Page 161 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 161

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – NUW

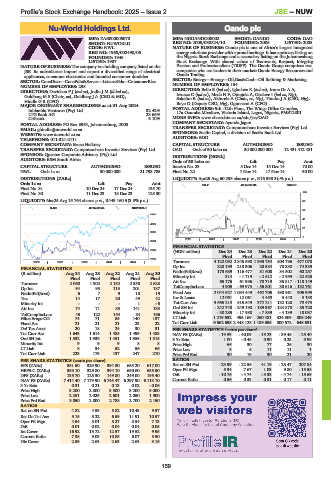

Nu-World Holdings Ltd. Oando plc

NUW OAN

ISIN: ZAE000005070 ISIN: NGOANDO00002 SHORT: OANDO CODE: OAO

SHORT: NUWORLD REG NO: 2005/038824/10 FOUNDED: 2005 LISTED: 2005

CODE: NWL NATURE OF BUSINESS: Oando plc is one of Africa’s largest integrated

REG NO: 1968/002490/06 energy solutions provider with a proud heritage. It has a primary listing on

FOUNDED: 1946 the Nigeria Stock Exchange and a secondary listing on the Johannesburg

LISTED: 1987 Stock Exchange. With shared values of Teamwork, Respect, Integrity,

NATURE OF BUSINESS: The company is a holding company listed on the Passion and Professionalism (TRIPP). The Oando Group comprises two

JSE. Its subsidiaries import and export a diversified range of electrical companies who are leaders in their market: Oando Energy Resources and

appliances, consumer electronics and branded consumer durables. Oando Trading.

SECTOR: ConsDiscr—ConsPdts&Servcs—LeisureGds—ConsumerElec SECTOR: Energy—Energy—Oil,Gas&Coal—Oil Refining & Marketing

NUMBER OF EMPLOYEES: 298 NUMBER OF EMPLOYEES: 154

DIRECTORS: DavidsonFJ(ind ne), JudinJM(ld ind ne), DIRECTORS: Bello B (ind ne), Igbokwe K (ind ne), Irune Dr A A,

Iwueze C (ind ne), Mede N F, Omojola A, Osakwe I (ind ne, Nig),

Goldberg M S (Chair, ne), Goldberg J A (CEO & MD), Sokefun R (ind ne), Akinrele A (Chair, ne, Nig), Tinubu J A (CEO, Nig),

Hindle G R (CFO) Boyo O (Deputy CEO, Nig), Ogunsemi A (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024 POSTAL ADDRESS: 9th -12th Floor, The Wings Office Complex,

Inhlanhla Ventures (Pty) Ltd. 32.42% 17a Ozumba Mbadiwe, Victoria Island, Lagos, Nigeria, PMB12801

LTG Bank AG 23.66%

Citibank 6.10% MORE INFO: www.sharedata.co.za/sdo/jse/OAO

POSTAL ADDRESS: PO Box 8964, Johannesburg, 2000 COMPANY SECRETARY: Ayotola Jagun

EMAIL: ghindle@nuworld.co.za TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

WEBSITE: www.nuworld.co.za SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

TELEPHONE: 011-321-2111 AUDITORS: BDO

COMPANY SECRETARY: Bruce Haikney CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. OAO Ords of 50 kobo ea 30 000 000 000 12 431 412 481

SPONSOR: Questco Corporate Advisory (Pty) Ltd. DISTRIBUTIONS [NGNk]

AUDITORS: RSM South Africa

Ords of 50 kobo ea Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 23 5 Dec 14 15 Dec 14 70.00

NWL Ords 1c ea 30 000 000 21 793 785 Final No 22 7 Nov 14 17 Nov 14 30.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Apr25 Avg 60 293 shares p.w., R16 398.3(-% p.a.)

Ords 1c ea Ldt Pay Amt

OILP 40 Week MA OANDO

Final No 31 10 Dec 24 17 Dec 24 135.70

Final No 30 11 Dec 23 18 Dec 23 125.30 100

LIQUIDITY: Mar25 Avg 15 764 shares p.w., R449 160.5(3.8% p.a.) 80

ALSH 40 Week MA NUWORLD

60

5259

41

4627

21

3995

1

2020 | 2021 | 2022 | 2023 | 2024 |

3364

FINANCIAL STATISTICS

(NGN million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

2732

Final Final Final Final Final

2100

2020 | 2021 | 2022 | 2023 | 2024 | Turnover 4 122 092 2 845 598 1 993 754 804 796 477 070

Op Inc 220 199 218 306 20 584 78 830 - 74 339

FINANCIAL STATISTICS NetIntPd(Rcvd) 173 689 116 477 81 600 34 502 60 257

(R million) Aug 24 Aug 23 Aug 22 Aug 21 Aug 20

Final Final Final Final Final Minority Int 314 - 1 719 - 2 512 - 2 959 - 22 525

Turnover 2 060 1 902 2 152 2 358 2 628 Att Inc 65 176 61 996 - 78 719 35 817 - 118 149

Op Inc 94 95 113 201 187 TotCompIncLoss 4 905 - 69 973 - 56 801 30 616 - 132 761

NetIntPd(Rcvd) 6 7 9 10 19 Fixed Ass 2 044 627 1 034 449 462 706 430 961 906 995

Tax 14 17 20 49 42 Inv & Loans 12 061 12 061 4 450 3 440 3 138

Minority Int - - - 1 - 6 Tot Curr Ass 3 666 213 815 549 372 211 132 128 70 473

Att Inc 74 71 85 141 133 Ord SH Int - 242 748 - 249 190 - 189 367 - 124 878 - 85 720

TotCompIncLoss 45 122 154 84 166 Minority Int - 30 285 - 17 988 - 7 839 - 4 139 18 037

Hline Erngs-CO 74 71 85 140 137 LT Liab 1 219 632 495 169 260 481 324 509 808 249

Fixed Ass 21 21 21 23 22 Tot Curr Liab 6 562 698 2 448 128 1 189 055 800 572 648 631

Def Tax Asset 20 18 24 30 31 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 643 1 614 1 485 1 499 1 483 NAV PS (ZARc) - 19.53 - 40.09 - 15.23 - 39.48 - 25.40

Ord SH Int 1 532 1 536 1 451 1 355 1 315 3 Yr Beta 1.00 - 0.48 0.90 0.23 0.98

Minority Int 9 9 9 8 8 Price High 66 30 77 26 30

LT Liab 8 34 52 56 66 Price Low 8 6 11 11 1

Tot Curr Liab 223 179 137 247 270 Price Prd End 30 19 30 21 20

RATIOS

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 351.50 329.90 394.30 655.20 617.00 Ret on SH Fnd - 23.99 - 22.56 41.19 - 25.47 207.84

HEPS-C (ZARc) 353.10 329.80 394.10 650.60 635.50 Oper Pft Mgn 5.34 7.67 1.03 9.80 - 15.58

DPS (ZARc) 135.70 125.30 149.80 249.00 195.40 D:E - 10.76 - 4.74 - 3.33 - 4.74 - 15.69

NAV PS (ZARc) 7 414.40 7 179.90 6 745.47 6 297.90 6 113.10 Current Ratio 0.56 0.33 0.31 0.17 0.11

3 Yr Beta 0.31 0.21 0.13 0.02 - 0.06

Price High 3 200 2 800 3 500 3 200 5 000

Price Low 2 251 2 025 2 601 2 050 1 900

Price Prd End 3 050 2 800 2 788 2 700 2 150

RATIOS

Ret on SH Fnd 4.82 4.59 5.82 10.43 9.57

Ret On Tot Ass 5.15 5.22 6.59 11.91 10.57

Oper Pft Mgn 4.54 5.01 5.27 8.54 7.13

D:E 0.01 0.02 0.04 0.04 0.05

Int Cover 16.92 13.72 12.57 19.52 9.95

Current Ratio 7.38 9.03 10.85 6.07 5.50

Div Cover 2.59 2.63 2.63 2.63 3.16

159