Page 154 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 154

JSE – MUS Profile’s Stock Exchange Handbook: 2025 – Issue 2

Mustek Ltd. Nampak Ltd.

MUS NAM

ISIN: ZAE000012373 SHORT: MUSTEK CODE: MST ISIN: ZAE000322095 SHORT: NAMPAK CODE: NPK

REG NO: 1987/070161/06 FOUNDED: 1987 LISTED: 1997 ISIN: ZAE000004966 SHORT: NAMPAK 6.5 CODE: NPP1

NATURE OF BUSINESS: The Mustek Group is a seamless end-to-end ISIN: ZAE000004958 SHORT: NAMPAK 6%P CODE: NPKP

information and communications technology (ICT) and sustainable REG NO: 1968/008070/06 FOUNDED: 1968 LISTED: 1969

technology solutions provider, founded by David Kan in 1987 and listed on NATURE OF BUSINESS: Nampak is Africa’s leading diversified packaging

the JSE in 1997. Over the years, it has transformed from a manufacturer, and has been listed on the JSE since 1969. Nampak operates

distribution-oriented entity to a cohesive Group with a mission centred on from 19 sites in South Africa, contributing approximately 68% to group

anticipating stakeholder needs for long-term sustainability. The Group’s revenue,14sitesintherestofAfrica,contributing 32%togrouprevenue.

strategic intent is to build strong businesses and create synergies for SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng

sustainablesuccessbyoperatingasaunifiedentitywithasharedmission. NUMBER OF EMPLOYEES: 2 463

SECTOR:Technology—Technology—Hardware&Equipment—Hardware DIRECTORS: MnisiPJ(ind ne), Mzondeki K (ind ne), Ridley S (ind ne),

NUMBER OF EMPLOYEES: 1 197 Siyotula N (ind ne), van der Veen A (Chair, ind ne), Roux P M (CEO),

DIRECTORS: Coetzee C J, Marlowe P (ind ne), Patmore R B (ld ind ne), Fullerton G (CFO), Hood A (COO)

Thomas S (ind ne), Mophatlane I (Chair, ind ne), EbrahimSAB(GroupFD), MAJOR ORDINARY SHAREHOLDERS as at 13 Nov 2024

Engelbrecht H (Group CEO) PSG Asset Management 11.11%

MAJOR ORDINARY SHAREHOLDERS as at 15 Nov 2024 Allan Gray 10.43%

Novus Holdings Ltd. 35.07% M&G Investment Management (Pty) Ltd. 10.23%

The DK Trust 16.60% POSTAL ADDRESS: PO Box 69983, Bryanston, 2021

Government Employees Pension Fund 5.70% MORE INFO: www.sharedata.co.za/sdo/jse/NPK

POSTAL ADDRESS: PO Box 1638, Parklands, 2121 COMPANY SECRETARY: Omeshnee Pillay

MORE INFO: www.sharedata.co.za/sdo/jse/MST TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Sirkien van Schalkwyk SPONSOR: PSG Capital (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: PricewaterhouseCoopers Inc.

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: BDO South Africa Inc.

NPK Ords no par val 600 000 000 8 476 184

CAPITAL STRUCTURE AUTHORISED ISSUED NPKP Prefs 200c ea 400 000 400 000

MST Ords no par value 250 000 000 57 540 000 NPP1 Prefs 200c ea 100 000 100 000

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Ords no par val Ldt Pay Amt

Final No 28 8 Oct 24 14 Oct 24 7.50 Final No 87 8 Jan 16 18 Jan 16 23000.00

Final No 27 10 Oct 23 16 Oct 23 77.00 Interim No 86 26 Jun 15 6 Jul 15 10500.00

LIQUIDITY: Apr25 Avg 951 062 shares p.w., R10.9m(85.9% p.a.) LIQUIDITY: Apr25 Avg 74 405 shares p.w., R28.9m(45.6% p.a.)

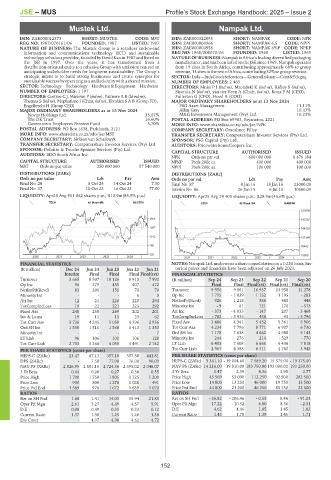

TECH 40 Week MA MUSTEK

GENI 40 Week MA NAMPAK

230209

1503

187267

1257 144325

1012 101384

766 58442

520 15500

2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS NOTES: Nampak Ltd. underwent a share consolidation on a 1:250 basis, his-

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 torical prices and financials have been adjusted on 26 July 2023.

Interim Final Final Final Final(rst) FINANCIAL STATISTICS

Turnover 3 665 8 507 10 126 8 910 7 992 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Op Inc 96 279 455 407 472 Final Final Final(rst) Final(rst) Final(rst)

NetIntPd(Rcvd) 83 206 151 70 70 Turnover 9 956 9 881 16 937 13 958 11 278

Minority Int - - - 5 3 Op Inc 1 715 - 1 039 1 152 1 195 - 283

Att Inc 12 21 220 220 294 NetIntPd(Rcvd) 926 1 218 586 485 448

TotCompIncLoss 19 22 221 223 292 Minority Int - 9 81 121 170 - 513

Fixed Ass 248 258 269 202 201 Att Inc - 373 - 4 033 - 147 207 - 3 468

Inv & Loans 19 11 13 23 62 TotCompIncLoss - 702 - 3 936 438 93 - 3 796

Tot Curr Ass 3 736 4 245 5 050 4 396 2 956 Fixed Ass 3 486 4 341 5 452 5 361 5 906

Ord SH Int 1 530 1 516 1 568 1 413 1 350 Tot Curr Ass 4 234 7 796 8 771 6 907 6 730

Minority Int - - - - 7 Ord SH Int 1 178 1 638 4 662 4 988 5 143

LT Liab 96 106 101 106 128 Minority Int 244 276 214 - 529 - 770

Tot Curr Liab 2 733 3 266 4 055 3 491 2 142 LT Liab 6 403 7 608 6 665 6 436 7 818

PER SHARE STATISTICS (cents per share) Tot Curr Liab 2 967 4 388 6 311 4 780 3 945

HEPS-C (ZARc) 23.47 67.13 357.18 357.38 441.81 PER SHARE STATISTICS (cents per share)

DPS (ZARc) - 7.50 77.00 76.00 90.00 HEPS-C (ZARc) 3 361.10 - 39 004.60 7 589.20 15 575.00 - 19 375.00

NAV PS (ZARc) 2 826.95 2 801.15 2 724.36 2 395.02 2 046.07 NAV PS (ZARc) 14 216.00 19 810.00 183 750.00 193 000.00 193 250.00

3 Yr Beta 0.44 0.20 0.27 0.38 0.55 3 Yr Beta 1.47 2.39 4.36 3.95 2.77

Price High 1 700 1 750 1 805 1 725 1 200 Price High 45 569 53 000 112 250 92 500 282 500

Price Low 900 800 1 270 1 028 491 Price Low 14 800 13 250 46 000 19 750 13 500

Price Prd End 1 589 978 1 672 1 639 1 070 Price Prd End 44 800 21 200 46 250 83 750 22 500

RATIOS RATIOS

Ret on SH Fnd 1.68 1.41 14.01 15.94 21.83 Ret on SH Fnd - 26.82 - 206.46 - 0.53 8.46 - 91.03

Oper Pft Mgn 2.61 3.27 4.49 4.57 5.91 Oper Pft Mgn 17.22 - 10.52 6.80 8.56 - 2.51

D:E 0.08 0.49 0.31 0.23 0.12 D:E 4.62 4.46 1.85 1.45 1.82

Current Ratio 1.37 1.30 1.25 1.26 1.38 Current Ratio 1.43 1.78 1.39 1.45 1.71

Div Cover - 4.97 4.90 4.62 4.72

152