Page 108 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 108

JSE – DEN Profile’s Stock Exchange Handbook: 2025 – Issue 2

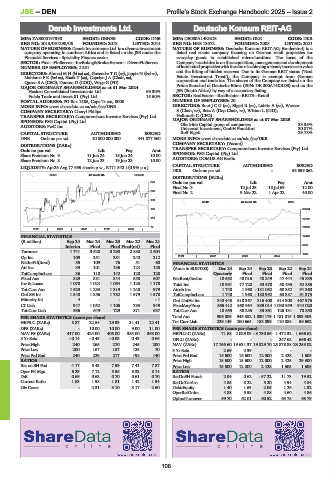

Deneb Investments Ltd. Deutsche Konsum REIT-AG

DEN DEU

ISIN: ZAE000197398 SHORT: DENEB CODE: DNB ISIN: DE000A14KRD3 SHORT: DKR CODE: DKR

REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014 REG NO: HRB 13072 FOUNDED: 2008 LISTED: 2021

NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment NATURE OF BUSINESS: Deutsche Konsum REIT-AG, Broderstorf, is a

company operating in southern Africa and is listed on the JSE under the listed real estate company focusing on German retail properties for

Financial Services - Speciality Finance sector. everyday goods in established micro-locations. The focus of the

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs Company’s activities is on the acquisition, management and development

NUMBER OF EMPLOYEES: 2 581 of local retail properties with the aim of achieving a steady increase in value

DIRECTORS: Ahmed M H (ld ind ne), Govender T G (ne), Jappie N (ind ne), and the lifting of hidden reserves. Due to its German REIT status (‘Real

Mahloma F K (ind ne), Shaik Y (ne), Copelyn J A (Chair, ne), Estate Investment Trust’), the Company is exempt from German

Queen S A (CEO), Duncan D (COO), Wege G (FD) corporation and trade tax. The shares of the Company are listed on the

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Prime Standard of Deutsche Börse (ISIN: DE 000A14KRD3) and on the

Hosken Consolidated Investments Ltd. 69.30% JSE (South Africa) by way of a secondary listing.

Fulela Trade and Invest 81 (Pty) Ltd. 15.50% SECTOR: RealEstate—RealEstate—REITS—Retail

POSTAL ADDRESS: PO Box 1585, Cape Town, 8000 NUMBER OF EMPLOYEES: 20

MORE INFO: www.sharedata.co.za/sdo/jse/DNB DIRECTORS: BootJCG(ne), Elgeti R (ne), Lubitz A (ne), Wasser

COMPANY SECRETARY: Cheryl Philips S (Chair, ne), Betz A (Dep Chair, ne), Wittan L (CIO),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Hellmuth C (CFO)

SPONSOR: PSG Capital (Pty) Ltd. MAJOR ORDINARY SHAREHOLDERS as at 07 Mar 2025

AUDITORS: PwC Inc. Obotritia Capital group of companies 33.36%

Universal Investment, GmbH Frankfurt

30.87%

CAPITAL STRUCTURE AUTHORISED ISSUED Rolf Elgeti 29.78%

DNB Ords no par val 10 000 000 000 441 877 560 MORE INFO: www.sharedata.co.za/sdo/jse/DKR

COMPANY SECRETARY: (Vacant)

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Share Premium No 9 11 Jun 24 18 Jun 24 10.00 SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: DOMUS AG Berlin

Share Premium No 8 12 Jun 23 19 Jun 23 10.00

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Apr25 Avg 77 659 shares p.w., R171 842.1(0.9% p.a.)

DKR Ords no par val - 53 859 862

GENF 40 Week MA DENEB

DISTRIBUTIONS [EURc]

270 Ords no par val Ldt Pay Amt

Final No 3 12 Jul 23 18 Jul 69 12.00

230

Final No 2 9 Mar 22 1 Apr 22 40.00

190

REIV 40 Week MA DKR

150 33664

110 27252

70 20840

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 14429

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Interim Final Final Final(rst) Final 8017

Turnover 1 741 3 528 3 290 2 880 2 604

1605

Op Inc 109 251 281 240 212 2021 | 2022 | 2023 | 2024 |

NetIntPd(Rcvd) 55 109 76 51 60 FINANCIAL STATISTICS

Att Inc 39 101 136 124 125 (Amts in EUR’000) Dec 24 Sep 24 Sep 23 Sep 22 Sep 21

TotCompIncLoss 36 118 142 128 128 Quarterly Final Final Final Final

Fixed Ass 829 881 844 658 607 NetRent/InvInc 10 552 48 016 48 249 47 444 45 835

Inv & Loans 1 078 1 024 1 064 1 125 1 178 Total Inc 10 991 77 720 53 570 58 435 52 885

Tot Curr Ass 1 529 1 283 1 319 1 240 979 Attrib Inc 1 740 1 968 - 181 052 60 352 91 360

Ord SH Int 1 840 1 856 1 782 1 679 1 578 TotCompIncLoss 1 740 1 968 - 180 992 60 387 91 373

Minority Int 4 - - - - 1 Ord UntHs Int 340 443 318 367 316 400 514 300 467 975

LT Liab 947 1 052 1 106 783 949 FixedAss/Prop 865 412 860 964 989 014 1 030 959 944 020

Tot Curr Liab 936 649 729 871 637 Tot Curr Ass 18 655 58 285 33 861 126 131 78 850

PER SHARE STATISTICS (cents per share) Total Ass 906 089 945 382 1 030 179 1 181 815 1 093 303

HEPS-C (ZARc) 8.87 22.54 29.33 31.41 22.41 Tot Curr Liab 229 149 260 665 183 899 110 088 59 652

DPS (ZARc) - 10.00 10.00 9.00 11.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 417.00 424.00 406.00 385.00 363.00 HEPLU-C (ZARc) 71.68 2 029.09 - 3 730.56 1 472.32 1 666.62

3 Yr Beta - 0.14 - 0.45 - 0.03 0.43 0.66 DPLU (ZARc) - - - 247.62 666.42

Price High 240 265 270 245 200 NAV (ZARc) 17 756.60 19 631.37 19 829.70 25 878.88 23 255.02

Price Low 200 167 187 125 70 3 Yr Beta 2.69 2.39 - - -

Price Prd End 240 229 217 198 140 Price Prd End 15 600 15 600 12 000 2 428 1 605

RATIOS Price High 15 600 15 600 12 000 2 428 29 300

Ret on SH Fnd 4.17 5.43 7.59 7.41 7.87 Price Low 15 600 12 000 2 428 1 605 1 605

Oper Pft Mgn 6.29 7.12 8.55 8.33 8.14 RATIOS

D:E 0.69 0.63 0.70 0.61 0.70 RetOnSH Funds 2.04 0.62 - 57.22 11.73 19.52

Current Ratio 1.63 1.98 1.81 1.42 1.54 RetOnTotAss 4.85 8.22 5.20 4.94 4.84

Div Cover - 2.31 3.10 3.17 2.60 Debt:Equity 1.40 1.63 2.05 1.26 1.32

OperRetOnInv 4.88 5.58 4.88 4.60 4.86

OpInc:Turnover 59.70 62.01 60.52 63.78 65.79

106