Page 152 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 152

JSE – MTN Profile’s Stock Exchange Handbook: 2025 – Issue 2

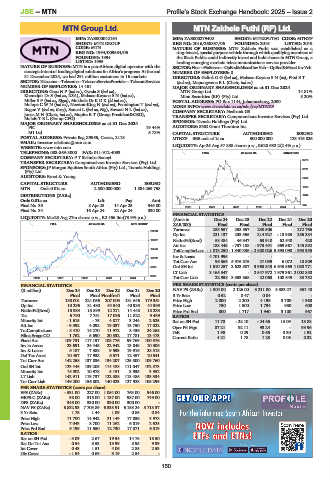

MTN Group Ltd. MTN Zakhele Futhi (RF) Ltd.

MTN MTN

ISIN: ZAE000042164 ISIN: ZAE000279402 SHORT: MTNZFUTHI CODE: MTNZF

SHORT: MTN GROUP REG NO: 2016/268837/06 FOUNDED: 2016 LISTED: 2019

CODE: MTN NATURE OF BUSINESS: MTN Zakhele Futhi was established as a

REG NO: 1994/009584/06 ring-fenced, special purpose vehicle through which qualifying members of

FOUNDED: 1994 the Black Public could indirectly invest and hold shares in MTN Group, a

LISTED: 1995 leading emerging markets telecommunications service provider.

NATURE OF BUSINESS: MTN is a pan-African digital operator with the SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

strategic intentof leading digital solutionsfor Africa’s progress. Atthe end NUMBER OF EMPLOYEES: 0

31 December 2024, we had 291 million customers in 16 markets. DIRECTORS: GelinkGG(ind ne), Mabaso-KoyanaSN(ne), Pitsi E T

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices (ind ne), Mapongwana B L (Chair, ind ne)

NUMBER OF EMPLOYEES: 14 461 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

DIRECTORS: GosaNP(ind ne), Gwala S (ind ne), MTN Group Ltd. 14.81%

Kheradpir Dr S (ind ne, USA), Mabaso-KoyanaSN(ind ne), Mion Securities (RF) (Pty) Ltd. 8.20%

MillerSP(ind ne, Blgm), Mokhele DrKDK(ld ind ne), POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000

MolopeCWN(ind ne), Newton-King N (ind ne), Pennington T (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/MTNZF

Rague V (ind ne, Keny), Sanusi L (ind ne, Nig), SowaziNL(ind ne), COMPANY SECRETARY: Nedbank GS

Jonas M H (Chair, ind ne), Mupita R T (Group President&CEO),

MolefeTBL (Group CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 SPONSOR: Tamela Holdings (Pty) Ltd.

PIC 19.44% AUDITORS: SNG Grant Thornton Inc.

M1 Ltd. 5.78% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: Private Bag X9955, Cresta, 2118 MTNZF BEE ords of 1c ea 300 000 000 123 416 826

EMAIL: investor.relations@mtn.com

WEBSITE: www.mtn.com LIQUIDITY: Apr25 Avg 57 858 shares p.w., R628 632.2(2.4% p.a.)

TELEPHONE: 083-869-3000 FAX: 011-912-4093 FINA 40 Week MA MTNZFUTHI

COMPANY SECRETARY: P T Sishuba-Bonoyi

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 3720

SPONSORS: JP Morgan Equities South Africa (Pty) Ltd., Tamela Holdings 3101

(Pty) Ltd.

AUDITORS: Ernst & Young 2482

CAPITAL STRUCTURE AUTHORISED ISSUED

1863

MTN Ords 0.01c ea 2 500 000 000 1 884 269 758

DISTRIBUTIONS [ZARc] 1244

Ords 0.01c ea Ldt Pay Amt

Final No 35 8 Apr 25 14 Apr 25 345.00 2020 | 2021 | 2022 | 2023 | 2024 | 625

Final No 34 16 Apr 24 22 Apr 24 330.00

FINANCIAL STATISTICS

LIQUIDITY: Mar25 Avg 27m shares p.w., R2 456.0m(73.9% p.a.)

(Amts in Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

FTEL 40 Week MA MTN GROUP ZAR’000) Final Final Final Final Final

Turnover 253 557 253 557 230 506 - 272 766

20280

Op Inc 221 137 233 555 214 927 - 18 983 256 284

16937 NetIntPd(Rcvd) 58 484 46 347 63 910 62 540 428

Att Inc 188 445 - 737 188 - 973 491 869 567 145 892

13594

TotCompIncLoss - 1 013 250 - 1 340 336 - 2 680 026 5 593 098 - 993 955

Inv & Loans 4 701 996 - - - -

10252

Tot Curr Ass 96 566 5 976 875 27 039 6 072 10 809

6909 Ord SH Int 1 610 257 2 623 507 3 963 843 6 643 869 1 050 771

LT Liab 3 165 347 - 2 547 972 1 979 361 2 002 850

3566 Tot Curr Liab 22 958 3 353 368 22 063 108 549 33 752

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 NAV PS (ZARc) 1 304.00 2 126.00 3 211.00 5 383.27 851.40

Final Final Final(rst) Final Final 3 Yr Beta 0.52 0.47 0.84 - -

Turnover 188 001 221 056 207 003 181 646 179 361 Price High 2 000 2 200 4 199 3 700 1 360

Op Inc 10 296 31 480 54 540 40 935 44 595 Price Low 750 1 500 1 794 930 600

NetIntPd(Rcvd) 15 933 15 899 12 271 14 448 18 233 Price Prd End 800 1 717 1 940 3 100 967

Tax 6 790 7 751 17 036 11 822 9 439 RATIOS

Minority Int - 1 615 - 75 4 817 3 244 2 625 Ret on SH Fnd 11.70 - 28.10 - 24.56 13.09 13.88

Att Inc - 9 592 4 092 19 037 13 750 17 022 Oper Pft Mgn 87.21 92.11 93.24 - 93.96

TotCompIncLoss - 8 410 14 270 11 972 8 436 24 268 D:E 1.98 0.29 0.65 0.30 1.92

Hline Erngs-CO 1 762 5 690 20 532 17 781 13 473 Current Ratio 4.21 1.78 1.23 0.06 0.32

Fixed Ass 109 731 117 197 108 776 99 769 100 576

Inv in Assoc 23 691 24 445 22 942 13 848 10 306

Inv & Loans 5 187 7 388 9 593 19 916 28 518

Def Tax Asset 10 457 17 938 6 571 12 457 10 541

Tot Curr Ass 142 258 137 836 134 207 125 800 109 760

Ord SH Int 123 445 139 205 114 488 111 047 102 873

Minority Int 15 002 10 978 5 151 3 935 3 352

LT Liab 142 911 119 737 122 588 118 486 133 334

Tot Curr Liab 149 200 156 802 140 023 127 928 108 299

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 531.00 227.00 1 054.00 763.00 946.00

HEPS-C (ZARc) 98.00 315.00 1 137.00 987.00 749.00

DPS (ZARc) 345.00 330.00 330.00 300.00 -

NAV PS (ZARc) 6 832.93 7 705.89 6 338.91 6 158.24 5 718.37

3 Yr Beta 1.75 1.44 1.09 0.85 0.84

Price High 11 700 14 942 21 149 17 836 8 978

Price Low 7 043 8 700 11 262 6 019 2 625

Price Prd End 9 199 11 550 12 730 17 071 6 019

RATIOS

Ret on SH Fnd - 8.09 2.67 19.94 14.78 18.50

Ret On Tot Ass 0.54 5.53 13.99 8.95 9.39

Int Cover 0.43 1.51 4.06 2.85 2.53

Div Cover - 1.54 0.69 3.19 2.54 -

150