Page 77 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 77

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – AFR

TELEPHONE: 011-779-1300

African Rainbow Minerals Ltd. COMPANY SECRETARY: Alyson D’Oyley

TRANSFER SECRETARY: Computershare Investor

AFR

Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: Deloitte, KPMG Inc.

BANKERS: ABSA Bank Ltd., FirstRand Bank Ltd.,

NedbankLtd.,StandardBankofSouthAfricaLtd.

Scan the QR code to

visit our website

SEGMENTAL REPORTING as at 31 Dec 24 (asa%of Sales)

Ferrous 63.33%

Platinum 30.93%

ISIN: ZAE000054045 SHORT: ARM CODE: ARI Coal 5.74%

REG NO: 1933/004580/06 FOUNDED: 1933 LISTED: 1988

CALENDAR Expected Status

NATURE OF BUSINESS: Next Final Results Sep 2025 Unconfirmed

ARMisaleadingdiversifiedSouthAfricanminingcompanywith Annual General Meeting Dec 2025 Unconfirmed

longlife assets in key commodities.ARM,its subsidiaries,joint

ventures, joint operations and associates explore, develop, Next Interim Results Mar 2026 Unconfirmed

operateandholdinterestsintheminingandmineralsindustry. CAPITAL STRUCTURE AUTHORISED ISSUED

The current operational focus is on platinum group metals ARI Ords 5c ea 500 000 000 224 667 778

(PGMs), base metals, ferrous metals and alloys, coal, iron ore, DISTRIBUTIONS [ZARc]

manganese ore and ferromanganese. ARM also has an invest- Ords 5c ea Ldt Pay Amt

ment in Harmony Gold Mining Company Ltd. Interim No 132 1 Apr 25 7 Apr 25 450.00

Final No 131 1 Oct 24 7 Oct 24 900.00

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining Interim No 130 2 Apr 24 8 Apr 24 600.00

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 Final No 129 3 Oct 23 9 Oct 23 1200.00

African Rainbow Minerals & Exploration Investments 40.02%

Government Employees Pension Fund 7.41% LIQUIDITY: Mar25 Avg 3m shares p.w., R563.0m(72.6% p.a.)

ARM Broad-Based Economic Empowerment Trust 7.08%

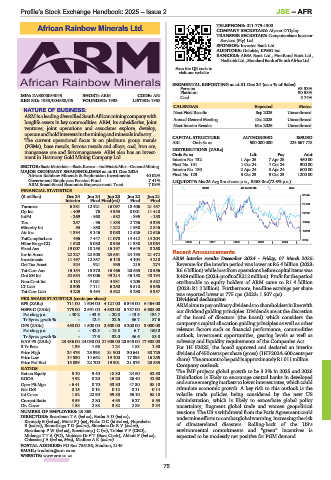

INDM 40 Week MA ARM

FINANCIAL STATISTICS

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 31545

Interim Final Final(rst) Final Final

27138

Turnover 6 381 12 921 16 097 18 406 21 457

Op Inc - 409 76 4 953 8 001 11 418

22732

IntPd - 269 - 868 - 582 - 395 - 158

Tax 257 - 96 1 833 2 736 3 333 18325

Minority Int 53 - 850 1 242 1 938 2 846

13918

Att Inc 1 394 3 146 8 080 12 426 12 626

TotCompIncLoss 496 7 447 11 070 14 412 14 204 9512

Hline Erngs-CO 1 520 5 080 8 983 11 338 13 064 2020 | 2021 | 2022 | 2023 | 2024 |

Fixed Ass 19 007 18 153 16 197 9 645 8 268 Recent Announcements

Inv in Assoc 22 227 22 808 23 661 24 193 21 472

Investments 11 497 12 857 6 148 4 104 4 210 ARM interim results December 2024 - Friday, 07 March 2025:

Def Tax Asset 924 921 935 215 274 Revenue for the interim period was lower at R6.4 billion (2023:

Tot Curr Ass 15 154 15 370 16 466 20 685 18 556 R6.6billion)whilelossfromoperationsbeforecapitalitemswas

Ord SH Int 52 654 54 006 49 214 46 158 40 194 R409million(2023:profitofR212million).Profitfortheperiod

Non-Cont Int 4 134 4 081 4 931 4 205 3 582 attributable to equity holders of ARM came to R1.4 billion

LT Liab 8 305 7 111 6 250 5 510 5 956 (2023: R1.2 billion). Furthermore, headline earnings per share

Tot Curr Liab 4 225 5 494 3 622 3 298 3 357 was reported lower at 775 cps (2023: 1 507 cps).

PER SHARE STATISTICS (cents per share) Dividend declaration

EPS (ZARc) 711.00 1 604.00 4 121.00 6 343.00 6 464.00 ARMaimstopayordinarydividends toshareholders inlinewith

HEPS-C (ZARc) 775.00 2 591.00 4 582.00 5 787.00 6 688.00 our dividend guiding principles. Dividends are at the discretion

Pct chng p.a. - 40.2 - 43.5 - 20.8 - 13.5 134.7 of the board of directors (the board) which considers the

Tr 5yr av grwth % - 12.4 22.6 36.7 87.6

DPS (ZARc) 450.00 1 500.00 2 600.00 3 200.00 3 000.00 company’s capital allocation guiding principles as well as other

Pct chng p.a. - - 42.3 - 18.8 6.7 150.0 relevant factors such as financial performance, commodities

Tr 5yr av grwth % - 17.6 32.0 46.6 83.0 outlook, investment opportunities, gearing levels as well as

NAV PS (ZARc) 23 436.00 24 038.00 21 905.00 20 545.00 17 908.00 solvency and liquidity requirements of the Companies Act.

3 Yr Beta 1.39 1.66 1.24 1.83 1.50 For 1H F2025, the board approved and declared an interim

Price High 24 476 23 998 31 900 30 641 30 725 dividendof450centspershare(gross)(1HF2024:600centsper

Price Low 14 830 14 662 19 100 17 895 16 255 share).TheamounttobepaidisapproximatelyR1011million.

Price Prd End 15 039 22 700 19 901 21 375 25 535 Company outlook

RATIOS The IMF projects global growth to be 3.3% in 2025 and 2026.

Ret on Equity 5.10 9.40 18.30 24.60 32.50 Disinflation is likely to encourage central banks in developed

ROOA 4.92 0.20 15.20 26.40 42.60

Oper Pft Mgn - 6.41 0.70 33.80 47.30 58.10 and some emerging markets to lower interest rates, which could

Net D:E 0.15 0.13 0.12 0.11 0.14 stimulate economic growth. A key risk to this outlook is the

Int Cover 1.52 22.90 39.80 56.10 58.10 volatile trade policies being considered by the new US

Current Ratio 3.59 2.80 4.55 6.27 5.53 administration, which is likely to exacerbate global policy

Div Cover 1.58 2.88 3.82 2.89 3.34 uncertainty, fragment global trade and worsen geopolitical

NUMBER OF EMPLOYEES: 23 369 tensions. The US’s withdrawal from the Paris Agreement could

DIRECTORS: BoardmanTA(ind ne), BothaAD(ind ne), undermineeffortstocombatglobalwarming,increasingtherisk

Kennedy B (ind ne), MnisiPJ(ne), NokoDC(ld ind ne), Nqwababa of climaterelated disasters. Rolling-back of the US’s

B(ind ne), RamuthagaTG(ind ne), Simelane DrRV(ind ne),

SteenkampPW(ind ne), SteenkampJC(ne), Tobias V P (CEO), environmental commitments and “green” incentives is

MhlangaTTA (FD), Motsepe Dr P T (Exec Chair), Abbott F (ind ne), expected to be modestly net positive for PGM demand.

ChissanoJA(ind ne, Moz), MaditseAK(ind ne)

POSTAL ADDRESS: PO Box 786136, Sandton, 2146

EMAIL: ir.admin@arm.co.za

WEBSITE: www.arm.co.za

75