Page 153 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 153

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – MUL

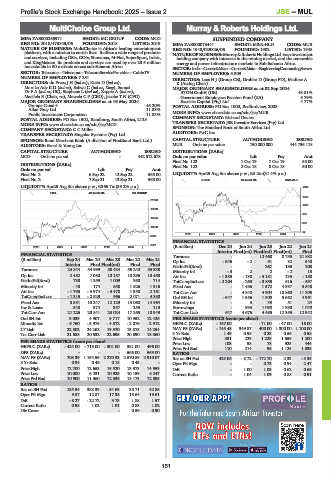

MultiChoice Group Ltd. Murray & Roberts Holdings Ltd.

MUL MUR

ISIN: ZAE000265971 SHORT: MC GROUP CODE: MCG SUSPENDED COMPANY

REG NO: 2018/473845/06 FOUNDED: 2018 LISTED: 2019 ISIN: ZAE000073441 SHORT: M&R-HLD CODE: MUR

NATURE OF BUSINESS: MultiChoice is Africa’s leading entertainment REG NO: 1948/029826/06 FOUNDED: 1902 LISTED: 1948

platform, with a mission to enrich lives. It offers a wide range of products NATUREOF BUSINESS:Murray &RobertsHoldingsLtd.isaninvestment

and services, including DStv, GOtv, Showmax, M-Net, SuperSport, Irdeto, holding company with interests in the mining market, and the renewable

and KingMakers. Its products and services are used by over 23.5 million energy and power infrastructure markets in Sub-Saharan Africa.

households in 50 markets across sub-Saharan Africa. SECTOR: Inds—Constr&Mats—Constr&Mats—EngineeringContractingServcs

SECTOR: Telecoms—Telecoms—TelecomServiceProvider—CableTV NUMBER OF EMPLOYEES: 5 309

NUMBER OF EMPLOYEES: 7 251 DIRECTORS: Laas H J (Group CE), Grobler D (Group FD), Maditse A

DIRECTORS: du PreezJH(ind ne), Klein D (ind ne), K (Acting Chair)

Moroka AdvKD(ind ne), Sabwa C (ind ne, Keny), Sanusi MAJOR ORDINARY SHAREHOLDERS as at 02 Sep 2024

DrFA(ind ne, UK), Stephens L (ind ne), Zappia A (ind ne), ATON GmbH (DE) 43.81%

Masilela E (Chair, ne), Mawela C P (CEO), Jacobs T N (CFO) Government Employees Pension Fund (ZA) 9.79%

MAJOR ORDINARY SHAREHOLDERS as at 16 May 2024 Excelsia Capital (Pty) Ltd. 4.77%

Groupe Canal+ 45.20% POSTAL ADDRESS: PO Box 1000, Bedfordview, 2008

Allan Gray Ltd. 11.83% MORE INFO: www.sharedata.co.za/sdo/jse/MUR

Public Investment Corporation 11.83% COMPANY SECRETARY: Richard Davies

POSTAL ADDRESS: PO Box 1502, Randburg, South Africa, 2125

MORE INFO: www.sharedata.co.za/sdo/jse/MCG TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

COMPANY SECRETARY: C C Miller SPONSOR: The Standard Bank of South Africa Ltd.

AUDITORS: PwC Inc.

TRANSFER SECRETARY: Singular Systems (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Ernst & Young Inc. MUR Ords no par value 750 000 000 444 736 118

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

MCG Ords no par val - 442 512 678 Ords no par value Ldt Pay Amt

Final No 123 1 Oct 19 7 Oct 19 55.00

DISTRIBUTIONS [ZARc] Final No 122 2 Oct 18 8 Oct 18 50.00

Ords no par val Ldt Pay Amt

Final No 3 6 Sep 22 12 Sep 22 565.00 LIQUIDITY: Apr25 Avg 3m shares p.w., R5.2m(31.4% p.a.)

Final No 2 7 Sep 21 13 Sep 21 565.00 CONM 40 Week MA M&R-HLD

LIQUIDITY: Apr25 Avg 3m shares p.w., R365.7m(39.2% p.a.) 1634

FTEL 40 Week MA MC GROUP

1320

21243

1005

18259

691

15274

376

12290

62

2020 | 2021 | 2022 | 2023 | 2024 |

9305

FINANCIAL STATISTICS

6321 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

2020 | 2021 | 2022 | 2023 | 2024 |

Interim Final(rst) Final(rst) Final(rst) Final

FINANCIAL STATISTICS Turnover - - 12 460 8 755 21 882

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 Op Inc - 646 - 2 91 82 540

Interim Final Final(rst) Final Final NetIntPd(Rcvd) - - 267 186 208

Turnover 24 844 54 999 58 424 55 240 53 338 Minority Int - 3 2 2 - 2 13

Op Inc 2 452 7 080 10 157 10 296 10 458 Att Inc - 1 385 - 138 - 3 181 135 - 180

NetIntPd(Rcvd) 730 1 359 1 009 950 714 TotCompIncLoss - 2 204 - 263 - 3 853 616 - 597

Minority Int - 48 - 174 558 1 526 1 916 Fixed Ass - 1 486 1 572 4 397 3 548

Att Inc - 1 796 - 3 974 - 3 478 1 358 2 161 Tot Curr Ass - 4 840 4 904 10 860 11 805

TotCompIncLoss - 1 315 - 2 529 966 2 071 4 380 Ord SH Int - 647 1 556 1 808 5 662 4 961

Fixed Ass 8 851 10 247 12 129 13 060 14 964 Minority Int - 3 33 51 24

Inv & Loans 340 374 357 255 119 Borrowings - 933 1 080 1 390 1 040

Tot Curr Ass 21 226 20 841 23 024 17 265 18 949 Tot Curr Liab 647 4 676 4 485 12 355 12 942

Ord SH Int 3 039 4 907 9 717 10 952 12 426 PER SHARE STATISTICS (cents per share)

Minority Int - 5 760 - 5 975 - 4 372 - 2 876 - 2 912 HEPS-C (ZARc) - 167.00 - - 71.00 - 47.00 16.00

LT Liab 22 502 24 262 19 570 13 875 14 254 NAV PS (ZARc) - 145.48 349.87 400.00 1 300.00 1 100.00

Tot Curr Liab 21 588 20 532 22 695 20 890 18 560 3 Yr Beta 1.49 0.98 0.23 0.56 0.58

Price High 331 229 1 229 1 559 1 200

PER SHARE STATISTICS (cents per share)

925

444

58

HEPS-C (ZARc) - 424.00 - 715.00 - 301.00 381.00 496.00 Price Low 103 214 78 1 125 1 035

Price Prd End

110

96

DPS (ZARc) - - - 565.00 565.00 RATIOS

NAV PS (ZARc) 708.39 1 154.59 2 270.33 2 570.89 2 910.07 Ret on SH Fnd 429.06 - 8.72 - 172.70 2.33 - 3.35

3 Yr Beta 0.34 0.46 0.18 0.45 - Oper Pft Mgn - - 0.73 0.94 2.47

Price High 12 200 12 653 15 520 13 973 14 559 D:E - 1.00 1.03 0.62 0.65

Price Low 10 000 6 231 10 925 10 159 8 247 Current Ratio - 1.04 1.09 0.88 0.91

Price Prd End 10 900 11 360 12 336 13 173 12 895

RATIOS

Ret on SH Fnd 135.54 388.39 - 54.63 35.71 42.85

Oper Pft Mgn 9.87 12.87 17.38 18.64 19.61

D:E - 8.27 - 22.72 3.73 1.88 1.57

Current Ratio 0.98 1.02 1.01 0.83 1.02

Div Cover - - - 0.56 0.90

151