Page 84 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 84

JSE – ARG Profile’s Stock Exchange Handbook: 2025 – Issue 2

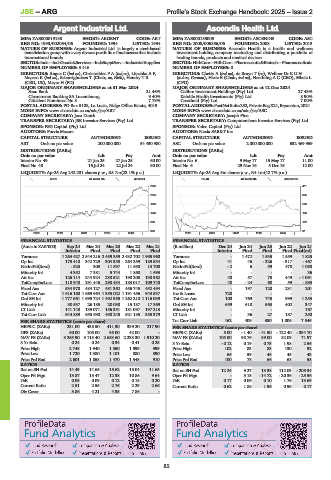

Argent Industrial Ltd. Ascendis Health Ltd.

ARG ASC

ISIN: ZAE000019188 SHORT: ARGENT CODE: ART ISIN: ZAE000185005 SHORT: ASCENDIS CODE: ASC

REG NO: 1993/002054/06 FOUNDED: 1994 LISTED: 1994 REG NO: 2008/005856/06 FOUNDED: 2008 LISTED: 2013

NATURE OF BUSINESS: Argent Industrial Ltd. is largely a steel-based NATURE OF BUSINESS: Ascendis Health is a health and wellness

beneficiation group with a very diverse portfolio of businesses that include investment holding company marketing and distributing a portfolio of

international brands. leading brands, products and medical devices.

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals

NUMBER OF EMPLOYEES: 3 416 NUMBER OF EMPLOYEES: 0

DIRECTORS: Angus C (ind ne), ChristofidesPA(ind ne), Litschka A F, DIRECTORS: Chetty A (ind ne), de Bruyn T (ne), Wellner DrKUH

Mapasa K (ind ne), Scharrighuisen T (Chair, ne, Neth), Hendry T R (ind ne, German), Harie B (Chair, ind ne), Neethling A C (CEO), Mbele L

(CEO, UK), Meyer H (FD) (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 MAJOR ORDINARY SHAREHOLDERS as at 12 Dec 2024

Saxo Bank 21.46% Calibre Investment Holdings (Pty) Ltd. 27.43%

Clearstream Banking SA Luxembourg 9.40% Kefolile Health Investments (Pty) Ltd. 8.90%

Citiclient Nominees No 8 7.79% Cresthold (Pty) Ltd. 7.00%

POSTAL ADDRESS: PO Box 5108, La Lucia, Ridge Office Estate, 4019 POSTAL ADDRESS:PostNetSuite252, PrivateBagX21,Bryanston,2021

MORE INFO: www.sharedata.co.za/sdo/jse/ART MORE INFO: www.sharedata.co.za/sdo/jse/ASC

COMPANY SECRETARY: Jaco Dauth COMPANY SECRETARY: Joseph Fine

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. SPONSOR: Valeo Capital (Pty) Ltd.

AUDITORS: Forvis Mazars AUDITORS: Nexia SAB&T Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

ART Ords no par value 200 000 000 54 430 980 ASC Ords no par value 2 000 000 000 632 469 959

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Ords no par value Ldt Pay Amt

Interim No 49 21 Jan 25 27 Jan 25 60.00 Interim No 6 9 May 17 15 May 17 11.00

Final No 48 16 Jul 24 22 Jul 24 60.00 Final No 5 29 Nov 16 5 Dec 16 12.00

LIQUIDITY: Apr25 Avg 242 231 shares p.w., R5.7m(23.1% p.a.) LIQUIDITY: Apr25 Avg 5m shares p.w., R4.1m(42.7% p.a.)

SUPS 40 Week MA ARGENT PHAR 40 Week MA ASCENDIS

2805 411

2319 335

1832 259

1346 183

859 107

373 31

2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Interim Final Final Final Final Interim Final Final Final Final(rst)

Turnover 1 264 427 2 544 216 2 459 359 2 432 702 1 965 960 Turnover - 1 472 1 535 1 559 1 825

Op Inc 175 418 342 729 304 358 264 259 189 534 Op Inc 41 46 - 226 - 317 - 467

NetIntPd(Rcvd) - 523 303 11 597 11 650 13 700 NetIntPd(Rcvd) - 2 6 59 478 1 080

Minority Int 4 352 7 381 5 744 1 868 1 693 Minority Int - - - - 36

Att Inc 126 114 244 924 230 521 190 208 130 362 Att Inc 40 57 75 449 - 1 091

TotCompIncLoss 118 948 291 446 298 434 183 017 109 740 TotCompIncLoss 40 - 24 60 59 - 893

Fixed Ass 534 978 484 127 481 362 456 745 452 494 Fixed Ass - 197 120 231 201

Tot Curr Ass 1 616 160 1 669 964 1 355 022 1 191 456 943 537 Inv & Loans 720 - - - -

Ord SH Int 1 777 661 1 695 724 1 492 955 1 262 210 1 116 039 Tot Curr Ass 100 769 745 999 1 253

Minority Int 30 537 26 185 20 038 15 187 17 369 Ord SH Int 659 618 563 402 347

LT Liab 141 148 139 071 156 351 181 097 197 213 Minority Int - - - - 167

Tot Curr Liab 644 889 653 690 490 245 521 185 355 379 LT Liab - 36 27 187 250

PER SHARE STATISTICS (cents per share) Tot Curr Liab 162 409 380 1 006 7 545

HEPS-C (ZARc) 231.00 438.50 411.30 339.20 217.90 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 60.00 105.00 95.00 42.00 - HEPS-C (ZARc) 5.00 - 1.40 - 41.50 - 122.40 - 334.70

NAV PS (ZARc) 3 265.90 3 115.40 2 683.60 2 238.30 1 910.20 NAV PS (ZARc) 105.00 98.76 89.00 82.09 71.97

3 Yr Beta 0.24 0.24 0.34 0.41 0.25 3 Yr Beta - 0.12 0.19 0.73 1.98 2.56

Price High 2 748 1 940 1 550 1 599 999 Price High 102 83 83 130 92

Price Low 1 720 1 380 1 101 880 390 Price Low 66 59 48 45 43

Price Prd End 2 601 1 858 1 470 1 348 910 Price Prd End 100 78 66 68 58

RATIOS RATIOS

Ret on SH Fnd 14.43 14.65 15.62 15.04 11.65 Ret on SH Fnd 12.24 9.27 13.38 112.03 - 205.34

Oper Pft Mgn 13.87 13.47 12.38 10.86 9.64 Oper Pft Mgn - 3.15 - 14.72 - 20.36 - 25.56

D:E 0.09 0.09 0.12 0.18 0.20 D:E 0.17 0.06 0.10 1.76 13.69

Current Ratio 2.51 2.55 2.76 2.29 2.66 Current Ratio 0.62 1.88 1.96 0.99 0.17

Div Cover 3.86 4.21 4.35 7.86 -

82