Page 94 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 94

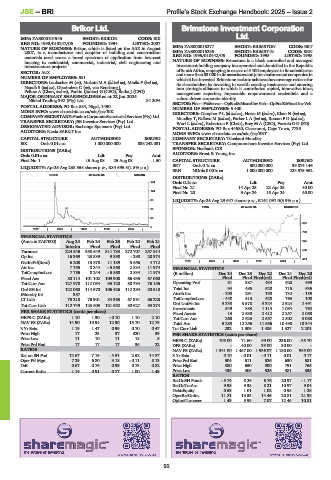

JSE – BRI Profile’s Stock Exchange Handbook: 2025 – Issue 2

Brikor Ltd. Brimstone Investment Corporation

BRI Ltd.

ISIN: ZAE000101945 SHORT: BRIKOR CODE: BIK

REG NO: 1998/013247/06 FOUNDED: 1994 LISTED: 2007 BRI

NATURE OF BUSINESS: Brikor, which is listed on the AltX in August ISIN: ZAE000015277 SHORT: BRIMSTON CODE: BRT

CODE: BRN

2007, is a manufacturer and supplier of building and construction ISIN: ZAE000015285 SHORT: BRIMST-N LISTED: 1998

FOUNDED: 1995

REG NO: 1995/010442/06

materials used across a broad spectrum of application from low-cost

housing to residential, commercial, industrial, civil engineering and NATURE OF BUSINESS: Brimstone is a black controlled and managed

infrastructure projects. investment holding company incorporated and domiciled in the Republic

SECTOR: AltX of South Africa, employing in excess of 5 400 employees in its subsidiaries

and more than 33 000 in its associates and joint ventures and companies in

NUMBER OF EMPLOYEES: 581 which it hasinvested.Brimstoneseeks toachieve above average returnsfor

DIRECTORS: LaubscherM(ne), Mokate M A (ld ind ne), Mtsila F (ind ne), its shareholders by investing in wealth creating businesses and entering

Naudè S (ind ne), Oberholzer C (ne), van Rensburg J, into strategic alliances to which it contributes capital, innovative ideas,

Pellow A (Chair, ind ne), Parkin (Junior) G (CEO), Botha J (CFO) management expertise, impeccable empowerment credentials and a

MAJOR ORDINARY SHAREHOLDERS as at 22 Jan 2024 values driven corporate identity.

Nikkel Trading 392 (Pty) Ltd. 84.20% SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

POSTAL ADDRESS: PO Box 884, Nigel, 1490 NUMBER OF EMPLOYEES: 5 400

MORE INFO: www.sharedata.co.za/sdo/jse/BIK DIRECTORS: Campher P L (ld ind ne), Hewu M (ind ne), Khan N (ind ne),

COMPANY SECRETARY:FusionCorporateSecretarialServices(Pty)Ltd. Moodley T, Ndlovu M (ind ne), Parker L A (ind ne), Roman F D (ind ne),

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Wort L (ind ne), Robertson F (Chair), Brey M A (CEO), Fortuin G G (FD)

DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd. POSTAL ADDRESS: PO Box 44580, Claremont, Cape Town, 7735

AUDITORS: Nexia SAB&T Inc. MORE INFO: www.sharedata.co.za/sdo/jse/BRT

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Tiloshani Moodley

BIK Ords 0.01c ea 1 000 000 000 838 242 031 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Nedbank CIB

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt AUDITORS: Ernst & Young Inc.

Final No 1 15 Aug 08 25 Aug 08 1.50 CAPITAL STRUCTURE AUTHORISED ISSUED

BRT Ords 0.1c ea 500 000 000 39 874 146

LIQUIDITY: Apr25 Avg 238 358 shares p.w., R34 695.3(1.5% p.a.)

BRN NOrds 0.001c ea 1 000 000 000 224 975 962

CONM 40 Week MA BRIKOR

DISTRIBUTIONS [ZARc]

154 Ords 0.1c ea Ldt Pay Amt

Final No 21 14 Apr 25 22 Apr 25 40.00

124

Final No 20 9 Apr 24 15 Apr 24 40.00

95 LIQUIDITY: Apr25 Avg 29 647 shares p.w., R161 091.0(3.9% p.a.)

FINA 40 Week MA BRIMSTON

65

35

876

5

2020 | 2021 | 2022 | 2023 | 2024 |

760

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 645

Interim Final Final Final Final

530

Turnover 224 546 350 549 311 733 272 707 257 914

Op Inc 16 369 23 839 9 898 - 298 20 974 414

NetIntPd(Rcvd) 6 208 13 878 11 189 5 656 4 712 2020 | 2021 | 2022 | 2023 | 2024 |

Att Inc 7 755 8 244 - 5 868 2 834 11 974 FINANCIAL STATISTICS

TotCompIncLoss 7 755 8 244 - 5 868 2 834 11 974 (R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Fixed Ass 80 114 101 102 109 908 66 435 67 060 Final Final Final(rst) Final Final(rst)

Tot Curr Ass 127 978 112 054 93 120 80 794 76 156 Operating Prof 31 387 434 620 499

Ord SH Int 122 068 114 670 106 426 112 294 80 510 Total Inc 94 485 528 715 636

Minority Int 357 - - - - Attrib Inc - 200 291 190 732 - 185

LT Liab 75 218 76 901 84 365 67 381 66 228 TotCompIncLoss - 440 513 628 763 108

Tot Curr Liab 112 749 123 503 121 552 80 627 53 274 Ord UntHs Int 3 238 3 578 3 324 2 924 2 491

Investments 549 883 1 114 1 084 792

PER SHARE STATISTICS (cents per share) Fixed Assets 13 2 530 2 412 2 257 2 058

HEPS-C (ZARc) 1.10 1.30 - 0.10 1.10 2.10 Tot Curr Ass 260 2 623 2 557 2 802 3 088

NAV PS (ZARc) 14.90 13.94 12.90 13.70 12.79 Total Ass 5 283 12 256 11 656 10 498 10 344

3 Yr Beta 1.19 1.47 0.99 0.70 0.47 Tot Curr Liab 232 1 509 1 485 1 327 2 201

Price High 17 23 37 320 39 PER SHARE STATISTICS (cents per share)

Price Low 11 10 11 18 5 HEPS-C (ZARc) 108.00 71.60 69.00 236.00 - 38.70

Price Prd End 17 17 17 36 22 DPS (ZARc) - 40.00 33.00 30.00 -

RATIOS NAV PS (ZARc) 1 341.00 1 457.00 1 936.07 1 180.00 985.00

Ret on SH Fnd 12.67 7.19 - 5.51 2.52 14.87 3 Yr Beta 0.10 - 0.01 - 0.11 0.01 0.17

Oper Pft Mgn 7.29 6.80 3.18 - 0.11 8.13 Price Prd End 504 511 526 630 581

D:E 0.67 0.76 0.99 0.73 0.82 Price High 580 650 900 791 765

Current Ratio 1.14 0.91 0.77 1.00 1.43 Price Low 435 305 526 381 335

RATIOS

RetOnSH Funds - 5.74 8.26 6.76 20.97 - 1.17

RetOnTotAss 9.98 9.38 8.21 10.97 9.04

Debt:Equity 0.53 1.01 1.02 0.98 1.28

OperRetOnInv 11.21 13.33 14.45 20.81 21.38

OpInc:Turnover 1.43 5.99 7.07 12.45 10.81

92