Page 88 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 88

JSE – AVI Profile’s Stock Exchange Handbook: 2025 – Issue 2

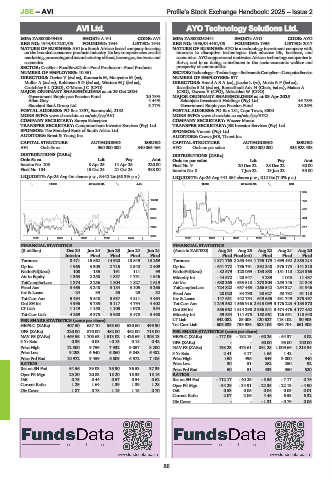

AVI Ltd. AYO Technology Solutions Ltd.

AVI AYO

ISIN: ZAE000049433 SHORT: A-V-I CODE: AVI ISIN: ZAE000252441 SHORT: AYO CODE: AYO

REG NO: 1944/017201/06 FOUNDED: 1944 LISTED: 1944 REG NO: 1996/014461/06 FOUNDED: 1996 LISTED: 2017

NATURE OF BUSINESS: AVI is a South African based company focusing NATURE OF BUSINESS: AYO is a technology investment company with

on the branded consumer products industry. Its key competencies are the interests in disruptive technologies that advance life, business, and

marketing, processingandmanufacturingoffood,beverages, footwearand economics. AYO supports and motivates African technology companies to

cosmetics. thrive, and in so doing, contributes to the socio-economic welfare and

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products prosperity of communities.

NUMBER OF EMPLOYEES: 10 351 SECTOR:Technology—Technology—Software&CompSer—ComputerService

DIRECTORS: Davies V (ind ne), Koursaris M, Mouyeme M (ne), NUMBER OF EMPLOYEES: 677

Muller A (ind ne), RobinsonSG(ind ne), WattersMJ(ind ne), DIRECTORS: AmodABA(ne), Jacobs L (ne), MosiaRP(ind ne),

Crutchley S L (CEO), O’Meara J C (CFO) RasethabaSM(ind ne), Ramatlhodi Adv N (Chair, ind ne), Makan A

MAJOR ORDINARY SHAREHOLDERS as at 29 Oct 2024 (CEO), Dzvova V (CFO), Mclachlan W (COO)

Government Employees Pension Fund 20.75% MAJOR ORDINARY SHAREHOLDERS as at 03 Apr 2025

Allan Gray 4.44% Sekunjalo Investment Holdings (Pty) Ltd. 45.78%

Standard Bank Group Ltd. 3.77% Government Employees Pension Fund 25.26%

POSTAL ADDRESS: PO Box 1897, Saxonwold, 2132 POSTAL ADDRESS: PO Box 181, Cape Town, 8000

MORE INFO: www.sharedata.co.za/sdo/jse/AVI MORE INFO: www.sharedata.co.za/sdo/jse/AYO

COMPANY SECRETARY: Sureya Scheepers COMPANY SECRETARY: Wazeer Moosa

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: The Standard Bank of South Africa Ltd. SPONSOR: Vunani (Pty) Ltd.

AUDITORS: Ernst & Young Inc. AUDITORS: Crowe JHB, Thawt Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

AVI Ords 5c ea 960 000 000 340 065 466 AYO Ords no par value 2 000 000 000 326 922 438

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt Ords no par value Ldt Pay Amt

Interim No 106 8 Apr 25 14 Apr 25 220.00 Final No 9 20 Dec 22 28 Dec 22 60.00

Final No 104 15 Oct 24 21 Oct 24 388.00 Interim No 8 7 Jun 22 13 Jun 22 35.00

LIQUIDITY: Apr25 Avg 4m shares p.w., R442.2m(68.3% p.a.) LIQUIDITY: Apr25 Avg 441 864 shares p.w., R12.0m(7.0% p.a.)

FOOD 40 Week MA A-V-I TECH 40 Week MA AYO

965

10550 778

9500 591

8450 404

7400 217

6350 30

2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 (Amts in ZAR’000) Aug 24 Aug 23 Aug 22 Aug 21 Aug 20

Interim Final Final Final Final Final Final(rst) Final Final Final

Turnover 8 471 15 862 14 920 13 845 13 269 Turnover 1 871 765 2 253 494 1 755 179 1 699 492 2 885 214

Op Inc 1 965 3 305 2 715 2 540 2 409 Op Inc - 641 772 - 786 791 - 392 248 - 376 173 - 141 310

NetIntPd(Rcvd) 108 185 191 111 99 NetIntPd(Rcvd) - 82 579 - 128 059 - 133 838 - 151 110 - 224 365

Att to Equity 1 363 2 258 1 837 1 751 1 646 Minority Int - 44 572 - 20 947 4 239 1 043 11 437

TotCompIncLoss 1 374 2 256 1 804 1 827 1 619 Att Inc - 680 265 - 633 510 - 270 303 - 259 146 21 343

Fixed Ass 3 465 3 248 3 184 3 105 3 266 TotCompIncLoss - 724 822 - 657 463 - 266 542 - 254 327 31 946

Inv & Loans 24 33 35 29 32 Fixed Ass 28 020 34 798 38 627 50 792 91 110

Tot Curr Ass 5 494 5 548 5 537 4 811 4 464 Inv & Loans 147 651 442 754 649 656 431 749 375 497

Ord SH Int 4 996 5 785 5 117 4 794 4 402 Tot Curr Ass 1 249 362 1 565 916 2 615 099 3 176 223 4 183 370

LT Liab 1 149 1 150 1 105 1 078 954 Ord SH Int 586 562 1 514 298 2 956 841 3 474 476 4 177 452

Tot Curr Liab 4 269 3 375 3 980 3 473 3 490 Minority Int 59 634 111 673 150 561 125 651 118 640

PER SHARE STATISTICS (cents per share) LT Liab 342 082 85 008 120 627 116 102 30 903

HEPS-C (ZARc) 407.50 687.10 553.60 530.60 499.90 Tot Curr Liab 603 033 759 986 583 106 486 704 661 908

DPS (ZARc) 220.00 870.00 482.00 462.00 715.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 1 469.55 1 706.63 1 513.02 1 426.69 1 308.13 HEPS-C (ZARc) - 177.09 - 182.19 - 60.25 - 64.37 8.02

3 Yr Beta 0.36 0.08 - 0.15 0.18 0.42 DPS (ZARc) - - 60.00 95.00 100.00

Price High 12 500 9 759 7 932 9 057 8 200 NAV PS (ZARc) 198.23 473.61 861.25 1 009.66 1 213.94

Price Low 9 293 6 540 6 060 6 048 6 482 3 Yr Beta 2.41 4.17 1.65 1.42 -

Price Prd End 10 972 9 459 6 809 6 572 7 105 Price High 150 496 649 3 000 940

RATIOS Price Low 30 51 262 250 92

Ret on SH Fnd 54.56 39.03 35.90 36.53 37.39 Price Prd End 50 51 433 350 520

Oper Pft Mgn 23.20 20.83 18.20 18.35 18.16 RATIOS

D:E 0.75 0.44 0.57 0.54 0.62 Ret on SH Fnd - 112.17 - 40.25 - 8.56 - 7.17 0.76

Current Ratio 1.29 1.64 1.39 1.39 1.28 Oper Pft Mgn - 34.29 - 34.91 - 22.35 - 22.13 - 4.90

Div Cover 1.87 0.78 1.15 1.15 0.70 D:E 0.53 0.05 0.04 0.03 0.01

Current Ratio 2.07 2.06 4.48 6.53 6.32

Div Cover - - - 1.31 - 0.79 0.06

86