Page 147 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 147

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – MER

Merafe Resources Ltd. Metair Investments Ltd.

MER MET

ISIN: ZAE000060000 SHORT: MERAFE CODE: MRF ISIN: ZAE000090692 SHORT: METAIR CODE: MTA

REG NO: 1987/003452/06 FOUNDED: 1987 LISTED: 1988 REG NO: 1948/031013/06 FOUNDED: 1948 LISTED: 1949

NATURE OF BUSINESS: Merafe is listed on the Johannesburg Stock NATURE OF BUSINESS:Metair is a publicly-owned company listed on the

Exchange (JSE)andA2Xinthe GeneralMiningsectorunderthe sharecode Johannesburg Stock Exchange. From its headquarters in Johannesburg the

MRF. Merafe’s business is the 20.5% participation through its group manages an international portfolio of companies that manufacture,

wholly-owned subsidiary, Merafe Ferrochrome, in the earnings before distribute and retail products for energy storage and automotive

interest, tax, depreciation and amortisation (EBITDA) of the Venture in components. Metair was formed in 1948, becoming a supplier of

which Glencore OperationsSouth Africa (Pty) Ltd. (Glencore) has a 79.5% automotive components to a single OEM in South Africa in 1964. As

participation. The group’s major shareholders are Glencore (Netherlands) Metair has grown, our strategy has evolved to meet the challenges of

B.V. (Glencore BV)and the Industrial Development Corporation of South competing in the global automotive industry. Today, Metair is a truly

Africa (IDC). Merafe and Glencore formed the Venture in July 2004 when international company with multiple OEM customers around the world, a

they pooled their chrome operations to create the largest ferrochrome broad range of aftermarket and non-automotive products, operations in

producer in the world. five countries and ambitions to grow into five continents within the next

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining five years.

NUMBER OF EMPLOYEES: 6 719 SECTOR: Consumer Discretionary—Auto&Parts—Auto&Parts—Auto

DIRECTORS: Green D (ne), Mabusela-Aikhuere N (ind ne), NUMBER OF EMPLOYEES: 16 750

McClaughlan J (ind ne), McGluwa D (ne), Tlale K (ind ne), Vuso M J (ind ne), DIRECTORS: GiliamPH(ind ne), Mawasha B (ld ind ne),

Phiri S D (Chair, ind ne), Matlala Z (CEO), Chocho D (FD) Medupe N (ind ne), MkhondoNL(ind ne), MuellMH(ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 SithebeAK(ind ne), Sithole S (alt), Mgoduso T N (Chair, ind ne),

Glencore BV 28.82% O’Flaherty P S (CEO)

Industrial Development Corporation of SA Ltd. 21.88% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

POSTAL ADDRESS: PO Box 652157, Benmore, 2010 Coronation Fund Managers 14.04%

MORE INFO: www.sharedata.co.za/sdo/jse/MRF Foord 7.46%

COMPANY SECRETARY: CorpStat Governance Services Value Active PFP H4 QI Hedge Fund 7.39%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. POSTAL ADDRESS:PostNetSuite231, PrivateBagX31,Saxonwold,2132

SPONSOR: One Capital Sponsor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/MTA

AUDITORS: Deloitte & Touche Inc. COMPANY SECRETARY: S M Vermaak

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: One Capital

MRF Ords 1c ea 3 500 000 000 2 499 126 870

AUDITORS: Ernst & Young Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords 1c ea Ldt Pay Amt MTA Ords no par value 400 000 000 198 985 886

Final No 21 1 Apr 25 7 Apr 25 8.00

Interim No 20 3 Sep 24 9 Sep 24 20.00 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

LIQUIDITY: Apr25 Avg 12m shares p.w., R16.1m(24.7% p.a.) Final No 71 5 Apr 22 11 Apr 22 90.00

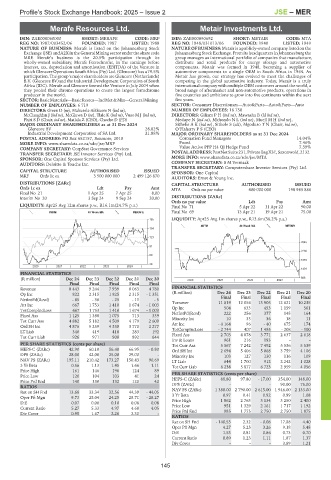

INDM 40 Week MA MERAFE Final No 69 13 Apr 21 19 Apr 21 75.00

185 LIQUIDITY: Apr25 Avg 1m shares p.w., R13.6m(36.2% p.a.)

AUTM 40 Week MA METAIR

154

123

2645

91

2230

60

1816

29

2020 | 2021 | 2022 | 2023 | 2024 |

1401

FINANCIAL STATISTICS

(R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 2020 | 2021 | 2022 | 2023 | 986

Final Final Final Final Final

Revenue 8 443 9 244 7 939 8 063 4 780 FINANCIAL STATISTICS

(R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Op Inc 822 2 315 1 925 2 315 - 1 351

Final

Final

Final

Final

Final

NetIntPd(Rcvd) - 65 - 38 - 25 - 11 - 5 Turnover 11 819 12 056 13 905 12 621 10 235

Att Inc 667 1 753 1 410 1 674 - 1 003

TotCompIncLoss 667 1 753 1 410 1 674 - 1 003 Op Inc 504 633 453 1 159 561

Fixed Ass 1 125 1 388 1 075 713 339 NetIntPd(Rcvd) 222 256 377 145 164

Tot Curr Ass 4 882 5 182 4 509 4 179 2 609 Minority Int 10 33 36 18 11

96

174

- 40

675

Ord SH Int 4 876 5 259 4 330 3 770 2 277 Att Inc - 4 164 407 1 495 - 208 - 100

- 2 744

TotCompIncLoss

LT Liab 340 419 418 283 192

Tot Curr Liab 926 971 908 892 644 Fixed Ass 2 703 4 078 3 771 2 637 2 618

Inv & Loans 961 216 193 - -

PER SHARE STATISTICS (cents per share) Tot Curr Ass 5 567 7 242 7 492 5 536 5 539

HEPS-C (ZARc) 42.90 60.10 56.40 66.95 - 0.80 Ord SH Int 2 694 5 406 5 068 3 759 4 106

DPS (ZARc) 28.00 42.00 25.00 29.00 - Minority Int 103 127 130 116 109

NAV PS (ZARc) 195.11 210.42 173.27 150.43 90.69 LT Liab 644 1 700 912 2 242 1 028

3 Yr Beta 0.56 1.13 1.45 1.66 1.11 Tot Curr Liab 6 238 5 877 6 723 2 959 4 056

Price High 161 146 196 124 89

Price Low 120 104 103 41 24 PER SHARE STATISTICS (cents per share)

Price Prd End 140 130 132 120 42 HEPS-C (ZARc) 88.80 - 97.80 - - 17.00 - 354.00 148.00

90.00

DPS (ZARc)

75.00

RATIOS

Ret on SH Fnd 13.68 33.34 32.56 44.39 - 44.05 NAV PS (ZARc) 1 388.00 2 790.00 2 615.00 1 946.00 2 133.00

0.92

0.41

3 Yr Beta

1.08

0.99

0.97

Oper Pft Mgn 9.73 25.04 24.25 28.71 - 28.27

D:E 0.07 0.08 0.10 0.08 0.08 Price High 1 862 2 763 3 134 3 250 2 400

Current Ratio 5.27 5.33 4.97 4.68 4.05 Price Low 951 1 329 2 161 1 717 1 192

1 875

2 750

985

Price Prd End

2 750

1 775

Div Cover 0.95 1.67 2.26 2.30 -

RATIOS

Ret on SH Fnd - 148.53 2.32 - 0.08 17.88 4.40

Oper Pft Mgn 4.27 5.25 3.26 9.18 5.48

D:E 1.53 0.81 0.86 0.73 0.70

Current Ratio 0.89 1.23 1.11 1.87 1.37

Div Cover - - - 3.89 1.21

145