Page 75 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 75

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – AFR

African and Overseas Enterprises Ltd. African Dawn Capital Ltd.

AFR AFR

ISIN: ZAE000000485 SHORT: AF & OVR CODE: AOO ISIN: ZAE000223194 SHORT: AFDAWN CODE: ADW

ISIN: ZAE000000493 SHORT: AF&OVR 6%PP CODE: AOVP REG NO: 1998/020520/06 FOUNDED: 1997 LISTED: 2004

ISIN: ZAE000009718 SHORT: AFOVR-N CODE: AON NATURE OF BUSINESS: African Dawn Capital Ltd. (the “Company” or

REG NO: 1947/027461/06 FOUNDED: 1947 LISTED: 1948 “Afdawn”) was formed in 1998 as a micro finance company which,

NATURE OF BUSINESS: African and Overseas Enterprises has been listed following its listing on the Alternative Exchange of the JSE in 2004, grew

on the JSE since 1948. The company has a controlling interest in Rex into a niche finance provider. The Group, through its wholly owned

Trueform and its group which has interests in the retailing of fashion subsidiaries,EliteandEliteTwo,providesunsecuredpersonalloans(micro

apparel, property and water infrastructure sectors. finance) and provides online consulting to entrepreneurs, investors and

SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers advisors through its online YueDiligence platform.

NUMBER OF EMPLOYEES: 0 SECTOR: AltX

DIRECTORS: NaylorPM(ld ind ne), Ntshingwa B (ind ne), Roberts NUMBER OF EMPLOYEES: 57

HB(ind ne), Molosiwa M R (Chair, ind ne), Golding M (CEO), DIRECTORS: BliedenSJ(ne), Stagman B (ld ind ne), Slabbert J (Chair),

Nel W D (FD) Hope G (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Geomer Investments (Pty) Ltd. 78.61% Arvesco 153 (Pty) Ltd. 36.46%

Ceejay Trust 10.45% Caleo Afdawn Limited Liability Partnership 17.32%

Gingko Investments 2 (Pty) Ltd. 4.75% Bus Ven Invest No 1499 (Pty) Ltd. 2.72%

POSTAL ADDRESS: PO Box 1856, Cape Town, 8000 POSTAL ADDRESS: PO Box 5455, Weltevreden Park, 1715

MORE INFO: www.sharedata.co.za/sdo/jse/AOO MORE INFO: www.sharedata.co.za/sdo/jse/ADW

COMPANY SECRETARY: Anita Gihwala COMPANY SECRETARY: Alun Rich (on behalf of Statucor (Pty) Ltd.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. DESIGNATED ADVISOR: PSG Capital (Pty) Ltd.

AUDITORS: PwC Inc. AUDITORS: Badenhorst Schalekamp and Associates Inc T/A CBS Group

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

AON NOrds 0.25c ea 80 000 000 10 221 921 ADW Ords 40c ea 125 000 000 73 511 608

AOO Ords no par value 10 000 000 1 618 750 LIQUIDITY: Apr25 Avg 39 328 shares p.w., R5 147.9(2.8% p.a.)

AOVP 6% Prefs 200c ea 275 000 275 000

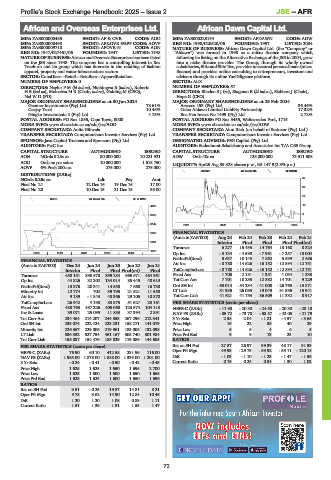

JS3021 40 Week MA AFDAWN

DISTRIBUTIONS [ZARc]

NOrds 0.25c ea Ldt Pay Amt 37

Final No 21 12 Dec 16 19 Dec 16 17.00

30

Final No 20 10 Dec 15 21 Dec 15 35.00

23

GERE 40 Week MA AF & OVR

4263 16

3705 8

1

3147

2021 | 2022 | 2023 | 2024

2589 FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

2031 Interim Final Final Final Final(rst)

Turnover 6 277 15 435 14 764 13 168 8 324

1473

2020 | 2021 | 2022 | 2023 | 2024 | Op Inc - 3 134 - 4 598 - 7 961 - 7 257 - 10 004

FINANCIAL STATISTICS NetIntPd(Rcvd) 5 637 10 143 7 862 5 539 2 686

(Amts in ZAR’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Att Inc - 8 780 - 14 626 - 16 152 - 12 894 - 12 751

Interim Final Final Final(rst) Final TotCompIncLoss - 8 780 - 14 626 - 16 152 - 12 894 - 12 751

Turnover 458 151 890 578 899 284 665 671 464 961 Fixed Ass 1 708 2 181 1 351 1 034 1 333

Op Inc 44 826 32 202 134 014 85 445 48 613 Tot Curr Ass 7 701 10 235 12 382 14 701 9 229

NetIntPd(Rcvd) 13 376 20 341 14 558 7 660 16 730 Ord SH Int - 63 014 - 54 234 - 41 008 - 26 765 - 13 871

Minority Int 12 774 702 39 795 21 521 11 550 LT Liab 31 935 26 085 19 049 31 536 15 941

Att Inc 9 189 - 1 843 48 366 29 105 10 870 Tot Curr Liab 41 621 41 753 36 509 11 332 8 917

TotCompIncLoss 26 942 4 198 83 875 51 627 23 161 PER SHARE STATISTICS (cents per share)

Fixed Ass 488 763 487 226 405 060 123 674 104 113 HEPS-C (ZARc) - 11.90 - 20.30 - 24.50 - 20.30 - 23.10

Inv & Loans 39 071 25 095 11 833 37 394 2 891 NAV PS (ZARc) - 85.72 - 73.78 - 58.57 - 42.05 - 21.79

Tot Curr Ass 234 464 214 207 244 353 267 296 212 341 3 Yr Beta 2.58 2.04 - 1.21 - 4.57 - 3.65

Ord SH Int 235 074 222 424 223 231 158 271 141 079 Price High 15 22 35 40 29

Minority Int 226 367 229 806 219 961 183 006 132 098 Price Low 5 5 4 6 5

LT Liab 536 332 527 754 461 167 305 740 301 984 Price Prd End 9 9 13 23 10

Tot Curr Liab 155 087 154 476 185 829 175 086 144 605 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 27.87 26.97 39.39 48.17 91.93

HEPS-C (ZARc) 76.90 60.10 412.58 231.96 116.00 Oper Pft Mgn - 49.93 - 29.79 - 53.92 - 55.11 - 120.18

NAV PS (ZARc) 1 985.00 1 878.00 1 888.00 1 339.00 1 201.00 D:E - 1.03 - 1.10 - 1.23 - 1.47 - 1.55

3 Yr Beta - 0.24 - 0.41 - 0.50 - 0.42 - 0.45 Current Ratio 0.19 0.25 0.34 1.30 1.03

Price High 1 625 1 625 1 650 1 696 2 700

Price Low 1 625 1 600 1 600 1 650 1 665

Price Prd End 1 625 1 625 1 600 1 650 1 696

RATIOS

Ret on SH Fnd 9.51 - 0.25 19.87 14.81 8.21

Oper Pft Mgn 9.78 3.62 14.90 12.84 10.46

D:E 1.20 1.20 1.08 0.89 1.11

Current Ratio 1.51 1.39 1.31 1.53 1.47

73