Ldt Pay Amt

Interim No 20 7 Jan 25 13 Jan 25 22.00

LIQUIDITY: Apr25 Avg 369 shares p.w., R44.4(-% p.a.)

Final No 19 16 Jul 24 22 Jul 24 30.00

FOOD 40 Week MA AH-VEST

LIQUIDITY: Apr25 Avg 2m shares p.w., R13.7m(7.9% p.a.)

55

GENF 40 Week MA AFORBES

44 847

34 742

23 636

13 531

2 425

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 320

2020 | 2021 | 2022 | 2023 | 2024 |

(Amts in ZAR’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Interim Final Final Final Final FINANCIAL STATISTICS

Turnover 100 631 237 081 211 321 206 190 180 203 (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Op Inc 1 375 8 190 4 202 4 389 15 902 Interim Final Final Final Final(rst)

NetIntPd(Rcvd) 1 133 2 845 3 278 2 757 3 060 Net Revenue 2 140 3 905 4 487 4 198 3 895

Att Inc 178 3 973 1 463 1 202 10 206 Op Profit 444 687 687 657 607

NetIntPd(Rcvd) - 71 - 189 - 104 - 60 - 59

TotCompIncLoss 178 3 973 1 463 2 062 10 206

Fixed Ass 46 734 48 212 46 972 42 570 41 247 Minority Int 11 20 10 12 18

Tot Curr Ass 103 854 108 397 83 080 79 708 69 303 Att Inc 352 672 704 495 185

Ord SH Int 50 713 50 535 46 562 45 303 44 247 TotCompIncLoss - 727 785 494 170

LT Liab 30 188 32 923 37 549 40 654 44 607 Fixed Ass 515 543 387 472 544

Tot Curr Liab 89 697 94 001 68 471 61 235 51 490 Inv & Loans 449 486 416 989 379 714 363 816 333 217

Tot Curr Ass 3 301 3 959 3 990 3 588 3 611

PER SHARE STATISTICS (cents per share) Ord SH Int 3 647 4 542 4 455 4 073 3 991

HEPS-C (ZARc) 0.17 3.88 1.35 2.02 9.99 Minority Int 48 48 24 33 37

DPS (ZARc) - - - 0.20 1.00 LT Liab 450 402 417 485 380 032 363 932 333 348

NAV PS (ZARc) 49.70 49.53 45.63 44.40 43.39 Tot Curr Liab 1 333 1 586 1 754 2 434 2 634

3 Yr Beta 0.93 0.75 - 1.84 - 2.43 - 2.31

Price High 13 16 50 60 55 PER SHARE STATISTICS (cents per share)

Price Low 10 2 13 11 9 HEPS-C (ZARc) 28.40 52.90 45.50 37.20 31.20

Price Prd End 13 10 16 50 40 DPS (ZARc) - 110.00 42.00 32.00 22.00

RATIOS NAV PS (ZARc) 2 903.66 367.48 363.67 331.68 312.77

Ret on SH Fnd 0.70 7.86 3.14 2.65 23.07 3 Yr Beta - 0.72 - 0.88 - 0.22 0.40 0.46

Oper Pft Mgn 1.37 3.45 1.99 2.13 8.82 Price High 799 874 583 488 490

D:E 0.60 0.68 0.83 0.91 1.03 Price Low 593 462 388 315 300

Current Ratio 1.16 1.15 1.21 1.30 1.35 Price Prd End 720 631 510 462 410

Div Cover - - - 10.10 10.01 RATIOS

Ret on SH Fnd 19.65 15.08 15.94 12.35 5.04

Oper Pft Mgn 20.75 17.59 15.31 15.65 15.58

D:E 121.89 90.96 84.85 88.63 82.76

Current Ratio 2.48 2.50 2.27 1.47 1.37

Div Cover - 0.50 1.36 1.23 0.65

77