Page 92 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 92

JSE – BLU Profile’s Stock Exchange Handbook: 2025 – Issue 2

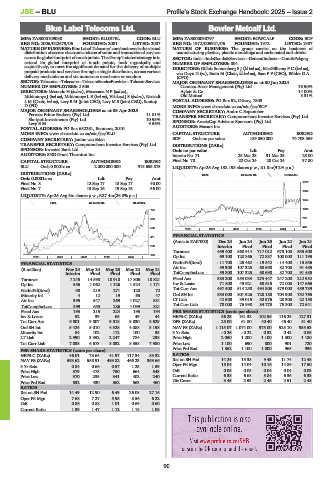

Blue Label Telecoms Ltd. Bowler Metcalf Ltd.

BLU BOW

ISIN: ZAE000109088 SHORT: BLUETEL CODE: BLU ISIN: ZAE000030797 SHORT: BOWCALF CODE: BCF

REG NO: 2006/022679/06 FOUNDED: 2001 LISTED: 2007 REG NO: 1972/005921/06 FOUNDED: 1972 LISTED: 1987

NATURE OF BUSINESS: Blue Label Telecoms’ core business is the virtual NATURE OF BUSINESS: The group carries on the business of

distribution of secure electronic tokens of value and transactional services manufacturing plastics, plastic mouldings and carbonated soft drinks.

across its global footprint of touch points. The Group’s stated strategy is to SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng

extend its global footprint of touch points, both organically and NUMBER OF EMPLOYEES: 804

acquisitively, to meet the significant demand for the delivery of multiple DIRECTORS: Gillett Sonnenberg S J (ld ind ne), MacGillivray F C (ind ne),

prepaid products and services through a single distributor, across various van Duyn D (ne), Brain M (Chair, ld ind ne), Sass P F (CEO), Böhler G A

delivery mechanisms and via numerous merchants or vendors. (CFO)

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

NUMBER OF EMPLOYEES: 2 505 Camissa Asset Management (Pty) Ltd. 16.50%

DIRECTORS: Masondo H (ind ne), Mnxasana N P (ind ne), Aylett & Co 14.00%

Mthimunye J (ind ne), Mthimunye L E (ind ne), Vilakazi J S (ind ne), Nestadt Old Mutual 8.31%

LM(Chair, ind ne), Levy B M (Joint CEO), Levy M S (Joint CEO), Suntup POSTAL ADDRESS: PO Box 92, Ottery, 7808

D(FD) MORE INFO: www.sharedata.co.za/sdo/jse/BCF

MAJOR ORDINARY SHAREHOLDERS as at 03 Apr 2025 COMPANY SECRETARY: Andre C September

Peresec Prime Brokers (Pty) Ltd. 11.81% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Shotput Investments (Pty) Ltd. 10.95% SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

Levy B M 9.56%

POSTAL ADDRESS: PO Box 652261, Benmore, 2010 AUDITORS: Mazars Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/BLU CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Janine van Eden BCF Ords no par value 189 850 000 74 703 569

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

SPONSOR: Investec Bank Ltd. Ords no par value Ldt Pay Amt

AUDITORS: SNG Grant Thornton Inc. Interim No 71 25 Mar 25 31 Mar 25 25.00

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 70 22 Oct 24 28 Oct 24 37.80

BLU Ords 0.0001c ea 2 000 000 000 913 655 873 LIQUIDITY: Apr25 Avg 132 193 shares p.w., R1.8m(9.2% p.a.)

DISTRIBUTIONS [ZARc] GENI 40 Week MA BOWCALF

Ords 0.0001c ea Ldt Pay Amt

1970

Final No 8 12 Sep 17 18 Sep 17 40.00

Final No 7 13 Sep 16 19 Sep 16 36.00

1662

LIQUIDITY: Apr25 Avg 5m shares p.w., R27.4m(26.0% p.a.)

1354

FTEL 40 Week MA BLUETEL

1046

778

737

656

533 2020 | 2021 | 2022 | 2023 | 2024 | 429

411 FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

288 Interim Final Final Final Final

Turnover 459 400 860 914 717 012 673 100 635 500

166

2020 | 2021 | 2022 | 2023 | 2024 | Op Inc 69 100 120 866 72 837 100 000 111 195

NetIntPd(Rcvd) - 11 700 - 25 462 - 19 542 - 14 400 - 15 556

FINANCIAL STATISTICS

(R million) Nov 24 May 24 May 23 May 22 May 21 Att Inc 59 300 107 325 68 698 82 700 91 485

Interim Final Final Final Final TotCompIncLoss 59 300 107 325 68 698 82 700 91 485

Turnover 7 245 14 598 18 918 17 806 18 821 Fixed Ass 383 200 353 033 273 447 247 200 212 952

Op Inc 556 1 062 1 126 1 524 1 171 Inv & Loans 71 800 49 621 68 615 72 000 147 666

NetIntPd(Rcvd) 90 219 271 120 72 Tot Curr Ass 497 500 514 258 494 803 479 000 459 789

Minority Int 4 12 19 65 47 Ord SH Int 833 000 801 926 728 180 704 300 732 765

Att Inc 395 647 269 1 027 831 LT Liab 42 500 39 015 30 576 28 300 22 158

TotCompIncLoss 399 653 286 1 099 821 Tot Curr Liab 78 000 76 998 84 773 75 300 72 641

Fixed Ass 193 215 224 195 194 PER SHARE STATISTICS (cents per share)

Inv & Loans 52 39 65 49 44 HEPS-C (ZARc) 86.25 161.38 102.96 116.25 127.31

Tot Curr Ass 9 801 9 807 9 018 9 830 8 629 DPS (ZARc) 25.00 61.80 40.40 46.40 51.40

Ord SH Int 5 424 5 010 4 328 4 088 3 198 NAV PS (ZARc) 1 115.07 1 074.00 975.00 925.10 935.53

Minority Int 84 102 112 100 35 3 Yr Beta - 0.26 - 0.22 0.32 0.42 0.05

LT Liab 2 990 3 352 2 247 784 238 Price High 2 050 1 200 1 100 1 300 1 180

Tot Curr Liab 7 038 6 673 8 032 8 358 7 980 Price Low 1 100 690 800 901 720

PER SHARE STATISTICS (cents per share) Price Prd End 1 362 1 100 1 000 965 936

HEPS-C (ZARc) 46.01 73.64 41.97 117.34 83.32 RATIOS

NAV PS (ZARc) 593.62 558.91 489.82 466.23 363.66 Ret on SH Fnd 14.24 13.38 9.43 11.74 12.48

3 Yr Beta 0.84 0.66 0.57 1.25 1.59 Oper Pft Mgn 15.04 14.04 10.16 14.86 17.50

Price High 579 478 750 664 543 D:E 0.05 0.05 0.04 0.04 0.03

Price Low 370 235 341 402 240 Current Ratio 6.38 6.68 5.84 6.36 6.33

Price Prd End 532 430 362 563 460 Div Cover 3.45 2.53 2.45 2.51 2.48

RATIOS

Ret on SH Fnd 14.49 12.90 6.49 26.08 27.16

Oper Pft Mgn 7.68 7.27 5.95 8.56 6.22

D:E 0.86 0.88 1.01 0.69 0.60

Current Ratio 1.39 1.47 1.12 1.18 1.08

90