Page 82 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 82

JSE – ANG Profile’s Stock Exchange Handbook: 2025 – Issue 2

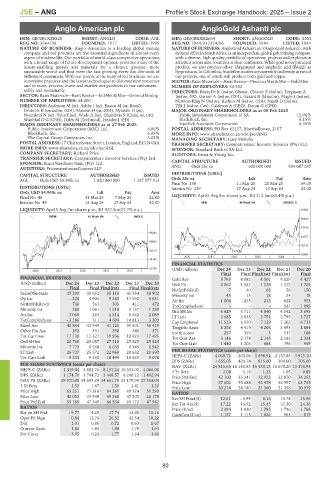

Anglo American plc AngloGold Ashanti plc

ANG ANG

ISIN: GB00B1XZS820 SHORT: ANGLO CODE: AGL ISIN: GB00BRXH2664 SHORT: ANGGOLD CODE: ANG

REG NO: 3564138 FOUNDED: 1917 LISTED: 1999 REG NO: 1944/017354/06 FOUNDED: 1944 LISTED: 1944

NATURE OF BUSINESS: Anglo American is a leading global mining NATURE OF BUSINESS: AngloGold Ashanti plc (AngloGold Ashanti), with

company and our products are the essential ingredients in almost every itsheadofficeinSouthAfrica,isanindependent,globalgoldminingcompany

aspect of modern life. Our portfolio of world-class competitive operations, with a diverse, high-quality portfolio of operations, projects and exploration

with a broad range of future development options, provides many of the activities across nine countries on four continents. While gold is our principal

future-enabling metals and minerals for a cleaner, greener, more product, we also produce silver (Argentina) and sulphuric acid (Brazil) as

sustainable world and that meet the fast growing every day demands of by-products. In Colombia, feasibility studies are currently underway at two of

billions of consumers. With our people at the heart of our business, we use our projects, one of which will produce both gold and copper.

innovative practices and the latest technologies to discover new resources SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

and to mine, process, move and market our products to our customers – NUMBER OF EMPLOYEES: 36 952

safely and sustainably. DIRECTORS: Busia Dr K (ind ne, Ghana), Cleaver B (ind ne), Ferguson A

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining (ind ne, UK), Garner A (ind ne, USA), Gasant R (ld ind ne), Magie J (ind ne),

NUMBER OF EMPLOYEES: 64 000 Newton-King N (ind ne), Richter M (ind ne, USA), Sands D (ind ne),

DIRECTORS: Anderson M (ne), Ashby I (ne), Bastos M (ne, Brazil), Tilk J (ind ne, Can), Calderon A (CEO), Doran G (CFO)

Grote Dr B (snr ind ne, USA), Maxson H (ne, USA), Nyasulu H (ne), MAJOR ORDINARY SHAREHOLDERS as at 05 Feb 2025

Nyembezi N (ne), Tyler I (ne), Wade A (ne), Chambers S (Chair, ne, UK), Public Investment Corporation of SA 15.04%

Wanblad D G (CEO), Daley M (Technical), Heasley J (FD) BlackRock, Inc. 8.15%

MAJOR ORDINARY SHAREHOLDERS as at 27 Feb 2025 Van Eck Assciates Corporation 6.35%

Public Investment Corporation (SOC) Ltd. 6.86% POSTAL ADDRESS: PO Box 62117, Marshalltown, 2107

BlackRock, Inc. 6.05% MORE INFO: www.sharedata.co.za/sdo/jse/ANG

The Capital Group Companies Inc. 5.03% MANAGING SECRETARY: Lucy Mokoka

POSTAL ADDRESS:17Charterhouse Street,London,England,EC1N6RA TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/AGL SPONSOR: Standard Bank of SA Ltd.

COMPANY SECRETARY: Richard Price AUDITORS: Ernst & Young Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PricewaterhouseCoopers LLP ANG Ords 25c ea 600 000 000 504 087 287

DISTRIBUTIONS [USDc]

CAPITAL STRUCTURE AUTHORISED ISSUED

AGL Ords USD 54.945c ea 1 820 000 000 1 337 577 913 Ords 25c ea Ldt Pay Amt

Final No 130 11 Mar 25 28 Mar 25 69.00

DISTRIBUTIONS [USDc] Interim No 129 27 Aug 24 13 Sep 24 22.00

Ords USD 54.945c ea Ldt Pay Amt

Final No 46 11 Mar 25 7 May 25 22.00 LIQUIDITY: Apr25 Avg 8m shares p.w., R4 212.6m(83.4% p.a.)

Interim No 45 13 Aug 24 27 Sep 24 42.00 MINI 40 Week MA ANGGOLD

LIQUIDITY: Apr25 Avg 7m shares p.w., R3 927.5m(27.7% p.a.) 81902

INDM 40 Week MA ANGLO

69460

57019

68281

44577

56901

32136

45522

19694

2020 | 2021 | 2022 | 2023 | 2024 |

34143

FINANCIAL STATISTICS

22763 (USD million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

2020 | 2021 | 2022 | 2023 | 2024 |

Final Final Final(rst) Final(rst) Final

FINANCIAL STATISTICS Gold Rev 5 793 4 582 4 501 4 029 4 427

(USD million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 Wrk Pft 2 067 1 027 1 129 1 172 1 709

Final Final Final(rst) Final Final(rst) NetIntPd(Rcd) 7 30 68 58 150

SalesOfSubsids 27 290 30 652 35 118 41 554 30 902 Minority Int 45 13 18 24 18

Op Inc - 228 3 904 9 243 17 592 5 631 Att Inc 1 004 - 235 233 622 953

NetIntPd(Rcvd) 746 563 301 411 472 TotCompIncLoss - - - 541 1 095

Minority Int 280 1 061 1 510 3 137 1 239 Ord SH Int 6 629 3 711 4 040 4 042 3 695

Att Inc - 3 068 283 4 514 8 562 2 089 LT Liab 2 685 2 835 2 754 2 795 2 727

TotCompIncLoss - 3 186 311 4 604 10 813 3 303 Cap Employed 11 523 6 970 7 129 7 202 6 713

Fixed Ass 40 844 43 949 41 125 39 501 36 419 Tangible Assts 8 256 4 419 4 208 3 493 2 884

Other Fin Ass 292 391 390 340 371 Inv & Loans 257 359 3 117 188

Tot Curr Ass 17 130 17 327 19 936 18 923 17 495 Tot Curr Ass 3 146 2 174 2 145 2 143 2 334

Ord SH Int 20 760 25 057 27 318 27 825 25 824 Tot Curr Liab 1 440 1 205 884 798 959

Minority Int 7 773 6 560 6 635 6 945 6 942

LT Liab 26 737 25 572 22 960 20 632 20 690 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 9 233 9 355 10 494 10 583 9 078 HEPS-C (ZARc) 4 048.72 - 203.06 1 898.92 2 157.88 3 915.10

DPS (ZARc) 1 655.03 424.74 815.00 304.00 705.00

PER SHARE STATISTICS (cents per share) NAV (ZARc) 24 815.65 16 161.83 16 430.13 15 670.20 13 176.93

HEPS-C (ZARc) 1 319.04 3 802.76 8 157.24 10 353.00 4 066.00 3 Yr Beta 1.04 1.18 1.22 1.05 0.89

DPS (ZARc) 1 174.70 1 744.72 3 448.57 6 240.12 1 492.94 Price Prd End 42 100 35 341 32 923 32 870 34 252

NAV PS (ZARc) 29 070.08 34 693.70 34 651.79 33 179.99 27 353.04 Price High 57 602 55 688 43 478 38 597 63 735

3 Yr Beta 1.53 1.67 1.51 1.41 1.20 Price Low 30 214 28 740 21 300 21 356 20 979

Price High 65 251 77 318 84 261 69 924 51 290 RATIOS

Price Low 40 053 39 548 49 368 47 505 20 178 Ret SH Fund($) 12.61 - 5.94 6.16 15.78 25.96

Price Prd End 55 185 47 349 66 334 65 172 47 942 Ret Tot Ass($) 17.22 14.92 15.45 17.30 24.36

RATIOS Price ($/oz) 2 394 1 930 1 793 1 796 1 768

Ret on SH Fnd - 9.77 4.25 17.74 33.65 10.16 CashCost($/oz) 1 157 1 115 1 024 963 819

Oper Pft Mgn - 0.84 12.74 26.32 42.34 18.22

D:E 1.01 0.86 0.72 0.63 0.67

Current Ratio 1.86 1.85 1.90 1.79 1.93

Div Cover - 3.95 0.24 1.77 1.64 1.86

80