Page 189 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 189

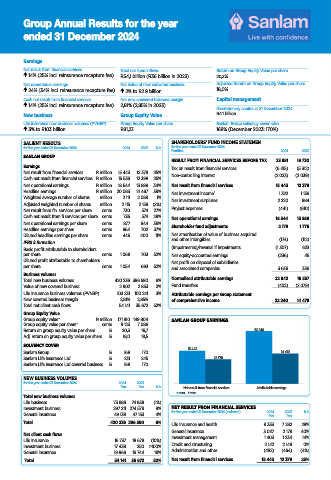

Group Annual Results for the year

ended 31 December 2024

Earnings

Net result from financial services Total net fund inflows Return on Group Equity Value per share

14% (25% incl. reinsurance recapture fee) R54,1 billion (R36 billion in 2023) 20,3%

Net operational earnings Net value of new convered business Adjusted Return on Group Equity Value per share

24% (34% incl. reinsurance recapture fee) 2% to R2.9 billion 18,0%

Cash net result from financial services Net new convered business margin Capital management

14% (25% incl. reinsurance recapture fee) 2,81% (2,85% in 2023)

Discretionary capital at 31 December 2024

New business Group Equity Value R4.1 billion

Life insurance new business volumes (PVNBP) Group Equity Value per share Sanlam Group solvency cover ratio

3% to R103 billion R81,23 168% (December 2023: 170%)

SALIENT RESULTS SHAREHOLDERS’ FUND INCOME STATEMEN

for the year ended 31 December 2024 2024 2023 % for the year ended 31 December 2024

R’million 2024 2023

SANLAM GROUP

RESULT FROM FINANCIAL SERVICES BEFORE TAX 23 881 19 730

Earnings Tax on result from financial services (6 415) (5 312)

Net result from financial services R million 15 443 12 379 25% Non-controlling interest (2 023) (2 039)

Cash net result from financial services R million 15 536 12 398 25%

Net operational earnings R million 18 544 13 889 34% Net result from financial services 15 443 12 379

Headline earnings R million 20 083 14 467 39% Net investment income` 1 322 1 136

Weighted average number of shares million 2 111 2 089 1% Net investment surpluses 2 220 984

Adjusted weighted number of shares million 2 115 2 158 (2%)

Net result from fin. services per share cents 730 574 27% Project expenses (441) (610)

Cash net result from fi.services per share cents 735 574 28% Net operational earnings 18 544 13 889

Net operational earnings per share cents 877 644 36% Shareholder fund adjustments 2 179 1 776

Headline earnings per share cents 964 702 37%

Diluted headline earnings per share cents 445 400 11% Net amortisation of value of business acquired (174) (112)

and other intangibles

IFRS information

Basic profit attributable to shareholders (Impairments)/reversal if impairments (1 307) 623

per share cents 1 068 703 52% Net equity-accounted earnings (236) 45

Diluted profit attributable to shareholders Net profit on disposal of subsidiaries

per share cents 1 054 693 52% and associated companies 3 636 336

Business volumes

Total new business volumes 420 236 396 590 6% Normalised attributable earnings 22 642 16 557

Value of new covered business 2 902 2 853 2% Fund transfers (402) (2 079)

Life insurance business volumes (PVNBP) 103 231 100 241 3% Attributable earnings per Group statement

New covered business margin 2,81% 2,85% of comprehensive income 22 240 14 478

Total net client cash flows 54 141 35 672 52%

Group Equity Value

Group equity value* R million 171 810 149 904 SANLAM GROUP EARNINGS

Group equity value per share* cents 8 123 7 086

Return on group equity value per share % 20,3 16,7 22 240

Adj. return on group equity value per share % 18,0 19,5

SOLVENCY COVER 15 443

Sanlam Group % 168 170 14 478

Sanlam Life Insurance Ltd % 231 245 12 379

Sanlam Life Insurance Ltd covered business % 168 170

NEW BUSINESS VOLUMES

for the year ended 31 December 2024 2024 2023

R’m R’m % Net result from financial services Attributable earnings

2024 2023

Total new business volumes

Life business 73 886 74 858 (1%)

Investment business 297 211 274 579 8% NET RESULT FROM FINANCIAL SERVICES

General insurance 49 139 47 153 4% for the year ended 31 December 2024 (reviewed) 2024 2023 %

R’m

R’m

Total 420 236 396 590 6% Life insurance and health 9 333 7 282 28%

General insurance 3 047 2 179 40%

Net client cash fl ows

Life insurance 16 737 18 678 (10%) Investment management 1 403 1 234 14%

Investment business 17 438 250 >100% Credit and structuring 2 142 2 148 0%

General insurance 19 966 16 744 19% Administration and other (482) (464) (4%)

Total 54 141 35 672 52% Net result from financial services 15 443 12 379 25%

08/05/2025 10:22:13

JSE R&E book AR2024 v20250508.indd 1

JSE R&E book AR2024 v20250508.indd 1 08/05/2025 10:22:13