Page 164 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 164

JSE – OMN Profile’s Stock Exchange Handbook: 2025 – Issue 2

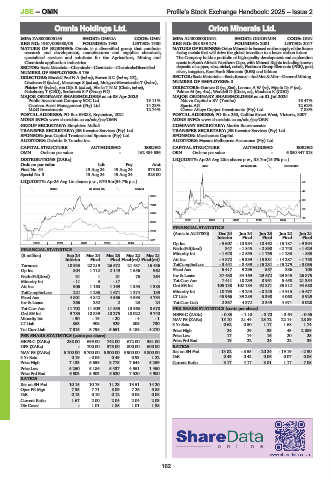

Omnia Holdings Ltd. Orion Minerals Ltd.

OMN ORI

ISIN: ZAE000005153 SHORT: OMNIA CODE: OMN ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN

REG NO: 1967/003680/06 FOUNDED: 1953 LISTED: 1980 REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017

NATURE OF BUSINESS: Omnia is a diversified group that conducts NATURE OF BUSINESS: OrionMineralsisfocusedonthe supply of the future

research and development, manufactures and supplies chemicals, facing metals that will drive the global transition to a lower carbon future.

specialised services and solutions for the Agriculture, Mining and The Company holds a portfolio of high-quality development and exploration

Chemicals application industries. assets in South Africa’s Northern Cape, with Mineral Rights including known

SECTOR: Basic Materials—Chemicals—Chemicals—Chemicals:Diversified deposits of copper, zinc, nickel, cobalt, Platinum Group Elements (PGE), gold,

NUMBER OF EMPLOYEES: 3 756 silver, tungsten, Rare Earth Elements (REE) and lithium.

DIRECTORS: Binedell Prof N A (ind ne), Bowen R C (ind ne, UK), SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

Cavaleros G (ind ne), MncwangoS(ind ne), Mokgosi-Mwantembe T (ind ne), NUMBER OF EMPLOYEES: 0

Plaizier W (ind ne), van Dijk R (ind ne), Eboka T N M (Chair, ind ne), DIRECTORS: Gomwe G (ne, Zim), Lennox A W (ne), Mpofu Dr P (ne),

Gobalsamy T (CEO), Serfontein S P (Group FD) PalmerM(ne, Aus), Waddell D (Chair, ne), Moxham K (COO)

MAJOR ORDINARY SHAREHOLDERS as at 08 Apr 2025 MAJOR ORDINARY SHAREHOLDERS as at 31 Jul 2024

Public Investment Company SOC Ltd. 19.11% Ndovu Capital x BV (Tembo) 16.47%

Camissa Asset Management (Pty) Ltd. 14.23% Sparta AG 12.62%

M&G Investments 12.74% Clover Alloys Copper Investments (Pty) Ltd. 7.88%

POSTAL ADDRESS: PO Box 69888, Bryanston, 2021 POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007

MORE INFO: www.sharedata.co.za/sdo/jse/OMN MORE INFO: www.sharedata.co.za/sdo/jse/ORN

GROUP SECRETARY: Simphiwe Mdluli COMPANY SECRETARY: Martin Bouwmeester

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. SPONSOR: Merchantec Capital

AUDITORS: Deloitte & Touche Inc. AUDITORS: Mazars Melbourne Assurance (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

OMN Ords no par value - 162 484 636 ORN Ords no par value - 6 850 447 818

DISTRIBUTIONS [ZARc] LIQUIDITY: Apr25 Avg 20m shares p.w., R3.7m(15.0% p.a.)

Ords no par value Ldt Pay Amt

MINI 40 Week MA ORIONMIN

Final No 64 13 Aug 24 19 Aug 24 375.00

Special No 3 13 Aug 24 19 Aug 24 325.00

LIQUIDITY: Apr25 Avg 1m shares p.w., R70.9m(34.7% p.a.) 58

CHES 40 Week MA OMNIA

47

8658

36

7034

26

5409

15

2020 | 2021 | 2022 | 2023 | 2024 |

3785

FINANCIAL STATISTICS

2161

(Amts in AUD’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Interim Final Final Final Final

537

2020 | 2021 | 2022 | 2023 | 2024 | Op Inc - 5 607 - 10 984 - 10 492 - 15 187 - 9 394

FINANCIAL STATISTICS NetIntPd(Rcvd) 347 - 1 845 - 2 890 - 2 748 - 1 629

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 Minority Int - 1 648 - 2 555 - 1 795 - 1 238 - 885

Interim Final Final Final(rst) Final(rst) Att Inc - 4 872 - 5 389 - 15 331 - 14 287 - 1 758

Turnover 10 933 22 219 26 572 21 437 16 436 TotCompIncLoss - 3 441 - 8 439 - 15 231 - 15 279 - 3 036

Op Inc 804 1 712 2 149 1 556 962 Fixed Ass 6 417 5 296 557 386 103

NetIntPd(Rcvd) 31 1 81 76 264 Inv & Loans 37 430 34 169 29 672 29 345 26 875

Minority Int - 11 3 - 17 - - Tot Curr Ass 7 411 18 239 8 951 5 458 21 354

Att Inc 506 1 160 1 169 1 353 1 383 Ord SH Int 105 138 102 183 92 871 85 812 94 680

TotCompIncLoss 221 1 285 1 671 1 374 139 Minority Int - 10 793 - 9 243 - 8 245 - 4 915 - 3 677

Fixed Ass 4 801 4 842 4 566 4 593 4 794 LT Liab 45 966 39 289 5 390 4 068 3 929

Inv & Loans 266 252 2 23 24 Tot Curr Liab 2 337 4 372 2 349 4 671 3 028

Tot Curr Ass 11 702 11 609 11 535 10 563 8 670 PER SHARE STATISTICS (cents per share)

Ord SH Int 9 783 10 839 10 275 10 022 9 740 HEPS-C (ZARc) - 0.83 - 1.10 - 3.70 - 3.64 - 0.56

Minority Int - 30 - 19 - 20 - 4 - 1 NAV PS (ZARc) 18.10 21.44 23.72 22.14 28.89

LT Liab 863 908 929 805 730 3 Yr Beta 0.62 0.50 1.17 1.68 1.74

Tot Curr Liab 7 015 5 798 5 651 5 188 4 270 Price High 24 29 33 43 2 889

PER SHARE STATISTICS (cents per share) Price Low 17 14 16 20 25

HEPS-C (ZARc) 288.00 699.00 742.00 672.00 361.00 Price Prd End 19 22 24 22 39

DPS (ZARc) - 700.00 375.00 800.00 600.00 RATIOS

NAV PS (ZARc) 6 100.00 6 700.00 6 300.00 5 900.00 5 800.00 Ret on SH Fnd - 13.82 - 8.55 - 20.24 - 19.19 - 2.90

3 Yr Beta 0.19 - 0.06 0.49 0.93 1.22 D:E 0.49 0.42 0.06 0.07 0.06

Price High 7 133 6 655 8 775 7 644 5 259 Current Ratio 3.17 4.17 3.81 1.17 7.05

Price Low 5 250 5 186 5 437 4 551 1 450

Price Prd End 6 503 5 903 5 620 7 520 4 900

RATIOS

Ret on SH Fnd 10.15 10.75 11.23 13.51 14.20

Oper Pft Mgn 7.35 7.71 8.09 7.26 5.85

D:E 0.13 0.10 0.12 0.08 0.08

Current Ratio 1.67 2.00 2.04 2.04 2.03

Div Cover - 1.01 1.85 1.01 1.38

162