Page 194 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 194

JSE – SHA Profile’s Stock Exchange Handbook: 2025 – Issue 2

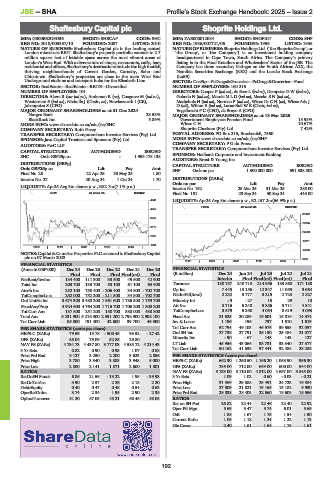

Shaftesbury Capital plc Shoprite Holdings Ltd.

SHA SHO

ISIN: GB00B62G9D36 SHORT: SHBCAP CODE: SHC ISIN: ZAE000012084 SHORT: SHOPRIT CODE: SHP

REG NO: 2010/003387/10 FOUNDED: 2007 LISTED: 2010 REG NO: 1936/007721/06 FOUNDED: 1936 LISTED: 1936

NATURE OF BUSINESS: Shaftesbury Capital plc is the leading central NATURE OF BUSINESS: Shoprite Holdings Ltd. (‘the Shoprite Group’, or

London mixed-use REIT. Shaftesbury’s property portfolio extends to 2.7 ‘the Group’, or ‘the Company’) is an investment holding company

million square feet of lettable space across the most vibrant areas of headquartered in Cape Town, South Africa. The Company’s primary

London’s West End. With a diverse mix of shops, restaurants, cafés, bars, listing is in the Food Retailers and Wholesalers’ Sector of the JSE. The

residential and offices, Shaftesbury’s destinations include the high footfall, Company has three secondary listings: on the South African A2X, the

thriving neighbourhoods of Covent Garden, Carnaby, Soho and Namibia Securities Exchange (NSX) and the Lusaka Stock Exchange

Chinatown. Shaftesbury’s properties are close to the main West End (LuSE).

Underground stations and transport hubs for the Elizabeth Line. SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

SECTOR: RealEstate—RealEstate—REITS—Diversified NUMBER OF EMPLOYEES: 160 216

NUMBER OF EMPLOYEES: 101 DIRECTORS: Cooper P (ind ne), de Beer L (ind ne), Dempster G W (ind ne),

DIRECTORS: Akers R (snr ind ne), Anderson R (ne), Cosgrave M (ind ne), Gobodo N (ind ne), Marole M L D (ind ne), Maseko S N (ind ne),

Westerman S (ind ne), Nicholls J (Chair, ne), Hawksworth I (CE), Mathebula H (ind ne), Norman P (ind ne), Wiese Dr C H (ne), Wiese Adv J

Jobanputra S (CFO) D(alt), Wilton E (ind ne), Lucas-Bull W E (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 Engelbrecht P C (CEO), de Bruyn A (CFO)

Norges Bank 23.53% MAJOR ORDINARY SHAREHOLDERS as at 18 Mar 2025

BlackRock Inc. 5.89% Government Employees Pension Fund 15.93%

MORE INFO: www.sharedata.co.za/sdo/jse/SHC Wiese C H 10.67%

COMPANY SECRETARY: Ruth Pavey Shoprite Checkers (Pty) Ltd. 7.42%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 215, Brackenfell, 7560

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/SHP

AUDITORS: PwC LLP COMPANY SECRETARY: P G du Preez

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Nedbank Corporate and Investment Banking

SHC Ords GBP25p ea - 1 953 178 138

AUDITORS: Ernst & Young Inc.

DISTRIBUTIONS [GBPp] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords GBP25p ea Ldt Pay Amt SHP Ords no par 1 300 000 000 591 338 502

Final No 28 22 Apr 25 30 May 25 1.80

Interim No 27 20 Aug 24 1 Oct 24 1.70 DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

LIQUIDITY: Apr25 Avg 3m shares p.w., R82.7m(7.1% p.a.)

Interim No 152 25 Mar 25 31 Mar 25 285.00

REIV 40 Week MA SHBCAP Final No 151 23 Sep 24 30 Sep 24 445.00

4941 LIQUIDITY: Apr25 Avg 8m shares p.w., R2 157.2m(66.9% p.a.)

FOOR 40 Week MA SHOPRIT

4352

31452

3762

27005

3173

22558

2583

18111

1994

2020 | 2021 | 2022 | 2023 | 2024 |

13664

NOTES: Capital & Counties Properties PLC renamed to Shaftesbury Capital

plc on 07 March 2023. 9217

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

(Amts in GBP’000) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 FINANCIAL STATISTICS

Final Final Final Final(rst) Final (R million) Dec 24 Jun 24 Jul 23 Jul 22 Jul 21

NetRent/InvInc 184 400 111 300 33 500 49 500 42 900 Interim Final Final(rst) Final(rst) Final

Total Inc 203 700 133 700 53 100 61 100 63 900 Turnover 130 757 240 718 214 956 183 868 171 188

Attrib Inc 252 100 750 400 - 206 400 34 800 - 702 700 Op Inc 7 445 13 156 12 347 11 055 9 664

TotCompIncLoss 252 000 752 200 - 211 800 34 800 - 702 700 NetIntPd(Rcvd) 2 232 3 777 3 215 2 723 2 827

Ord UntHs Int 3 674 300 3 480 200 1 561 600 1 786 800 1 759 700 Minority Int - 9 - 27 15 29 18

FixedAss/Prop 4 924 600 4 764 200 1 715 700 1 706 200 1 800 200 Att Inc 3 716 6 248 5 886 5 711 4 841

Tot Curr Ass 157 800 251 200 150 700 380 000 430 800 TotCompIncLoss 3 579 5 350 4 054 8 619 4 093

Total Ass 5 231 900 5 216 300 2 351 200 2 798 900 2 908 100 Fixed Ass 21 625 20 289 16 601 16 816 14 374

Tot Curr Liab 85 300 191 400 42 600 39 700 46 900 Inv & Loans 1 196 196 797 1 510 1 619

Tot Curr Ass 52 794 49 103 46 576 39 553 32 057

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 79.59 13.78 - 500.45 93.52 - 27.42 Ord SH Int 27 738 27 791 26 130 25 484 21 077

143

- 67

- 90

148

127

DPS (ZARc) 85.04 75.09 52.85 29.80 - Minority Int 45 956 43 066 38 731 33 340 27 577

LT Liab

NAV PS (ZARc) 4 734.73 4 437.80 3 777.03 4 585.72 4 214.43

3 Yr Beta 0.82 0.90 0.93 1.07 0.88 Tot Curr Liab 50 162 41 538 37 441 32 488 28 285

Price Prd End 3 127 3 250 2 200 3 623 2 856 PER SHARE STATISTICS (cents per share)

Price High 3 780 3 340 3 883 3 948 5 000 HEPS-C (ZARc) 662.30 1 250.50 1 166.20 1 063.90 956.30

Price Low 2 800 2 141 1 871 2 600 1 801 DPS (ZARc) 285.00 712.00 663.00 600.00 544.00

RATIOS NAV PS (ZARc) 5 133.00 5 110.00 4 812.00 4 697.00 3 845.00

RetOnSH Funds 6.86 21.56 - 13.22 1.95 - 39.93 3 Yr Beta 1.09 1.02 0.60 - 0.03 - 0.21

RetOnTotAss 3.90 2.57 2.26 2.18 2.20 Price High 31 569 29 588 25 491 24 723 16 384

Debt:Equity 0.40 0.47 0.48 0.54 0.63 Price Low 27 809 21 821 19 165 15 182 9 930

OperRetOnInv 3.74 2.34 1.95 2.90 2.38 Price Prd End 29 838 28 403 22 560 19 609 15 556

OpInc:Turnover 81.20 57.05 45.21 68.46 58.05 RATIOS

Ret on SH Fnd 26.82 22.44 22.46 22.40 22.92

Oper Pft Mgn 5.69 5.47 5.74 6.01 5.65

D:E 1.88 1.67 1.75 1.54 1.50

Current Ratio 1.05 1.18 1.24 1.22 1.13

Div Cover 2.40 1.61 1.64 1.75 1.61

192