Page 168 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 168

JSE – POW Profile’s Stock Exchange Handbook: 2025 – Issue 2

Powerfleet Inc. PPC Ltd.

POW PPC

ISIN: US73931J1097 SHORT: POWER CODE: PWR ISIN: ZAE000170049 SHORT: PPC CODE: PPC

REG NO: 7272486 FOUNDED: 2019 LISTED: 2024 REG NO: 1892/000667/06 FOUNDED: 1892 LISTED: 1910

NATURE OF BUSINESS: Powerfleet is a global leader of NATURE OF BUSINESS: PPC Ltd., its subsidiaries and equity-accounted

Internet-of-Things (“IoT”) solutions providing valuable business investments operate in Africa as producers of cement, aggregates,

intelligence for managing high-value enterprise assets that improve readymix and fly ash.

operational efficiencies. SECTOR: Inds—Constr&Mats—Constr&Mats—Cement

Powerfleet is headquartered in Woodcliff Lake, New Jersey, with offices NUMBER OF EMPLOYEES: 0

located around the globe. DIRECTORS: Gobodo N (ind ne), HansenBM(ne), Maphisa K (ne),

SECTOR:Telecoms—Telecoms—TelecomEquipment—TelecomEquipment MkhondoNL(ind ne), NaudeCH(ind ne), SmithDL(ne),

NUMBER OF EMPLOYEES: 0 Thompson M (ind ne), Moleketi P J (Chair, ind ne), Cardarelli M (CEO),

DIRECTORS: Jacobs I (ind ne, USA), Martin A (ind ne), McConnell Berlin B (Group CFO)

M(ind ne, USA), Brodsky M (Chair, ind ne, USA), Towe S (CEO, UK) MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

MAJOR ORDINARY SHAREHOLDERS as at 25 Mar 2024 Value Capital Partners 15.85%

ABRY Senior Equity Holdings V, LLC 18.07% M&G Investments 14.11%

Cannell Capital, LLC 15.22% Camissa Asset Management (Pty) Ltd. 10.28%

Lynrock Lake LP 9.69% POSTAL ADDRESS: PO Box 787416, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/PWR MORE INFO: www.sharedata.co.za/sdo/jse/PPC

COMPANY SECRETARY: David Wilson COMPANY SECRETARY: Kevin Ross

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: Ernst & Young LLP AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

PWR Ords USD0.01 ea - 133 926 955 PPC Ords no par value 10 000 000 000 1 553 764 624

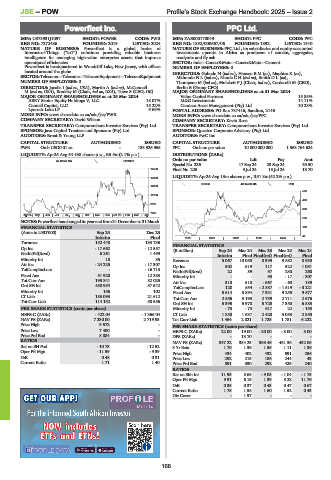

LIQUIDITY: Apr25 Avg 54 438 shares p.w., R5.5m(2.1% p.a.) DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

40 Week MA POWER

Special No 226 17 Sep 24 23 Sep 24 33.50

15500

Final No 225 9 Jul 24 15 Jul 24 13.70

13900 LIQUIDITY: Apr25 Avg 13m shares p.w., R51.8m(42.2% p.a.)

CONM 40 Week MA PPC

12300

573

10700

468

9100

363

7500

Apr 24 | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |Jan 25 | Feb | Mar | Apr

258

NOTES:Powerfleethaschangeditsyearendfrom31December to31March.

FINANCIAL STATISTICS 153

(Amts in USD’000) Sep 24 Dec 23

Interim Final 2020 | 2021 | 2022 | 2023 | 2024 | 48

Turnover 152 448 133 736 FINANCIAL STATISTICS

Op Inc - 17 662 - 12 557 (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

NetIntPd(Rcvd) 6 261 1 499 Interim Final Final(rst) Final(rst) Final

Minority Int 18 35 Revenue 5 067 10 058 8 399 9 882 8 938

AttInc -24225 -17307 Op Inc 502 619 117 522 1 051

TotCompIncLoss - - 16 713 NetIntPd(Rcvd) 22 89 97 230 268

Fixed Ass 51 928 12 383 Minority Int - - 93 - 17 - 307

Tot Curr Ass 195 341 82 025

Att Inc 318 510 - 667 - 60 189

Ord SH Int 450 954 57 542 TotCompIncLoss 120 554 - 2 887 - 1 519 - 3 221

Minority Int 156 102 Fixed Ass 5 614 5 894 7 331 9 255 9 577

LT Liab 183 093 21 612 Tot Curr Ass 2 556 3 193 2 759 2 711 2 676

Tot Curr Liab 114 132 58 556 Ord SH Int 5 395 5 970 5 725 7 350 6 883

PER SHARE STATISTICS (cents per share) Minority Int - 73 - 73 617 22 - 153

HEPS-C (ZARc) - 422.04 - 1 366.04 LT Liab 1 850 1 637 2 420 3 053 2 855

NAV PS (ZARc) 7 230.00 2 719.93 Tot Curr Liab 1 464 2 021 1 725 1 781 6 222

Price High 9 672 - PER SHARE STATISTICS (cents per share)

Price Low 7 400 - HEPS-C (ZARc) 22.00 19.00 - 20.00 - 3.00 3.00

Price Prd End 8 884 - DPS (ZARc) - 13.70 - - -

RATIOS NAV PS (ZARc) 347.22 384.23 368.46 461.36 432.05

Ret on SH Fnd - 10.73 - 12.52 3 Yr Beta 1.70 1.36 1.55 1.11 1.36

Oper Pft Mgn - 11.59 - 9.39 Price High 434 402 432 591 256

D:E 0.48 0.31 Price Low 292 215 186 244 43

Current Ratio 1.71 1.40

Price Prd End 391 330 292 425 240

RATIOS

Ret on Shh Int 11.95 8.65 - 9.05 - 1.04 - 1.75

Oper Pft Mgn 9.91 6.15 1.39 5.28 11.76

D:E 0.35 0.37 0.43 0.47 0.67

Current Ratio 1.75 1.58 1.60 1.52 0.43

Div Cover - 1.97 - - -

166