Page 143 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 143

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – LIG

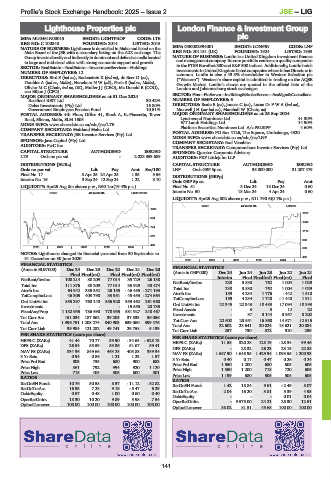

Lighthouse Properties plc London Finance & Investment Group

LIG plc

ISIN: MU0461N00015 SHORT: LIGHTPROP CODE: LTE

REG NO: C 100848 FOUNDED: 2014 LISTED: 2015 LON

NATURE OF BUSINESS: Lighthouse is domiciled in Malta and listed on the ISIN: GB0002994001 SHORT: LONFIN CODE: LNF

Main Board of the JSE with a secondary listing on the A2X exchange. The REG NO: 201151 (UK) FOUNDED: 1924 LISTED: 1933

Group invests directly and indirectly in dominant and defensive malls located NATURE OF BUSINESS: Lonfin is a United Kingdom investment finance

in large and mid-sized cities with strong economic support and growth. and management company. Its core portfolio centres on quality companies

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings in the FTSE Eurofirst 300 and S&P 500 indices. Additionally, Lonfin holds

NUMBER OF EMPLOYEES: 12 investments in United Kingdom listed companies where it has Directors in

common. Lonfin is also a 43.8% shareholder in Western Selection plc

DIRECTORS: Bird S (ind ne), Bodenstein K (ind ne), de Beer D (ne), (“Western”). Western’s share capital is admitted to trading on the AQSE

Doublet A (ind ne, Malta), HanekomNW(alt), Paris S (ind ne, Malta), Growth Market. Lonfin’s shares are quoted in the official lists of the

Olivier M C (Chair, ind ne, UK), Muller J J (CEO), Mc Donald E (COO), London and Johannesburg stock exchanges.

van Biljon J (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

Resilient REIT Ltd. 30.42% NUMBER OF EMPLOYEES: 6

Delsa Investments (Pty) Ltd. 16.80% DIRECTORS: Beale E (ne), Jousse C (ne), Lucas DrFWA(ind ne),

Government Employees Pension Fund 10.51% MaxwellJH(snr ind ne), Marshall W (Chair, ne)

POSTAL ADDRESS: 4th Floor, Office 41, Block A, IL-Piazzetta, Tower MAJOR ORDINARY SHAREHOLDERS as at 25 Sep 2024

Road, Sliema, Malta, SLM 1605 Lynchwood Nominees Ltd. 41.30%

MORE INFO: www.sharedata.co.za/sdo/jse/LTE WT Lamb Holdings Ltd. 14.90%

Platform Securities Nominees Ltd. A/c PSLSIPP

4.60%

COMPANY SECRETARY: Maitland Malta Ltd. POSTAL ADDRESS: PO Box 4126, The Square, Umhalanga, 4320

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/LNF

SPONSOR: Java Capital (Pty) Ltd. COMPANY SECRETARY: Rod Venables

AUDITORS: PwC Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Questco Corporate Advisory

LTE Ords no par val - 2 023 353 689 AUDITORS: PKF Littlejohn LLP

DISTRIBUTIONS [EURc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords no par val Ldt Pay Amt Scr/100 LNF Ords GBP 5p ea 35 000 000 31 207 479

Final No 17 8 Apr 25 24 Apr 25 1.35 3.56 DISTRIBUTIONS [GBPp]

Interim No 16 3 Sep 24 12 Sep 24 1.22 3.10

Ords GBP 5p ea Ldt Pay Amt

LIQUIDITY: Apr25 Avg 8m shares p.w., R60.1m(19.4% p.a.) Final No 51 3 Dec 24 18 Dec 24 0.60

Interim No 50 18 Mar 24 4 Apr 24 0.60

REDS 40 Week MA LIGHTPROP

LIQUIDITY: Apr25 Avg 802 shares p.w., R11 790.6(0.1% p.a.)

GENF 40 Week MA LONFIN

1094

1575

934

1346

774

1118

613

889

453

2020 | 2021 | 2022 | 2023 | 2024 |

660

NOTES: Lighthouse changed its financial year-end from 30 September to

31 December on 30 June 2020. 2020 | 2021 | 2022 | 2023 | 2024 | 432

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in EUR’000) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Final Final(rst) Final Final(rst) Final(rst) (Amts in GBP’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

NetRent/InvInc 108 214 80 209 77 014 35 729 26 138 Interim Final Final(rst) Final(rst) Final

Total Inc 111 876 80 209 77 014 35 929 30 474 NetRent/InvInc 230 3 830 762 1 004 1 029

1 004

Total Inc

1 029

762

3 830

230

Attrib Inc 64 942 385 352 25 155 - 46 485 - 271 193 Attrib Inc 159 4 234 1 776 - 442 1 510

TotCompIncLoss 46 305 403 790 33 951 - 45 453 - 274 664 TotCompIncLoss 159 4 234 1 748 - 1 440 1 911

Ord UntHs Int 855 297 760 140 356 920 355 462 261 968 Ord UntHs Int 22 345 22 343 18 483 17 094 18 893

Investments - - - 15 555 28 735

12

22

FixedAss/Prop 1 182 935 786 690 778 935 581 927 248 467 Fixed Assets - - 37 3 3 144 3 3 957 8 202

Investments

Tot Curr Ass 151 034 187 862 39 205 37 533 36 056 Tot Curr Ass 22 602 23 551 16 860 14 571 12 515

Total Ass 1 396 751 1 208 274 840 903 639 060 399 476 Total Ass 22 602 23 641 20 024 18 621 20 884

Tot Curr Liab 39 984 121 282 49 741 29 758 5 139

Tot Curr Liab 257 730 372 510 299

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 41.44 70.77 33.90 - 34.63 - 528.13 PER SHARE STATISTICS (cents per share) 128.19 - 28.34 99.46

11.58

HEPS-C (ZARc)

320.28

DPS (ZARc) 26.54 55.59 53.36 51.67 59.41

DPS (ZARc) - 28.32 26.23 23.15 22.85

NAV PS (ZARc) 834.36 849.66 463.28 405.83 389.34 NAV PS (ZARc) 1 687.90 1 648.95 1 429.94 1 093.55 1 200.93

3 Yr Beta 0.94 0.86 1.21 1.23 1.57 3 Yr Beta 0.40 0.17 0.47 0.26 0.24

Price Prd End 803 735 680 900 683

Price High 861 792 994 920 1 120 Price Prd End 1 550 1 200 680 505 605

718

720

1 200

Price High

1 550

605

Price Low 715 405 505 600 501

RATIOS Price Low 1 199 680 505 505 605

RATIOS

RetOnSH Funds 10.76 50.58 8.57 - 11.12 - 82.82 RetOnSH Funds 1.42 18.84 9.61 - 2.49 8.07

RetOnTotAss 16.95 7.28 9.16 - 5.47 6.29

Debt:Equity 0.57 0.48 1.00 0.60 0.40 RetOnTotAss 2.04 - 16.20 - 3.81 - 5.39 4.93

0.04

0.01

Debt:Equity

OperRetOnInv 18.30 10.20 9.89 5.98 7.54

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 OperRetOnInv - 9 575.00 24.21 25.30 12.51

OpInc:Turnover 38.02 81.51 45.68 100.00 100.00

141