Page 196 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 196

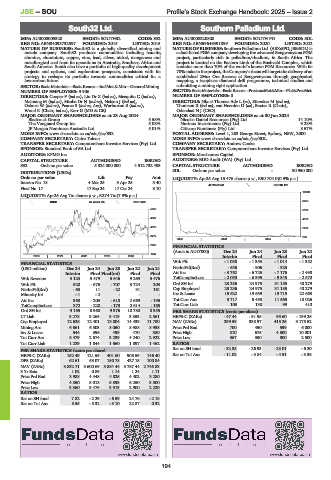

JSE – SOU Profile’s Stock Exchange Handbook: 2025 – Issue 2

South32 Ltd. Southern Palladium Ltd.

SOU SOU

ISIN: AU000000S320 SHORT: SOUTH32 CODE: S32 ISIN: AU0000220808 SHORT: SOUTH PD CODE: SDL

REG NO: ABN84093732597 FOUNDED: 2015 LISTED: 2015 REG NO: ABN59646391899 FOUNDED: 2020 LISTED: 2022

NATURE OF BUSINESS: South32 is a globally diversified mining and NATURE OF BUSINESS: Southern Palladium Ltd. (ASX:SPD, JSE:SDL) is

metals company. South32 produces commodities including bauxite, a dual-listed PGM company developing the advanced Bengwenyama PGM

alumina, aluminium, copper, zinc, lead, silver, nickel, manganese and project, particularly rich in palladium/rhodium, in South Africa. The

metallurgical coal from its operations in Australia, Southern Africa and project is located on the Eastern Limb of the Bushveld Complex, which

South America. South also have a portfolio of high-quality development contains more than 70% of the world’s known PGM Resources. With its

projects and options, and exploration prospects, consistent with its 70% stake in the project, the Company’s focus will target the delivery of an

strategy to reshape its portfolio towards commodities critical for a established 2Moz Ore Reserve at Bengwenyama through geophysical

low-carbon future. mapping, a twophase diamond drill programme, technical studies and

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining submitting a mining right application.

NUMBER OF EMPLOYEES: 9 906 SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet

DIRECTORS: Cooper F (ind ne), Liu Dr X (ind ne), Mesquita C (ind ne), NUMBER OF EMPLOYEES: 0

Msimang M (ind ne), Mtoba Dr N (ind ne), Nelson J (ind ne), DIRECTORS: Nkosi-Thomas Adv L (ne), Stirzaker M (ind ne),

Osborn W (ind ne), Pearce S (ind ne, Aus), Warburton S (ind ne), Thomson R (ind ne), van Heerden D (ne), Baxter R (Chair),

Wood K (Chair, ind ne), Kerr G (MD & CE) Odendaal N J (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 23 Aug 2024 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Blackrock Group 5.58% Nicolas Daniel Resources (Pty) Ltd. 14.10%

The Vanguard Group Inc. 5.08% Nurinox Investments (Pty) Ltd. 9.28%

JP Morgan Nominees Australia Ltd. 5.01% Citicorp Nominees (Pty) Ltd. 8.57%

MORE INFO: www.sharedata.co.za/sdo/jse/S32 POSTAL ADDRESS: Level 1, 283 George Street, Sydney, NSW, 2000

COMPANY SECRETARY: Claire Tolcon MORE INFO: www.sharedata.co.za/sdo/jse/SDL

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Andrew Cooke

SPONSOR: Standard Bank of SA Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: KPMG Inc. SPONSOR: Merchantec Capital

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: BDO Audit (WA) (Pty) Ltd.

S32 Ords no par value 5 324 000 000 4 512 732 493 CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [USDc] SDL Ords no par value - 90 950 000

Ords no par value Ldt Pay Amt LIQUIDITY: Apr25 Avg 15 476 shares p.w., R90 704.0(0.9% p.a.)

Interim No 18 4 Mar 25 3 Apr 25 3.40

40 Week MA SOUTH PD

Final No 17 17 Sep 24 17 Oct 24 3.10

10000

LIQUIDITY: Apr25 Avg 7m shares p.w., R274.7m(7.9% p.a.)

INDM 40 Week MA SOUTH32 8053

5860 6106

4997 4160

4135 2213

3272 266

2022 | 2023 | 2024 |

2409

FINANCIAL STATISTICS

(Amts in AUD’000) Dec 24 Jun 24 Jun 23 Jun 22

1547

2020 | 2021 | 2022 | 2023 | 2024 | Interim Final Final Final

Wrk Pft - 1 038 - 1 353 - 1 014 - 1 352

FINANCIAL STATISTICS

(USD million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 NetIntPd(Rcd) - 536 - 906 - 325 -

Interim Final Final(rst) Final Final Att Inc - 3 762 - 6 725 - 7 176 - 2 498

Wrk Revenue 3 123 5 479 5 646 9 269 5 476 TotCompIncLoss - 2 053 - 6 395 - 9 345 - 2 570

Wrk Pft 520 - 676 - 707 3 724 203 Ord SH Int 23 236 24 975 31 185 40 279

NetIntPd(Rcd) - 63 11 - 22 31 161 Cap Employed 23 236 24 975 31 185 40 279

Minority Int - 1 - 2 - - - Inv & Loans 19 622 19 659 19 719 22 663

Att Inc 360 - 203 - 618 2 669 - 195 Tot Curr Ass 3 717 5 453 11 565 18 026

TotCompIncLoss 372 - 228 - 173 2 614 - 165 Tot Curr Liab 103 138 99 410

Ord SH Int 9 165 8 960 9 376 10 780 8 955 PER SHARE STATISTICS (cents per share)

LT Liab 3 278 3 265 3 419 3 353 2 561 HEPS-C (ZARc) - 47.44 - 91.95 95.60 - 199.26

Cap Employed 12 626 12 401 13 004 14 439 11 780 NAV (ZARc) 299.59 338.97 415.26 3 175.52

Mining Ass 6 661 6 503 8 050 8 988 8 938 Price Prd End 700 450 599 6 000

Inv & Loans 544 396 499 470 380 Price High 810 675 4 500 10 001

Tot Curr Ass 3 479 2 574 3 239 4 240 2 922 Price Low 367 350 500 2 500

Tot Curr Liab 1 229 1 844 1 560 1 897 1 462 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH fund - 32.38 - 26.93 - 23.01 - 6.20

HEPS-C (ZARc) 152.49 121.55 401.60 905.59 146.40 Ret on Tot Ass - 11.02 - 3.84 - 4.51 - 3.36

DPS (ZARc) 62.61 63.07 150.78 427.15 100.84

NAV (ZARc) 3 832.71 3 600.69 3 884.44 3 787.44 2 746.83

3 Yr Beta 1.02 0.89 1.14 1.24 1.11

Price Prd End 3 988 4 448 4 825 4 402 3 280

Price High 4 850 5 018 5 893 6 250 3 500

Price Low 3 360 3 479 3 913 2 900 2 220

RATIOS

Ret on SH fund 7.82 - 2.29 - 6.59 24.76 - 2.18

Ret on Tot Ass 8.55 - 5.32 - 3.10 22.87 0.32

194