Page 98 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 98

JSE – CAP Profile’s Stock Exchange Handbook: 2025 – Issue 2

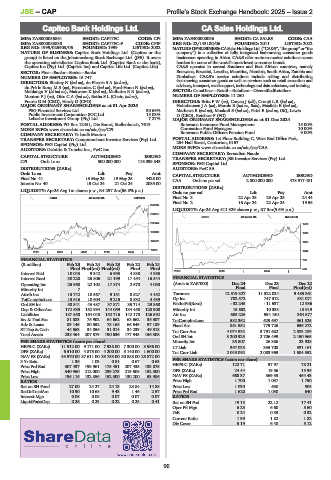

Capitec Bank Holdings Ltd. CA Sales Holdings Ltd.

CAP CAS

ISIN: ZAE000035861 SHORT: CAPITEC CODE: CPI ISIN: ZAE400000036 SHORT: CA SALES CODE: CAA

ISIN: ZAE000083838 SHORT: CAPITEC-P CODE: CPIP REG NO: 22/143100/06 FOUNDED: 2011 LISTED: 2022

REG NO: 1999/025903/06 FOUNDED: 1999 LISTED: 2002 NATUREOFBUSINESS:CASalesHoldingsLtd.(“CA&S”,“thegroup”or“the

NATURE OF BUSINESS: Capitec Bank Holdings Ltd. (Capitec or the company”) is a collective of fully integrated fast-moving consumer goods

group) is listed on the Johannesburg Stock Exchange Ltd. (JSE). It owns businesses operating in Africa. CA&S offer route-to-market solutions across

the operating subsidiaries Capitec Bank Ltd. (Capitec Bank or the bank), borders for some of the world’s most-loved consumer brands.

Capitec Ins (Pty) Ltd. (Capitec Ins) and Capitec Life Ltd. (Capitec Life). CA&S operates in several Southern and East African countries, namely

SECTOR: Fins—Banks—Banks—Banks Botswana, Eswatini, Lesotho, Mauritius, Namibia, South Africa, Zambia and

NUMBER OF EMPLOYEES: 15 747 Zimbabwe. CA&S’s service solutions include selling and distributing

DIRECTORS: Bhettay N (ind ne), du PlessisSA(ind ne), fast-moving consumer goods as well as services such as retail execution and

du Pré le RouxMS(ne), Fernandez C (ind ne), Ford-Hoon N (ind ne), advisory,transport,retailsupport,technologyanddatasolutions,andtraining.

Mahlangu V (ld ind ne), Makwane K (ind ne), MalhotraRR(ind ne), SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers

MoutonPJ(ne), OttoCA(ind ne), Botha S L (Chair, ind ne), NUMBER OF EMPLOYEES: 11 250

Fourie G M (CEO), Hardy G (CFO) DIRECTORS: BritzFW(ne), Craven J (alt), CronjéLR(ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 01 Apr 2025 HoltzhausenJA(ne), Marole B (ind ne, Bots), Masilela E (ind ne),

PSG Financial Services Ltd. 30.69% Mathews B (ind ne), Moakofi S (ind ne), Patel B (ind ne, UK), Lewis

Public Investment Corporation SOC Ltd. 15.03% D (CEO), Reichert F (FD)

Lebashe Investment Group (Pty) Ltd. 7.27% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

POSTAL ADDRESS: PO Box 12451, Die Boord, Stellenbosch, 7613 Botswana Insurance Fund Management 15.00%

MORE INFO: www.sharedata.co.za/sdo/jse/CPI Coronation Fund Managers 10.00%

COMPANY SECRETARY: Yolandé Mouton Botswana Public Officers Pension Fund 9.00%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: 1st Floor Building C, West End Office Park,

SPONSOR: PSG Capital (Pty) Ltd. 254 Hall Street, Centurion, 0157

AUDITORS: Deloitte & Touche Inc., PwC Inc. MORE INFO: www.sharedata.co.za/sdo/jse/CAA

COMPANY SECRETARY: Bernadien Naude

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CPI Ords 1c ea 500 000 000 116 099 843

SPONSOR: PSG Capital Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: PwC SA

Ords 1c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 41 13 May 25 19 May 25 4425.00 CAA Ords no par val 2 000 000 000 478 917 481

Interim No 40 15 Oct 24 21 Oct 24 2085.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Apr25 Avg 1m shares p.w., R4 297.2m(66.8% p.a.) Ords no par val Ldt Pay Amt

BANK 40 Week MA CAPITEC Final No 3 22 Apr 25 29 Apr 25 24.44

Final No 2 16 Apr 24 22 Apr 24 19.56

336182

LIQUIDITY: Apr25 Avg 511 329 shares p.w., R7.3m(5.6% p.a.)

284318

GERE 40 Week MA CA SALES

232454 1780

180589 1534

128725 1288

76861

2020 | 2021 | 2022 | 2023 | 2024 | 1042

FINANCIAL STATISTICS 796

(R million) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

Final Final(rst) Final(rst) Final Final 550

2022 | 2023 | 2024 |

Interest Paid 10 043 9 342 6 993 4 838 4 985

Interest Rcvd 30 228 25 806 21 199 17 454 16 544 FINANCIAL STATISTICS

Operating Inc 25 968 22 102 17 874 2 570 4 030 (Amts in ZAR’000) Dec 24 Dec 23 Dec 22

Minority Int 7 - - - - Final Final Final(rst)

Attrib Inc 13 742 10 567 9 151 8 527 4 452 Turnover 12 519 327 11 322 024 9 485 361

TotCompIncLoss 13 616 10 604 9 215 8 532 4 439 Op Inc 782 572 747 312 531 071

Ord SH Int 50 841 43 487 37 871 35 714 29 860 NetIntPd(Rcvd) - 32 245 - 11 537 12 936

Dep & OtherAcc 172 635 152 994 144 059 134 458 120 908 Minority Int 15 632 10 338 13 919

Liabilities 187 550 164 048 152 716 142 178 126 592 Att Inc 605 226 594 150 364 677

Inv & Trad Sec 81 883 75 902 64 662 63 662 35 307 TotCompIncLoss 582 362 629 697 361 525

Adv & Loans 89 145 80 552 78 168 66 549 57 189 Fixed Ass 861 552 779 726 636 272

ST Dep & Cash 44 563 34 856 31 014 34 239 49 318 Tot Curr Ass 4 074 932 3 791 682 2 883 289

Total Assets 238 464 207 579 190 636 177 943 156 508 Ord SH Int 3 200 925 2 706 499 2 150 965

PER SHARE STATISTICS (cents per share) Minority Int 35 807 26 386 23 928

HEPS-C (ZARc) 11 912.00 9 171.00 7 938.00 7 300.00 3 966.00 LT Liab 367 028 335 708 331 161

DPS (ZARc) 6 510.00 4 875.00 4 200.00 5 140.00 1 600.00 Tot Curr Liab 2 045 092 2 083 969 1 584 552

NAV PS (ZARc) 43 970.00 37 611.00 33 753.00 30 888.00 25 872.00

3 Yr Beta 1.36 1.03 0.84 0.67 0.63 PER SHARE STATISTICS (cents per share)

Price Prd End 307 437 199 961 175 451 207 435 133 875 HEPS-C (ZARc) 122.71 97.97 78.21

Price High 340 960 212 000 239 273 219 608 152 500 DPS (ZARc) 24.44 19.56 15.35

Price Low 196 116 132 856 152 500 130 200 53 986 NAV PS (ZARc) 668.37 569.33 454.43

RATIOS Price High 1 700 1 037 1 750

Ret on SH Fund 27.00 24.27 24.13 23.84 14.88 Price Low 1 030 630 505

RetOnTotalAss 10.90 10.68 9.43 1.46 2.57 Price Prd End 1 620 1 030 640

Interest Mgn 0.08 0.08 0.07 0.07 0.07 RATIOS

LiquidFnds:Dep 0.26 0.23 0.22 0.25 0.41 Ret on SH Fnd 19.18 22.12 17.41

Oper Pft Mgn 6.25 6.60 5.60

D:E 0.24 0.33 0.32

Current Ratio 1.99 1.82 1.82

Div Cover 5.19 6.40 5.12

96