Page 185 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 185

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – SAB

Sabvest Capital Ltd.

SAB

ISIN: ZAE000283511 SHORT: SABCAP CODE: SBP

REG NO: 2020/030059/06 FOUNDED: 2020 LISTED: 2020

NATURE OF BUSINESS: Sabcap is an investment group first listed on the

JSEin1988 asSabvestLtd.andasSabcap from2020. The Seabrooke Family

Trust (“SFT”) has voting control of Sabcap through an unlisted Z share and

has an economic interest of 41,7% through its holding in the listed

ordinary shares. At the year-end Sabcap had 38 370 000 shares in issue net

of treasury shares (2023: 39 220 000).

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

NUMBER OF EMPLOYEES: 0

DIRECTORS: Ighodaro O (ld ind ne), MthimunyeLE(ind ne), Rood L,

ShongweBJT(ind ne), Pillay K (Chair, ind ne), Seabrooke C S (CEO),

De Matteis K (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

The Seabrooke Family Trust 41.70%

InsingerGilissen Bankiers NV 7.50%

Nedgroup Securities (Pty) Ltd. 5.50%

POSTAL ADDRESS: PO Box 78677, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/SBP

COMPANY SECRETARY: Levitt Kirson Business Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

SBP Ords no par value 500 000 000 38 370 000

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 10 8 Apr 25 14 Apr 25 70.00

Interim No 9 10 Sep 24 16 Sep 24 35.00

LIQUIDITY: Apr25 Avg 45 128 shares p.w., R3.4m(6.1% p.a.)

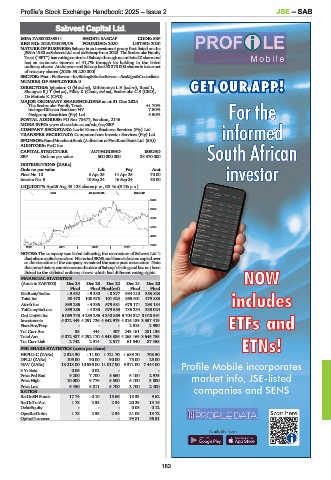

EQII 40 Week MA SABCAP

9400

8052

6704

5356

4008

2660

2020 | 2021 | 2022 | 2023 |

NOTES: The company was listed following the restructure of Sabvest Ltd.’s

dualsharecapitalstructure.HistoricalSENSandfinancialswerecopiedover

as the structure of the company remained the same post restructure. Note

that price history commencesat the date of Sabcap’slisting and hasnot been

linked to the delisted ordinary shares which had different voting rights.

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Final Final Final(rst) Final Final

NetRent/InvInc - 9 532 - 9 330 - 8 377 594 210 353 823

Total Inc 90 470 100 673 101 624 865 601 479 883

Attrib Inc 899 286 - 4 335 679 581 679 171 293 184

TotCompIncLoss 899 286 - 4 335 679 553 735 234 338 024

Ord UntHs Int 5 069 745 4 289 256 4 340 869 3 704 327 3 048 991

Investments 5 072 449 4 291 726 4 342 979 4 016 189 3 357 419

FixedAss/Prop - - - 2 515 2 990

Tot Curr Ass 38 444 407 243 161 281 136

Total Ass 5 072 487 4 292 170 4 343 386 4 265 169 3 645 755

Tot Curr Liab 2 742 2 914 2 517 61 540 87 458

PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) 2 324.30 - 11.00 1 721.70 1 689.70 708.50

DPLU (ZARc) 105.00 90.00 90.00 75.00 25.00

NAV (ZARc) 13 213.00 10 936.00 11 017.00 9 371.00 7 444.00

3 Yr Beta 0.05 0.02 - - -

Price Prd End 9 200 7 700 8 360 6 100 2 975

Price High 10 000 9 779 8 500 6 100 3 800

Price Low 6 450 6 011 5 700 2 700 2 400

RATIOS

RetOnSH Funds 17.74 - 0.10 15.66 18.33 9.62

RetOnTotAss 1.78 2.35 2.34 20.29 13.16

Debt:Equity - - - 0.08 0.12

OperRetOnInv 1.78 2.35 2.34 21.08 13.72

OpInc:Turnover - - - 99.81 96.51

183