Page 103 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 103

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – CLI

Clientèle Ltd. Collins Property Group Ltd.

CLI COL

ISIN: ZAE000117438 SHORT: CLIENTELE CODE: CLI ISIN: ZAE000152658 SHORT: COLLINS CODE: CPP

REG NO: 2007/023806/06 FOUNDED: 2007 LISTED: 2008 REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

NATURE OF BUSINESS: Clientèle, the holding Company of the Group, is NATURE OF BUSINESS: Collins Property Group Ltd. is an investment

incorporated in South Africa and is listed under the Insurance sector index holding company. At year-end , its principal business consisted of:

on the JSE. Its Long-term insurance subsidiary, Clientèle Life, markets, *A 100% interest in the property-owning and 90% in the serviced office

distributes and underwrites insurance and investment products and business of Moorgarth group of companies

invests funds derived therefrom and accounts for the majority of the *A 74.3% stake in the property-owning Collins Property group of

Group’s earnings and assets. The Group also provides personal and companies based in South Africa

business lines legal insurance policies underwritten through Clientèle *A 100% stake in property owning Nguni Property Fund group of

General Insurance, its Short-term insurance subsidiary. companies, based in Namibia

SECTOR: Fins—Insurance—Life Insurance—Life Insurance *A 100% stake in property-owning Tradehold Africa group of companies,

NUMBER OF EMPLOYEES: 3 663 based in Mauritius.

DIRECTORS: Chadwick G K (ne), Creamer T J (ne), Louw H, SECTOR: RealEstate—RealEstate—REITs—Industrial REITs

Mashilwane E (ind ne), Mayers H P (ne), Nkadimeng P G (ne), NUMBER OF EMPLOYEES: 5 195

Raisbeck M (ne), Stott B A (ind ne), Tabane R D T, Williams R D (ind ne), DIRECTORS: Coleman D (alt), Collins M (alt), EsterhuyseFH(ne),

Routledge G Q (Chair, ind ne), Reekie B W (MD), Boesch T (Interim CFO), FennerRD(ind ne), Harrop D A, Makhunga B (ind ne), RoelofsePJ(ind

Pillay A C (FD) ne), TempletonJWA(ne), Wiese AdvJD(alt),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 Wiese Dr C H (Chair, ne), Collins K (CEO), Lang G C (FD)

Friedshelf 1577 (Pty) Ltd. 61.20% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Hollard Group 19.48% Granadino Investments (Pty) Ltd. 30.10%

Yellowwoods Trust Investments (Pty) Ltd. 8.97% U Reit Collins (Pty) Ltd. 21.80%

POSTAL ADDRESS: PO Box 1316, Rivonia, 2128 Redbill Holdings (Pty) Ltd. 10.30%

MORE INFO: www.sharedata.co.za/sdo/jse/CLI POSTAL ADDRESS: PO Box 6100, Parow East, 7501

COMPANY SECRETARY: Eben Smit MORE INFO: www.sharedata.co.za/sdo/jse/CPP

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Pieter Johan Janse van Rensburg

SPONSOR: PwC Corporate Finance (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: PwC Inc. SPONSOR: Questco (Pty) Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CLI Ord 2c ea 750 000 000 453 235 596 CAPITAL STRUCTURE AUTHORISED ISSUED

CPP Ords no par val - 334 097 767

DISTRIBUTIONS [ZARc]

Ord2cea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 17 8 Oct 24 14 Oct 24 125.00 Ords no par val Ldt Pay Amt

Final No 16 19 Sep 23 26 Sep 23 125.00 Interim No 18 19 Nov 24 25 Nov 24 50.00

Final No 17 11 Jun 24 18 Jun 24 50.00

LIQUIDITY: Apr25 Avg 76 326 shares p.w., R878 065.3(0.9% p.a.)

LIQUIDITY: Apr25 Avg 43 192 shares p.w., R409 505.8(0.7% p.a.)

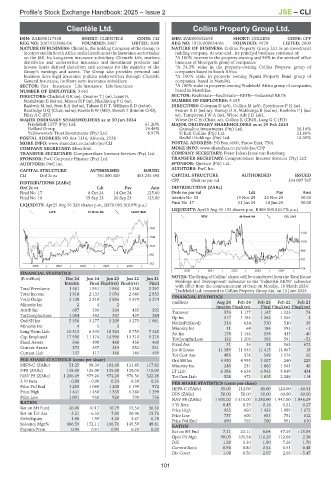

LIFE 40 Week MA CLIENTELE

REIV 40 Week MA COLLINS

1541

1202

1344

1035

1147

868

950

701

753

2020 | 2021 | 2022 | 2023 | 2024 |

534

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 NOTES: The listing of Collins’ shares will be transferred from the ‘Real Estate

Interim Final Final(rst) Final(rst) Final Holdings and Development’ subsector to the ‘Industrial REITs’ subsector

with effect from the commencement of trade on Monday, 18 March 2024.

Total Premiums 1 561 1 931 1 954 2 358 2 297 Tradehold Ltd. renamed to Collins Property Group Ltd. on 13 June 2023.

Total Income 1 818 2 133 3 054 2 640 2 853 FINANCIAL STATISTICS

Total Outgo 2 128 2 810 2 856 1 979 2 274

Aug 24

Feb 24

Minority Int 2 4 2 - - (million) Interim Final(rst) Feb 23 Feb 22 Feb 21

Final Final(rst) Final(rst)

Attrib Inc 697 330 344 435 392 Turnover 574 1 177 1 147 1 123 74

TotCompIncLoss 1 054 492 337 429 384 Op Inc 517 1 195 1 265 1 265 2

Ord SH Int 5 356 3 277 3 209 3 275 1 081 NetIntPd(Rcvd) 314 634 530 510 39

Minority Int 4 5 3 - - Minority Int 11 64 184 193 - 2

Long-Term Liab 10 515 6 535 10 524 8 755 7 325 Att Inc 178 1 144 158 413 - 40

Cap Employed 17 930 11 174 14 996 13 310 9 276 TotCompIncLoss 132 1 203 393 591 - 53

Fixed Assets 546 490 468 456 460 Fixed Ass 31 36 38 163 672

Current Assets 573 397 314 552 531 Inv & Loans 11 389 11 633 11 415 14 067 18

Current Liab 137 117 166 140 459

Tot Curr Ass 495 376 549 1 174 55

PER SHARE STATISTICS (cents per share) Ord SH Int 4 950 4 995 3 187 240 225

HEPS-C (ZARc) 51.25 98.39 102.60 131.45 117.82 Minority Int 243 231 1 065 1 041 45

DPS (ZARc) 125.00 125.00 125.00 120.00 110.00 LT Liab 6 386 6 634 6 943 8 849 434

NAV PS (ZARc) 1 206.49 979.26 974.28 976.56 322.28 Tot Curr Liab 528 472 1 025 2 288 114

3 Yr Beta - 0.08 - 0.08 0.24 0.39 0.55 PER SHARE STATISTICS (cents per share)

Price Prd End 1 250 1 060 1 200 1 199 972 HEPS-C (ZARc) 35.00 112.00 45.00 124.00 - 40.51

Price High 1 441 1 450 1 335 1 240 1 299 DPS (ZARc) 50.00 50.00 30.00 60.00 60.00

Price Low 1 001 950 920 790 756 NAV PS (ZARc) 1 501.00 1 515.00 1 240.00 1 947.00 1 846.09

RATIOS

3 Yr Beta 0.45 0.29 - 0.16 0.21 0.27

Ret on SH Fund 26.06 10.17 10.79 13.30 36.30 Price High 955 850 1 435 1 099 1 075

Ret on Tot Ass - 3.21 - 6.33 7.01 10.96 15.76 Price Low 737 600 653 751 612

Debt:Equity 1.96 1.99 3.28 2.67 6.78 Price Prd End 890 763 700 951 810

Solvency Mgn% 686.59 172.11 166.76 149.59 49.81 RATIOS

Payouts:Prem 0.95 0.91 0.91 0.20 0.20

Ret on SH Fnd 7.31 23.11 8.04 47.35 - 15.54

Oper Pft Mgn 90.09 101.54 110.29 112.68 2.38

D:E 1.28 1.30 1.80 7.28 1.70

Current Ratio 0.94 0.80 0.54 0.51 0.48

Div Cover 1.08 8.50 2.07 2.68 - 5.47

101