Page 162 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 162

JSE – OAS Profile’s Stock Exchange Handbook: 2025 – Issue 2

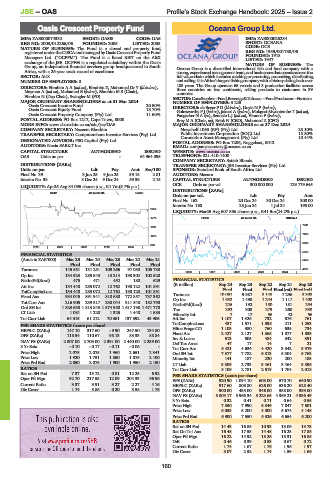

Oasis Crescent Property Fund Oceana Group Ltd.

OAS OCE

ISIN: ZAE000074332 SHORT: OASIS CODE: OAS ISIN: ZAE000025284

REG NO: 2003/012266/06 FOUNDED: 2005 LISTED: 2005 SHORT: OCEANA

NATURE OF BUSINESS: The Fund is a closed end property fund, CODE: OCE

REG NO: 1939/001730/06

registered underthe CISCAandmanagedby OasisCrescentProperty Fund FOUNDED: 1918

Managers Ltd. (“OCPFM”). The Fund is a listed REIT on the AltX LISTED: 1947

exchange of the JSE. OCPFM is a regulated subsidiary within the Oasis NATURE OF BUSINESS: The

Group, an independent financial services group headquartered in South Oceana Group is a diversified international fish and food company with a

Africa, with a 25-year track record of excellence. strong, experienced management team, and businesses that operate across the

SECTOR: AltX full value-chain which includes catching or procuring, processing, distributing,

NUMBER OF EMPLOYEES: 0 andselling.ItisAfrica’slargestfishingcompanywithahistorydatingbackover

105 years. The Group operates 65 vessels and 8 production facilities across

DIRECTORS: EbrahimAA(ind ne), Ebrahim Z, Mahomed Dr Y (ld ind ne), three countries on two continents, selling products to customers in 39

Mayman A (ind ne), Mohamed E (ind ne), Ebrahim M S (Chair), countries.

EbrahimN(Dep Chair),SwinglerM(FD) SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 NUMBER OF EMPLOYEES: 3 225

Oasis Crescent Income Fund 20.50% DIRECTORS: de Beyer P G (ld ind ne), Doyle N P (ind ne),

Oasis Crescent Equity Fund 18.70% Golesworthy P J (ind ne), Jakoet A (ind ne), Mokgosi-Mwantembe T (ind ne),

Oasis Crescent Property Company (Pty) Ltd. 11.60% Pangarker N A (ne), Sennelo L J (ind ne), Viranna P (ind ne),

POSTAL ADDRESS: PO Box 1217, Cape Town, 8000 Brey M A (Chair, ne), Brink N (CEO), Mahomed Z (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/OAS MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 2024

COMPANY SECRETARY: Nazeem Ebrahim Newshelf 1063 (RF) (Pty) Ltd. 25.10%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Public Investment Corporation (SOC) Ltd. 18.80%

Coronation Asset Management (Pty) Ltd.

10.44%

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. POSTAL ADDRESS: PO Box 7206, Roggebaai, 8012

AUDITORS: Nexia SAB&T Inc. EMAIL: companysecretary@oceana.co.za

CAPITAL STRUCTURE AUTHORISED ISSUED WEBSITE: www.oceana.co.za

OAS Units no par - 64 964 095 TELEPHONE: 021-410-1400

COMPANY SECRETARY: Satish Bhoola

DISTRIBUTIONS [ZARc] TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Units no par Ldt Pay Amt Scr/100 SPONSOR: Standard Bank of South Africa Ltd.

Final No 39 3 Jun 25 9 Jun 25 59.18 2.81 AUDITORS: Mazars

Interim No 38 3 Dec 24 9 Dec 24 59.36 2.15 CAPITAL STRUCTURE AUTHORISED ISSUED

OCE Ords no par val. 300 000 000 129 779 645

LIQUIDITY: Apr25 Avg 84 095 shares p.w., R1.7m(6.7% p.a.)

DISTRIBUTIONS [ZARc]

REIV 40 Week MA OASIS

Ords no par val. Ldt Pay Amt

Final No 162 20 Dec 24 30 Dec 24 300.00

Interim No 160 25 Jun 24 1 Jul 24 195.00

2054

LIQUIDITY: Mar25 Avg 607 586 shares p.w., R41.5m(24.2% p.a.)

1778 FOOD 40 Week MA OCEANA

7941

1501

7268

1225

6596

949

2020 | 2021 | 2022 | 2023 | 2024 |

5923

FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 5250

Final Final Final Final Final

Turnover 145 551 131 251 109 266 97 050 105 738 4577

2020 | 2021 | 2022 | 2023 | 2024 |

Op Inc 134 923 285 543 13 214 198 302 102 520

NetIntPd(Rcvd) 475 471 452 180 629 FINANCIAL STATISTICS

Att Inc 134 448 285 072 12 762 198 122 101 891 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Final

Final

Final Final(rst) Final(rst)

TotCompIncLoss 134 448 285 072 12 762 198 120 101 891 Turnover 10 061 9 987 8 148 7 296 8 308

Fixed Ass 934 045 891 941 818 680 772 857 737 362 Op Inc 1 632 1 490 1 244 1 117 1 400

Tot Curr Ass 216 905 239 317 230 044 311 548 182 790 NetIntPd(Rcvd) 226 192 180 181 254

Ord SH Int 1 823 638 1 813 843 1 574 950 1 617 198 1 471 770 Tax 292 308 273 260 330

LT Liab 1 081 1 220 1 325 1 448 1 583 Minority Int 7 17 36 42 56

Tot Curr Liab 64 315 61 212 70 361 137 392 43 905 Att Inc 1 107 1 326 732 676 761

PER SHARE STATISTICS (cents per share) TotCompIncLoss 437 1 571 1 895 211 1 253

HEPS-C (ZARc) 147.10 317.60 - 9.90 247.50 134.80 Hline Erngs-CO 1 103 980 760 635 734

DPS (ZARc) 118.54 110.67 98.13 83.33 88.84 Fixed Ass 2 427 2 127 1 865 1 877 1 835

NAV PS (ZARc) 2 807.00 2 703.00 2 391.00 2 440.00 2 239.00 Inv & Loans 513 505 484 342 391

3 Yr Beta - 0.10 - 0.17 - 0.11 - 0.06 - Def Tax Asset 47 17 14 7 21

Price High 2 075 2 075 1 960 2 651 2 341 Tot Curr Ass 5 421 4 634 4 420 3 342 3 979

5 304

6 813

7 782

7 577

Ord SH Int

5 763

Price Low 1 920 1 751 1 850 1 875 2 100 Minority Int 141 187 220 200 183

Price Prd End 2 050 2 075 1 900 1 950 2 150 LT Liab 3 309 2 733 3 461 3 464 3 896

RATIOS Tot Curr Liab 3 108 2 781 2 519 1 704 2 018

Ret on SH Fnd 7.37 15.72 0.81 12.25 6.92 PER SHARE STATISTICS (cents per share)

Oper Pft Mgn 92.70 217.55 12.09 204.33 96.96 EPS (ZARc) 920.90 1 094.10 603.00 570.70 650.90

Current Ratio 3.37 3.91 3.27 2.27 4.16 HEPS-C (ZARc) 917.60 808.80 626.00 536.20 628.40

Div Cover 1.74 3.86 0.20 3.58 1.76 DPS (ZARc) 300.00 435.00 346.00 358.00 393.00

NAV PS (ZARc) 5 809.17 5 966.34 5 223.65 4 369.21 4 936.49

3 Yr Beta 0.32 0.41 0.71 0.64 0.55

Price High 7 850 7 990 6 849 7 847 7 501

Price Low 6 053 5 200 4 300 5 674 4 148

Price Prd End 6 900 7 550 5 326 6 654 6 200

RATIOS

Ret on SH Fnd 14.43 16.85 10.93 13.06 13.73

Ret On Tot Ass 16.48 17.53 14.48 16.23 17.85

Oper Pft Mgn 16.22 14.92 15.26 15.31 16.85

D:E 0.46 0.39 0.53 0.67 0.72

Current Ratio 1.74 1.67 1.76 1.96 1.97

Div Cover 3.07 2.52 1.74 1.59 1.66

160