Page 201 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 201

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – STE

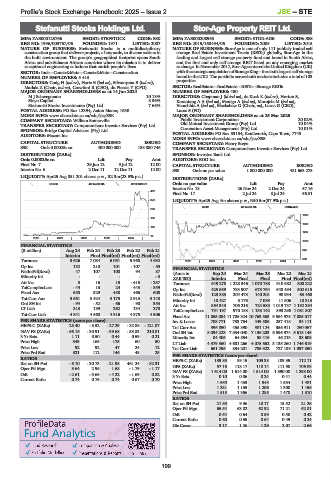

Stefanutti Stocks Holdings Ltd. Stor-Age Property REIT Ltd.

STE STO

ISIN: ZAE000123766 SHORT: STEFSTOCK CODE: SSK ISIN: ZAE000208963 SHORT: STOR-AGE CODE: SSS

REG NO: 1996/003767/06 FOUNDED: 1971 LISTED: 2007 REG NO: 2015/168454/06 FOUNDED: 2005 LISTED: 2015

NATURE OF BUSINESS: Stefanutti Stocks is a multidisciplinary NATURE OF BUSINESS: Stor-Age is one of only 111 publicly traded self

construction group that delivers projects, of any scale, to diverse sectors in storage Real Estate Investment Trusts (REITs) globally, Stor-Age is the

the built environment. The group’s geographical footprint spans South leading and largest self storage property fund and brand in South Africa,

Africa and sub-Saharan African countries where its mission is to deliver and the first and only self storage REIT listed on any emerging market

exceptional engineering solutions that enrich people’s lives. exchange. In November 2017, Stor-Age entered the United Kingdom (UK)

SECTOR: Inds—Constr&Mats—Constr&Mats—Construction with the strategic acquisition ofStorage King–the sixth largestselfstorage

NUMBER OF EMPLOYEES: 5 413 brand in the UK2. The portfolio across both markets includes a total of 103

DIRECTORS: Craig H (ind ne), Harie B (ind ne), Silwanyana B (ind ne), properties.

Matlala Z (Chair, ind ne), Crawford R (CEO), du Plessis Y (CFO) SECTOR: RealEstate—RealEstate—REITs—Storage REITs

MAJOR ORDINARY SHAREHOLDERS as at 14 Jun 2024 NUMBER OF EMPLOYEES: 480

M J Schwegmann 10.18% DIRECTORS: Chapman J (ld ind ne), de Kock K (ind ne), Horton S,

Steyn Capital 8.36% KorantengAA(ind ne), Menigo A (ind ne), Morojele M (ind ne),

Stefanutti Stocks Investments (Pty) Ltd. 7.66% Varachhia A (ind ne), Blackshaw G (Chair, ne), Lucas G (CEO),

POSTAL ADDRESS: PO Box 12394, Aston Manor, 1630 Lucas S (FD)

MORE INFO: www.sharedata.co.za/sdo/jse/SSK MAJOR ORDINARY SHAREHOLDERS as at 25 Mar 2025

COMPANY SECRETARY: William Somerville Public Investment Corporation 20.02%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Old Mutual Investment Group (Pty) Ltd. 10.04%

Coronation Asset Management (Pty) Ltd.

10.01%

SPONSOR: Bridge Capital Advisors (Pty) Ltd.

AUDITORS: Mazars Inc. POSTAL ADDRESS: PO Box 53154, Kenilworth, Cape Town, 7745

MORE INFO: www.sharedata.co.za/sdo/jse/SSS

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Henry Steyn

SSK Ords 0.00025c ea 400 000 000 188 080 746 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] SPONSOR: Investec Bank Ltd.

Ords 0.00025c ea Ldt Pay Amt AUDITORS: BDO Inc.

Final No 7 29 Jun 12 9 Jul 12 12.00 CAPITAL STRUCTURE AUTHORISED ISSUED

Interim No 6 2 Dec 11 12 Dec 11 12.00 SSS Ords no par value 1 000 000 000 481 663 273

LIQUIDITY: Apr25 Avg 851 201 shares p.w., R2.3m(23.5% p.a.) DISTRIBUTIONS [ZARc]

CONM 40 Week MA STEFSTOCK Ords no par value Ldt Pay Amt

Interim No 18 26 Nov 24 2 Dec 24 57.16

467

FinalNo 17 2 Jul24 8 Jul24 56.81

376 LIQUIDITY: Apr25 Avg 4m shares p.w., R50.5m(37.9% p.a.)

REIV 40 Week MA STOR-AGE

286

1589

195

1398

105

1207

14

2020 | 2021 | 2022 | 2023 | 2024 |

1016

FINANCIAL STATISTICS

(R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 825

Interim Final Final(rst) Final(rst) Final(rst)

Turnover 3 626 7 084 6 051 5 968 4 692 2020 | 2021 | 2022 | 2023 | 2024 | 633

Op Inc 132 210 101 - 107 - 55 FINANCIAL STATISTICS

NetIntPd(Rcvd) 47 107 100 94 87 (Amts in Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Minority Int - - - - - 3 ZAR’000) Interim Final Final Final Final(rst)

Att Inc 3 16 15 - 415 - 287 Turnover 649 278 1 228 346 1 070 788 910 682 800 222

TotCompIncLoss - 44 13 24 - 443 - 359 Op Inc 425 569 783 907 673 764 648 494 502 615

Fixed Ass 658 529 458 466 608 NetIntPd(Rcvd) 123 383 204 478 140 201 90 934 63 468

Tot Curr Ass 3 561 3 424 3 175 2 913 3 148 Minority Int 10 427 5 176 7 083 11 506 10 313

Ord SH Int - 94 - 52 - 66 - 90 353 Att Inc 864 343 706 216 724 583 1 019 737 1 192 294

LT Liab 213 189 262 134 270 TotCompIncLoss 751 197 970 188 1 133 142 893 290 1 081 807

Tot Curr Liab 4 841 4 560 4 316 4 375 4 506

Fixed Ass 11 855 084 11 706 324 10 763 563 9 554 975 7 885 017

PER SHARE STATISTICS (cents per share) Inv & Loans 708 771 733 754 449 586 257 418 34 111

HEPS-C (ZARc) 28.40 - 5.52 - 27.29 - 82.88 - 121.87 Tot Curr Ass 396 850 455 390 501 124 356 911 260 067

NAV PS (ZARc) - 56.16 - 30.91 - 39.68 - 53.83 210.81 Ord SH Int 8 034 228 7 534 040 7 136 203 6 596 974 5 618 145

3 Yr Beta 1.11 0.50 0.44 0.59 0.21 Minority Int 84 406 64 554 58 416 46 213 38 608

Price High 343 165 175 60 50 LT Liab 4 379 560 4 681 266 4 075 662 3 135 260 1 746 619

Price Low 92 92 47 24 12 Tot Curr Liab 661 296 834 201 785 922 727 189 1 097 850

Price Prd End 321 112 146 48 25 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 139.85 89.15 105.38 109.35 112.11

Ret on SH Fnd - 6.10 - 30.73 - 21.98 461.24 - 82.31 DPS (ZARc) 57.16 118.17 118.14 111.90 106.08

Oper Pft Mgn 3.64 2.96 1.68 - 1.79 - 1.17 NAV PS (ZARc) 1 614.00 1 614.00 1 514.00 1 390.00 1 298.00

D:E - 2.61 - 3.65 - 4.22 - 1.69 0.82 3 Yr Beta 0.10 0.06 0.24 0.41 0.44

Current Ratio 0.74 0.75 0.74 0.67 0.70

Price High 1 550 1 433 1 548 1 534 1 481

Price Low 1 231 1 135 1 206 1 300 1 156

Price Prd End 1 515 1 356 1 285 1 478 1 310

RATIOS

Ret on SH Fnd 21.55 9.36 10.17 15.52 21.26

Oper Pft Mgn 65.54 63.82 62.92 71.21 62.81

D:E 0.54 0.64 0.59 0.50 0.42

Current Ratio 0.60 0.55 0.64 0.49 0.24

Div Cover 3.17 1.26 1.29 2.07 2.66

199