Page 101 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 101

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – CHO

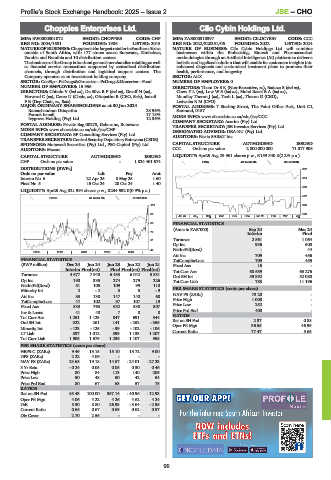

Choppies Enterprises Ltd. Cilo Cybin Holdings Ltd.

CHO CIL

ISIN: BW0000001072 SHORT: CHOPPIES CODE: CHP ISIN: ZAE000310397 SHORT: CILOCYBIN CODE: CCC

REG NO: 2004/1681 FOUNDED: 1986 LISTED: 2015 REG NO: 2022/320351/06 FOUNDED: 2022 LISTED: 2024

NATUREOF BUSINESS:Choppies isthelargestretailerinSouthernAfrica NATURE OF BUSINESS: Cilo Cybin Holdings Ltd. will combine

outside of South Africa, with 177 stores across Botswana, Zimbabwe, businesses within the Biohacking, Biotech and Pharmaceutical

Zambia and Namibia and 10 distribution centres. methodologies through an Artificial Intelligence (AI) platform to deliver a

The businessofthe Groupisfoodandgeneralmerchandiseretailing aswell holistic and legalised solution that will enable its customers insights into

as financial service transactions supported by centralised distribution enhanced diagnosis and customised treatment plans to promote their

channels, through distribution and logistical support centres. The health, performance, and longevity.

Company operates as an investment holding company. SECTOR: AltX

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 15 956 DIRECTORS: Tham Dr S K (Non-Executive, ne), Baduza S (ind ne),

DIRECTORS: Chitalu V (ind ne), De SilvaRP(ind ne), Graaff N (ne), ChewYL(ne), LowWS(ind ne), Mohd RazefBA(ind ne),

Harward C (ne), Corea U (Chair, ne), Ottapathu R (CEO, Bots), Ismail Moodley Theron J (ne), Teoh L (ne), Theron G (CEO),

F E (Dep Chair, ne, Bots) Ledwaba R M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 POSTAL ADDRESS: 7 Sterling Street, The Point Office Park, Unit C1,

Ramachandran Ottapathu 28.96% Samrand, 0157

Farouk Ismail 17.18% MORE INFO: www.sharedata.co.za/sdo/jse/CCC

Ivygrove Holding (Pty) Ltd. 12.36% COMPANY SECRETARY: Acorim (Pty) Ltd.

POSTAL ADDRESS: Private Bag 00278, Gaborone, Botswana TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/CHP DESIGNATED ADVISOR: DEA-RU (Pty) Ltd.

COMPANY SECRETARY: BP Consulting Services (Pty) Ltd. AUDITORS: Nexia SAB&T Inc.

TRANSFERSECRETARY: CentralSecurity DepositoryBotswana(CSDB)

SPONSORS: Motswedi Securities (Pty) Ltd., PSG Capital (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Mazars CCC Ords no par value 2 000 000 000 71 017 906

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Apr25 Avg 29 961 shares p.w., R159 340.8(2.2% p.a.)

CHP Ords no par value - 1 824 461 674 FINA 40 Week MA CILOCYBIN

DISTRIBUTIONS [BWPc] 967

Ords no par value Ldt Pay Amt

Interim No 6 22 Apr 25 8 May 25 1.60 814

Final No 5 15 Oct 24 28 Oct 24 1.40

660

LIQUIDITY: Apr25 Avg 321 994 shares p.w., R234 592.0(0.9% p.a.)

507

FOOR 40 Week MA CHOPPIES

110 353

98 200

| Jul 24 | Aug | Sep | Oct | Nov | Dec | Jan 25 | Feb | Mar | Apr

86 FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 24 Mar 24

73

Interim Final

Turnover 2 561 1 064

61

Op Inc 936 500

49 NetIntPd(Rcvd) - 44

2020 | 2021 | 2022 | 2023 | 2024 |

Att Inc 709 456

FINANCIAL STATISTICS TotCompIncLoss 709 455

(BWP million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Fixed Ass 16 -

Interim Final(rst) Final Final(rst) Final(rst) Tot Curr Ass 60 659 63 276

Turnover 4 677 7 940 6 433 6 042 5 331 Ord SH Int 59 892 52 080

Op Inc 190 335 274 279 226 Tot Curr Liab 783 11 196

NetIntPd(Rcvd) 51 105 109 99 110

Minority Int 2 - 2 3 5 - 9 PER SHARE STATISTICS (cents per share)

Att Inc 83 138 147 140 68 NAV PS (ZARc) 73.20 -

TotCompIncLoss 47 102 97 107 19 Price High 1 000 -

Fixed Ass 833 763 632 538 507 Price Low 252 -

Inv & Loans 41 40 7 8 8 Price Prd End 400 -

Tot Curr Ass 1 251 1 123 847 691 544 RATIOS

Ord SH Int 322 261 141 - 252 - 355 Ret on SH Fnd 2.37 0.88

Minority Int - 123 - 125 - 99 - 102 - 106 Oper Pft Mgn 36.55 46.99

LT Liab 837 1 012 899 1 133 1 207 Current Ratio 77.47 5.65

Tot Curr Liab 1 905 1 679 1 236 1 107 958

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 9.49 13.15 15.10 15.72 9.00

DPS (ZARc) 2.22 4.06 - - -

NAV PS (ZARc) 23.65 19.18 14.67 - 24.01 - 27.23

3 Yr Beta - 0.24 0.05 0.05 0.30 0.46

Price High 80 84 113 140 205

Price Low 50 48 50 42 54

Price Prd End 80 67 63 57 75

RATIOS

Ret on SH Fnd 85.43 100.00 357.14 - 40.96 - 12.93

Oper Pft Mgn 4.06 4.22 4.26 4.62 4.24

D:E 5.30 8.80 26.93 - 3.64 - 2.95

Current Ratio 0.66 0.67 0.69 0.62 0.57

Div Cover 2.70 2.56 - - -

99