Page 171 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 171

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – PSG

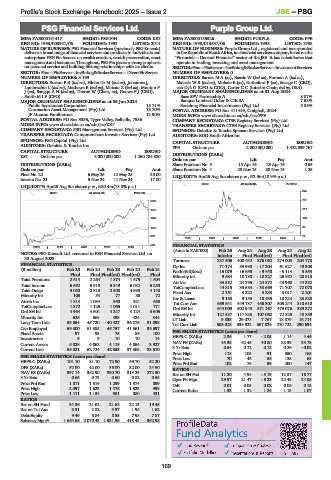

PSG Financial Services Ltd. Purple Group Ltd.

PSG PUR

ISIN: ZAE000191417 SHORT: PSG FIN CODE: KST ISIN: ZAE000185526 SHORT: PURPLE CODE: PPE

REG NO: 1993/003941/06 FOUNDED: 1993 LISTED: 2014 REG NO: 1998/013637/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: PSG Financial Services (previously PSG Konsult) NATURE OF BUSINESS: Purple Group Ltd., registered and incorporated

delivers a broad range of financial services and products to individuals and in the Republic of South Africa, is a financialservices company listedonthe

enterprises. PSG Fin focuses on wealth creation, wealth preservation, asset “Financials – General Financial” sector of the JSE. It has subsidiaries that

management and insurance. Throughout, PSG Fin places a strong emphasis operate in trading, investing and asset management.

on personal service and building lifelong relationships with its clients. SECTOR:Fins—FinServcs—InvBnkng&BrokerServcs—InvestmentServices

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 3 199 DIRECTORS: BarnesMA(ne), Bassie W (ind ne), Forman A (ind ne),

DIRECTORS: BurtonPE(ind ne), Hlobo Dr M (ind ne), Johannes J, MaiselaWB(ind ne), Mohale B (ne), Rutheford P (ne), Savage C (CEO),

Lambrechts L (ind ne), Mathews B (ind ne), Matsau Z (ind ne), Mouton P van Dyk G (CFO & COO), Carter C C (Interim Chair, ind ne, USA)

J(ne), SangquAH(ind ne), Theron W (Chair, ne), Gouws F J (CEO), MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024

SmithMIF (CFO) Base SPV Partnership A 8.87%

MAJOR ORDINARY SHAREHOLDERS as at 05 Jun 2024 Banque Lombard Odier & CIE SA 7.53%

Public Investment Corporation 15.11% Serialong Financial Investments (Pty) Ltd. 5.86%

Coronation Asset Management (Pty) Ltd. 13.70% POSTAL ADDRESS: PO Box 411449, Craighall, 2024

JF Mouton Familietrust 12.90% MORE INFO: www.sharedata.co.za/sdo/jse/PPE

POSTAL ADDRESS: PO Box 3335, Tyger Valley, Bellville, 7536 COMPANY SECRETARY: CTSE Registry Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/KST TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

COMPANY SECRETARY: PSG Management Services (Pty) Ltd. SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: BDO South Africa Inc.

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

PPE Ords no par 2 000 000 000 1 422 539 767

CAPITAL STRUCTURE AUTHORISED ISSUED

KST Ords no par 3 000 000 000 1 260 784 880 DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

DISTRIBUTIONS [ZARc] Share Premium No 5 15 Apr 16 25 Apr 16 0.65

Ords no par Ldt Pay Amt Share Premium No 4 20 Nov 15 30 Nov 15 1.25

Final No 22 6 May 25 12 May 25 35.00 LIQUIDITY: Apr25 Avg 3m shares p.w., R2.9m(10.9% p.a.)

Interim No 21 5 Nov 24 11 Nov 24 17.00

GENF 40 Week MA PURPLE

LIQUIDITY: Apr25 Avg 5m shares p.w., R80.4m(18.8% p.a.)

345

GENF 40 Week MA PSG FIN

2013 281

1726 217

1440 153

1153 89

867 25

2020 | 2021 | 2022 | 2023 | 2024 |

580 FINANCIAL STATISTICS

2020 | 2021 | 2022 | 2023 | 2024 |

(Amts in ZAR’000) Feb 25 Aug 24 Aug 23 Aug 22 Aug 21

NOTES: PSG Konsult Ltd. renamed to PSG Financial Services Ltd. on Interim Final Final(rst) Final Final(rst)

30 August 2023.

Turnover 237 506 400 432 276 062 274 003 204 778

FINANCIAL STATISTICS Op Inc 71 174 85 990 - 17 204 61 627 49 308

(R million) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21 NetIntPd(Rcvd) - 15 079 - 16 655 - 9 640 - 5 114 3 553

Final Final Final(rst) Final(rst) Final

- 10 327

9 684

Total Premiums 2 614 2 264 1 874 1 675 1 604 Minority Int 33 532 10 788 - 24 872 26 982 28 313

Att Inc

24 795

43 968

44 332

Total Income 6 692 5 910 5 349 6 032 5 250 TotCompIncLoss 44 815 35 583 - 33 669 71 707 72 070

Total Outgo 3 050 2 810 2 500 4 598 4 140 Fixed Ass 2 751 3 222 3 233 3 017 2 201

Minority Int 106 84 77 86 72 Inv & Loans 9 153 9 153 18 435 18 224 23 828

Attrib Inc 1 814 1 034 950 921 698 Tot Curr Ass 669 541 449 737 456 307 305 244 310 610

TotCompIncLoss 1 372 1 125 1 065 1 011 771 Ord SH Int 644 009 602 945 571 167 479 076 389 272

Ord SH Int 4 964 4 601 4 247 4 124 3 605 Minority Int 127 587 117 838 107 062 72 325 43 859

Minority Int 626 569 493 424 344 LT Liab 9 833 29 078 7 767 18 879 16 714

Long-Term Liab 53 054 45 720 40 427 36 276 31 095 Tot Curr Liab 503 018 339 522 367 824 270 722 290 694

Cap Employed 59 300 51 385 45 757 41 361 35 697

Fixed Assets 97 93 75 86 100 PER SHARE STATISTICS (cents per share)

Investments 9 9 10 10 14 HEPS-C (ZARc) 2.36 1.77 - 2.05 1.14 4.46

Current Assets 5 028 4 062 4 119 4 054 3 927 NAV PS (ZARc) 45.35 42.45 40.80 38.39 33.73

3 Yr Beta 0.54 0.72 0.18 0.26 - 0.02

Current Liab 55 021 62 724 42 353 37 305 38 510

Price High 118 105 91 350 165

PER SHARE STATISTICS (cents per share) Price Low 70 46 56 125 63

HEPS-C (ZARc) 101.10 81.10 72.90 69.70 52.20 Price Prd End 102 76 59 200 147

DPS (ZARc) 52.00 42.00 36.00 32.00 24.50 RATIOS

NAV PS (ZARc) 397.14 362.90 330.70 313.25 272.30 Ret on SH Fnd 11.20 4.94 - 5.19 12.87 16.77

3 Yr Beta 0.65 0.73 0.60 0.82 0.55 Oper Pft Mgn 29.97 21.47 - 6.23 22.49 24.08

Price Prd End 1 811 1 519 1 299 1 374 899 D:E 0.01 0.05 0.02 0.06 0.13

Price High 2 097 1 623 1 476 1 523 999 Current Ratio 1.33 1.32 1.24 1.13 1.07

Price Low 1 411 1 138 981 880 431

RATIOS

Ret on SH Fund 34.36 21.62 21.68 22.13 19.48

Ret on Tot Ass 3.31 2.82 3.37 1.96 1.62

Debt:Equity 9.49 8.84 8.53 7.98 7.87

Solvency Mgn% 1 664.65 2 070.43 1 931.96 418.43 362.98

169